Non-Linked, Non-Participating, Individual Life Insurance Pure Risk Premium Plan

Life is full of uncertainties, and the unexpected can happen at any moment. A promise of financial security in the face of life’s unpredictable events can provide immense peace of mind. This is where the concept of a promise, embodied in the form of life insurance, becomes invaluable.

When we make a promise to our loved ones, we are committing to be there for them, no matter what the future may hold. A life insurance is a tangible expression of this promise, ensuring that in the event of our passing, our dependents will be taken care of financially.

The promise of life insurance extends beyond the present, allowing us to leave a lasting legacy for our loved ones. By ensuring that our family’s financial needs are met, we can focus on creating cherished memories and building a strong foundation for their future. This promise becomes a testament to our love and care, a gift that will continue to provide for them long after we are gone.

Tata AIA’s flagship protection plan, Sampoorna Raksha Promise is the ultimate solution for comprehensive financial protection and security to your family.

2. PART B

2.1. Basic Definitions

1) Annualized Premium

shall be the premium payable in a year under a non-single pay option chosen by the policyholder, excluding the taxes, rider premiums, underwriting extra premiums, loading for modal premiums, if any.

2) Appointee

means the person appointed by You and named in the Policy Schedule, to receive the benefits payable under the Policy until Your nominee attains the age of majority. This is applicable only where the nominee is a minor.

3) Assignee

is the person to whom the rights and benefits under the Policy are transferred by way of an Assignment.

4) Assignment

is the process of transferring the rights and benefits under the Policy to an Assignee.

5) Base SA

of the policy would be the sum of the amount payable as lumpsum and discounted value of the staggered benefit stream, as computed using the discount factor (as mentioned in Flexible Payout Option in Part C Clause VII) as at policy inception.

6) Beneficiary / Claimant:

means the Policyholder or the Life Insured or the Nominee, the assignee or the legal heir of the Policyholder.

7) Business Day :

means days other than holidays where Stock exchanges with National wide terminals will open for trade (other than day on which exchanges are open for testing) or any day declared by the IRDAI as business day.

8) Date of commencement of Risk:

is as mentioned on the Policy Schedule.

9) Expiry Date:

Date of this Policy is shown in the Policy Schedule.

10) Extra Premium:

means an additional amount charged by Us, as per Our Underwriting Policy, which is determined on the basis of disclosures made by You in the Proposal Form or any other information received by Us including medical examination report of the Life Insured”

11) Grace Period:

means a period of 15 (Fifteen) days from the due date of the first unpaid Premium for monthly Premium payment mode and 30 (Thirty) days from the due date of first unpaid Premium for all other Premium payment mode, except Single Pay.

12) IRDAI / Authority/ IRDA of India:

means Insurance Regulatory and Development Authority of India.

13) Life Insured:

means the person whose life is insured under the Policy as shown in the Policy Schedule.

14) Medical Practitioner

means a person who holds a valid registration from the Medical Council of any State or Medical Council of India or Council for Indian Medicine or for Homeopathy set up by the Government of India or a State Government and is thereby entitled to practice medicine within its jurisdiction; and is acting within its scope and jurisdiction of license.

This would mean a practitioner treating the life assured must be holding a degree equivalent to MD/MS or higher in the relevant field to certify the medical condition. The Medical practitioner should not be:

• the policyholder/life assured himself/herself; or

• An authorised insurance intermediary (or related persons) involved with selling or servicing the insurance contract in question; or

• Employed by or under contractual engagement with the insurance company; or

• Related to the policyholder/life assured by blood or marriage.

[“Related Persons” refer to individuals related to the insurance intermediary by blood or by marriage who are practicing as Medical Practitioners.]

15) Nominee

means the person named in the Policy Schedule who has been nominated by the Annuitant in accordance with Section 39 of the Insurance Act, 1938 as amended from time to time to receive benefits in respect of this Policy.

16) Policy:

means this contract of insurance entered into between You and Us as evidenced by this document, the Proposal Form, the Policy Schedule and any additional information/document(s) provided to Us in respect of the Proposal Form along with any written instructions from You subject to Our acceptance of the same and any endorsement issued by Us.

17) Policy Anniversary:

refers to the same date each year as the Policy Date.

18) Policy Date:

as shown in the Policy Schedule is the date from which Policy Anniversaries, Policy Years, Policy Months and Premium Due Dates are determined.

19) Policy Term:

is the maximum period in years for which the policy can remain in force and is mentioned in the Policy Schedule.

20) Premium Payment Term:

is the number of years that premium is payable for and is mentioned in the Policy Schedule.

21) Pure Risk Product:

means insurance products (without any savings element) where the payment of agreed amount is assured on the happening of death of life assured or on happening of insured health related contingency within the term of the policy.

22) Revival Period:

means the period of five consecutive complete years from the date of first unpaid premium.

23) Revival Date:

is the approval date of revival of the Policy.

24) Single Premium:

shall be the premium payable under a single pay option chosen by the policyholder, excluding the taxes, rider premiums, underwriting extra premiums if any.

25) Sum Assured(SA) :

is the guaranteed amount of the benefit that is payable on the death of the Insured under this Policy. The Basic Sum Assured when the Policy is issued is shown in the Policy Schedule. If the Basic Sum Assured is subsequently altered according to the terms and conditions of the Policy, the adjusted amount after such alteration as evidenced by an endorsement issued by Us to this effect will become the Basic Sum Assured.

26) Total Premium Paid:

means total of all the premium paid under the base product, excluding any extra premium and taxes, if collected explicitly.

27) Underwriting Policy:

means our then prevailing Underwriting Policy as approved by Our board of directors.

28) Waiting Period:

means a period of first 90 days from the Date of Commencement of Risk.

29) We, US, OUR, Insurer, or Company: ,

refers to Tata AIA Life Insurance Company Limited.

30) you or Your

means the Policyholder of this Policy.

Interpretation:

Whenever the context requires, the masculine form shall apply to feminine and singular terms shall include the plural.

1. Key Highlights

• Flexibility to choose from 4 unique Death Benefi¬t options

• Whole of life cover available

• Acceleration of 50% of base sum assured on diagnosis of terminal illness

• Inbuilt waiver of premium on terminal illness

• Special discount for salaried customers on first year premium

• Additional first year premium discount on achieving important life milestones

• Flexibility to cover spouse under joint life option

• Option to receive death benefit as lumpsum and/or instalments

• Option to defer premiums by up to 12 months with FlexiPay Benefit

• Instant payout on claim intimation

• 15% lower premium for Female lives

• Enhance your protection through our comprehensive riders with unique health and wellness benefits

• Choice to transfer legacy sum assured to your child with Family Plan option

3. PART C

Tata AIA Sampoorna Raksha Promise is a non-linked, non-participating, pure risk, individual life insurance product offered to individual lives. The base cover is death where the death benefit is payable as lump sum, staggered or lumpsum and staggered as per the flexible payout option chosen by the Policyholder at the inception of the Policy, which cannot be altered thereafter. The Life Promise, Life Promise Plus, Joint Life Promise and Joint Life Promise Plus options under this product are also available under Point-of-sale variant.

BENEFIT PROVISIONS

The benefit features available under the product are as below. The choice needs to be made by You at the time of purchase and cannot be altered later. The benefits under the Policy shall be payable based on the options chosen by the Policyholder at the inception of the Policy.

I. Plan Options

Option 1: Life Promise Option

Option 2: Life Promise Plus Option

Option 3: Joint Life Promise Option

Option 4: Joint Life Promise Plus Option

II. Other Options

1. Flexible Payout Option

2. Cover Enhancement

3. Renewability option at Maturity

4. Cover Continuation Option

5. Flexi Pay benefit

6. Instant Payout on Claim intimation

7. Family Plan option

The details of the options available are as follows:

I. Plan Options

Option 1: Life Promise Option (NROP)

This is a pure risk variant wherein You choose the Base SA at the time of purchase subject to underwriting eligibility. In case the Life Insured dies during the Policy Term (provided all the due premiums are paid), the stipulated death benefit (based on Effective Sum Assured as applicable on the date of death – defined below) less any payout under Payor Accelerated Benefit shall be paid out to the Claimant (as per the payout plan chosen). The Policy shall terminate upon payment of this benefit.

The Effective Sum Assured applicable for computation of Death Benefit would include any Cover Enhancement Option purchased by exercising either the Life Stage or the Top-Up SA option along with Base SA.

Payor Accelerator Benefit:

This plan has an inbuilt benefit called “Payor Accelerator Benefit” wherein the benefit amount equal to 50% of the Base SA is paid out as lump sum on acceptance of Terminal Illness (“TI”) claim by the Company. Upon payment of the TI claim, all the future premiums (towards base benefit option and cover enhancement options, if opted) shall be waived off and the Policy shall continue to remain in- force for the remaining applicable benefit(s).

In case the Life Insured survives till Date of Maturity of Policy, no additional benefit is payable, and the Policy shall terminate on the Date of Maturity of Policy.

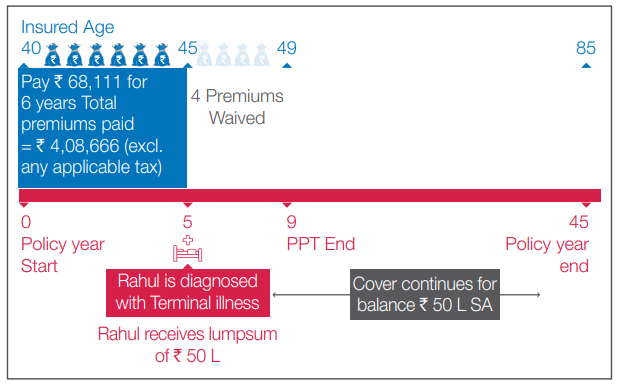

Payor Accelerator Benefit illustration:

Mr. Rahul, a 40 years healthy non-smoker business owner, purchases Tata AIA Sampoorna Raksha Promise for a policy term of 45 years and Sum Assured of 1 Cr. Rahul chooses to pay premiums for 10 years. Before paying the 7th premium instalment, he gets diagnosed with a terminal illness.

Option 2: Life Promise Plus Option (ROP)

Under this option, the death benefit will be as per Option 1 described above.

This is a protection-oriented variant wherein You can choose the Base SA at the time of purchase subject to underwriting eligibility. In case the Life Insured dies during the Policy Term (provided all the due premiums are paid), the stipulated death benefit (based on Effective Sum Assured as applicable on the date of death – defined below) less any payout under Payor Accelerated Benefit shall be paid out to the Claimant (as per the payout plan chosen). The death benefit shall be based on Effective Sum Assured as applicable on the date of death. The Policy shall terminate upon payment of this benefit.

The Effective Sum Assured applicable for computation of Death Benefit would include any Cover Enhancement Option purchased by exercising either the Life Stage or the Top-Up SA option along with Base SA.

Payor Accelerator Benefit:

This plan has an inbuilt benefit called “Payor Accelerator Benefit” wherein the benefit amount equal to 50% of the Base SA is paid out as lump sum on acceptance of Terminal Illness (“TI”) claim by the Company. Upon payment of the TI claim, all the future premiums (base benefit option and cover enhancement options, if opted) shall be waived off and the Policy shall continue to remain in force

In case the Life Insured survives till maturity, an amount equal to the 100% of the Total Premiums Paid (excluding loading for modal premiums and discount) towards the benefit option and “Life Stage” or “Top-up SA”, if opted, shall be payable at the end of the Policy Term, provided the Policy is not terminated earlier.

Option 3: Joint Life Promise Option (as of now Not available)

This is a pure risk variant wherein the Life Insured (first life) and spouse of the Life Insured (second life) would be covered under the same Policy. The Policyholder chooses the Base SA at the time of purchase subject to underwriting eligibility.

In case of first death of either of the Life Insured or simultaneous death of both the Life Insureds during the Policy Term (provided all the due premiums are paid), the stipulated death benefit (based on Effective Sum Assured as applicable on the date of death – defined below) less any payout under Payor Accelerated Benefit shall be paid out to the Claimant (as per the payout plan chosen).

The Effective Sum Assured applicable for the above computation of Death Benefit would include any Cover Enhancement Option purchased by exercising either the Life Stage or the Top-Up SA option along with Base SA.

In case of simultaneous death of both the first life and second life due to an accident, an additional amount equal to the Base SA shall be paid out to the Claimant as lump sum.

The policy will terminate upon payment of the entire sum of death benefit.

Payor Accelerator Benefit:

This plan has an inbuilt benefit called “Payor Accelerator Benefit” wherein the benefit amount equal to 50% of the Base SA is paid out as lump sum on acceptance of first Terminal Illness (“TI”) claim of either of the Life Insureds by the Company. Upon payment of the TI claim, all the future premiums (base benefit option and Life Stage or Top-Up SA, if opted) shall be waived off. The Policy will continue to remain in-force for the remaining applicable benefits.

Only one claim is admissible under “Payor Accelerator Benefit”.

In case any or both the Life Insureds survive till Date of Maturity of Policy, no additional benefit is payable, and the Policy shall terminate on the Date of Maturity of Policy.

Option 4: Joint Life Promise Plus Option (As of now not available)

Under this option, the death benefit will be as per Option 3 above.

This is a protection-oriented variant wherein the Life Insured (first life) and spouse of the Life Insured (second life) would be covered under the same Policy. The Policyholder chooses the Base SA at the time of purchase subject to underwriting eligibility.

In case of first death of either of the Life Insureds or simultaneous death of both the Life Insureds during the Policy Term (provided all the due premiums are paid), the stipulated death benefit (based on Effective Sum Assured as applicable on the date of death – defined below) less any payout under Payor Accelerated Benefit will be paid out to the Claimant (as per the payout plan chosen).

The Effective Sum Assured applicable for the above computation of Death Benefit would include any Cover Enhancement Option purchased by exercising either the Life Stage or the Top-Up SA option along with Base SA.

In case of simultaneous death of both the first life and second life due to an accident, an additional amount equal to the Base SA shall be paid out to the Claimant as lump sum.

Payor Accelerator Benefit:

This plan has an inbuilt benefit called “Payor Accelerator Benefit” wherein the benefit amount equal to 50% of the Base SA is paid out as lump sum on acceptance of first Terminal Illness (“TI”) claim of either first life or second life by us. Upon payment of the TI claim, all the future premiums (base benefit option and “Life Stage” or “Top-Up SA”, if opted) shall be waived off. The Policy will continue to remain in-force for the remaining applicable benefits. Only one claim is admissible under “Payor Accelerator Benefit”.

In case both the Life Insureds survive till Date of Maturity of Policy, an amount equal to the 100% of the Total Premiums Paid (excluding loading for modal premiums and discount) towards the benefit option and “Life Stage” or “Top-up SA”, if opted, shall be payable at the end of the Policy Term, provided the Policy is not terminated earlier.

“Terminal Illness” is defined as an advanced or rapidly progressing incurable and un-correctable medical condition which, in the opinion of two (2) independent Medical Practitioners specializing in treatment of such illness, has greater than 50% chance of death of the Life Assured within 6 months of the date of diagnosis of Terminal Illness. The Company reserves the right for independent assessment of the Terminal Illness.

The Payor Accelerator Benefit will commence after two years of issue of the policy. It is an accelerated benefit and is not available if the product is bought under PoS.

Premiums will vary depending on the option chosen.

II. Other Additional Options

1. Flexible Payout Option (Not Recommended)

You will have the option to opt for lump sum, staggered benefit or a combination of a lump sum amount and staggered benefit, as at the time of purchase (referred as the “Payout Plan” henceforth).

If the Payout Plan chosen includes a staggered benefit, at the time of purchase of the Policy, You would stipulate the benefit amount stream payable to the Claimant after death of the Life Insured. For premium calculation, sum assured for the staggered benefit portion shall be computed as the discounted value of the staggered benefit stream using a discount rate of 4% p.a.

The staggered benefit payment frequency can be Annual / Half Yearly / Quarterly / Monthly.

The staggered benefit will be paid as per the frequency chosen for the “Benefit Period” (up to 30 years) selected, starting from the next monthly anniversary following the date of occurrence of insured event. Any accrued staggered benefit, due before intimation of death, will be paid along with first payout under this option. You will have an option to choose between:

a. Level Income Payout – Fixed income payout throughout the chosen benefit period

b. Increasing Income Payout – Income increases year- on-year based on chosen simple interest rate (up to 15%) throughout the chosen benefit period.

At any time during the staggered period, the Claimant also has an option to receive the commuted value of the future staggered benefit stream as a lumpsum, discounted at the higher of (4% p.a., State Bank of India domestic 10-year term deposit rate prevailing at the time of commutation + 2%).

2. Cover Enhancement Options (Not Suggested)

a) Life Stage:

Under Life Stage option, You can increase the coverage amount on happening of any one of the following Life Stage events, subject to the Underwriting Policy of the Company and the option to increase the sum assured must be exercised within 180 days of the happening/incidence of the following event(s):

| Event | Additional Sum Assured as % of Base SA |

| Marriage (One Marriage Only) | 50% |

| Birth/Adoption of 1st Child | 25% |

| Birth/Adoption of 2nd Child | 25% |

| Home Loan disbursal* | 100%, subject to home loan amount sanctioned |

*Subject to Underwriting Policy of the Company

Once chosen, the option cannot be changed over the Policy Term, but You will always have a right to stop exercising the option in the future.

The additional sum assured can only be taken in the form of (up to) 4 tranches as mentioned in the above table provided there has been no claim under Payor Accelerator Benefit, where We will charge additional premium for each tranche. Any increase in the sum assured shall be effective from the Policy Anniversary succeeding the option exercise date.

You will have an option to surrender the additional sum assured tranches after payment of premiums for first five completed policy years. The tranches shall be terminated after payment of any applicable value on surrender. The tranches will be surrendered in reverse order to which they were availed, i.e., the latest tranche will be surrendered first, followed by the penultimate tranche, and so on. This shall be allowed till all incremental tranches are removed. Once reduced, the premium or sum assured cannot be subsequently increased.

The policy shall continue with the Effective Sum Assured as applicable at the time of termination for rest of the policy term.

This option is not available if the product is bought under Point-of-sale varient.

Life Milestone Discount

An additional first year premium discount of 0.5% on single premium and 2% on regular and limited pay policies will be offered to customers any one of the below mentioned milestones subject to the eligibility criteria specified.

| Event | Eligibility |

| Marriage | Within 6 months before or after the date of marriage |

| Birth/Adoption of child | Within 6 months before or after the birth / adoption date |

| Home Loan | Within 6 months of loan getting sanctioned |

| First Job | Within 6 months of joining date |

Currently, this discount is capped to a maximum of Rs 500 over the year and shall be subject to changes as determined by Board Approved Policy.

b) Top-Up SA ( not available )

Under Top-Up SA option, You can opt to increase the your life cover by a fixed percentage at each Policy Anniversary by paying an additional premium for every increase, subject to satisfactory underwriting as per the Underwriting Policy. You can opt to exercise the Top-SA option at the time of purchase of the policy, provided the premium payment term is at least 5 years.

The sum assured increase shall be by a fixed percentage ranging from 5% to 20% every year of the Base SA chosen at inception till the earlier of:

• the maximum sum assured eligibility as per the Underwriting Policy is breached

• The outstanding premium payment term becomes less than minimum specified under the product

• The outstanding policy term becomes less than the minimum allowed under the product

• The attained age becomes higher than maximum entry age allowed under the product

• Claim under Payor Accelerator Benefit.

This is subject to Underwriting Policy of the Company.

Once chosen, the option cannot be changed over the policy term, but You will always have a right to stop exercising the option in the future.

For each tranche, the additional premium will be determined using additional sum assured and the premium rate which will be derived basis the following:

• Attained age as of the policy anniversary at the point of increase, subject to the maximum entry age stipulated in the product.

• Outstanding policy term (in complete months) as of the policy anniversary succeeding the option exercise date, subject to the minimum policy term stipulated in the product.

• Outstanding premium paying term (in complete months) as of the policy anniversary succeeding the option exercise date, subject to a minimum premium paying term specified in the product.

• Aggregate sum assured (up to and including the increment in sum assured requested) opted for under the contract.

• Underwriting classification as applicable on the option exercise date.

You can opt to terminate the future increments at any time during the policy term and such termination will be effective from the next Policy Anniversary. Once the future increments are terminated, it is not possible to initiate the increments again over the remaining premium paying term of the policy.

In case You do not opt to terminate the future increments, there will be an option to surrender the additional sum assured tranches (i.e., in multiples of 5% of Base SA) after payment of premiums for first five completed policy years. The tranches shall be terminated after payment of any applicable value on surrender. The tranches will be surrendered in reverse order to which they were availed, i.e., the latest tranche will be surrendered first, followed by the penultimate tranche, and so on. This shall be allowed till all incremental tranches are removed. Once reduced, the premium or sum assured cannot be subsequently increased.

The Policy shall continue with the Effective Sum Assured as applicable at the time of termination for rest of the policy term.

This option (Top-SA) is not available if the product is bought under Point- of-sale variant.

3. Renewability option at Maturity: (Indirectly Not Allowed based on risk)

At maturity, You can choose to extend the term of their Policy. This option can be exercised a maximum of five times and is subject to Underwriting Policy. Additional premium shall be payable for the extended term, based on:

• Attained age at the time of maturity of Policy

• The chosen increase in Policy Term

This option is available subject to following:

• Life Promise, Life Promise Plus option has been opted

• Premium payment term is Regular Pay

• This option is not available if any claim under the policy for respective life assured has already been made

• This option is not available if any benefit under the policy has already expired

4. Cover Continuation Option: (Not Recommended)

In case of first death of either of the Life Insured during the policy term under Joint Life Promise and Joint Life Promise Plus, the surviving Life Insured may choose to continue his / her life cover by taking a Single Premium policy. This is subject to conditions specified in Underwriting Policy. The Single Premium amount shall be deducted from the death benefit payable with respect to first death. This option must be be chosen at inception of the policy; however the surviving Life Insured has a choice to not exercise this option at later date.

5. Flexi Pay Benefit

Needs to intimate 60 days before exercising Premium Deferment —-Indirectly not allowed)

Under this feature, for an in- force policy You may defer the due premium for a period of up to 12 months from the due date, while maintaining the full risk cover under the base plan and attached riders, if any at no additional cost/Premium.. In the event of a claim during this period, sum assured will be payable after deducting the unpaid premiums, if any, as on date of death or other insured event covered under base product and attached riders.

At the end of Premium Deferment period, the policyholder is required to pay the due premiums, including the premium applicable for the period of Premium Deferment, i.e., the base cover premium and additional premium (if any). During the Premium Deferment, the policy will remain in-force with the benefits applicable under Grace Period of the policy.

Please note the following conditions specific to Premium Deferment:

• The option is available to all premium paying terms (Regular, Limited) except Single pay

• The option can be exercised only after payment of 5 full years premium.

• The Premium Deferment shall be available for multiple times with a gap of 5 policy years from the expiry date of previous Premium Deferment.

• No interest shall be levied on the premium due during the Premium Deferment period.

• Once the Premium Deferment is exercised, it shall continue for maximum of 12 consecutive policy months i.e., one Premium Deferment shall mean 1 annual premium, 2 half-yearly premiums, 4 quarterly premium or 12 monthly premiums, as the case may be.

• There should be a gap of at least 5 policy years between the Premium Deferment i.e., policyholder can opt for next – after completion of 5 years from the expiry of last exercised Premium Deferment.

• The Policyholder needs to pay the total outstanding amount at the end of Premium Deferment period. For example, if the Policyholder exercises Premium Deferment in the 5th policy year, then at the end of Premium Deferment period, Policyholder has to pay the due premium for previous year (5th year) along with the next due premium (6th year)

• If the premiums due are not paid within 30 days (15 days in case of monthly mode) of the commencement of the next Policy Year after expiry of the Premium Deferment, the Policy (including Rider(s), if any) shall lapse and no benefits shall be payable in the Policy or the Rider(s), if any) and company shall be entitled to recover the same from any amounts or benefits payable under the Policy or Rider(s).

• This option can be exercised from the next premium anniversary, independent of the policy anniversary. For example, for a monthly mode policy, a policyholder having paid 12 monthly premiums may choose not to pay the next 12 monthly premiums.

• If the policyholder exercises the Premium Deferment in the last 5 years of the policy, then the next Premium Deferment shall not be allowed. Further, the Premium Deferment shall not be available during the last year of the premium paying term.

• This option will only be applicable on the Base premium and rider premium, if any.

• Policyholder can surrender the policy anytime along with this option even during the Premium Deferment year.

• The policyholder needs to intimate 60 days before exercising Premium Deferment. If a premium is unpaid with no prior intimation, the policy at the end of the grace period shall be treated as per clauses applicable in the Non-Forfeiture Section.

6. Instant Payout on Claim Intimation

Death Certificate is required for Claim Intimation —-it will be helpful for immediate survival, if you don’t have savings

In case of death of the Life Insured, post completion of waiting period of 3 Policy Year, from the policy inception or Revival of the Policy and provided the Policy is in force, an accelerated instant death benefit of INR 3 Lacs from the Sum Assured will be paid within 1 (one) working day from the claim registration date as a gesture to provide interim support. This feature could only be availed with the minimum sum assured of INR 1 Cr.

This payout shall be made only upon the Company being satisfied with respect to the validity and enforceability of the documents submitted along with the intimation of death claim.

The remaining sum assured shall be payable post the completion of the claim investigation. Further, in case of any discrepancy in the claim investigation resulting in the final decision of non-payment of the claim, the Company reserves the right to recover the already paid amount.

Eligibility criteria:

• This benefit can only be availed if the policy is in-force.

• This benefit is not payable in case of death during the first 3 policy years.

• Applicable only for policies with minimum Sum Assured of r 1 Crore.

• On receipt of intimation of death, a payment of 3 Lac is payable as Insta Payment. The balance Death benefit shall be payable at the time of claim settlement.

• Documents required for claim intimation are Death Certificate, Cancelled Cheque / Bank account de-tails, Claim intimation form, KYC of nominee and Policy document.

• In case the Policy is during the FlexiPay benefit period, then in case of death of the Life Insured, we will deduct the due amounts from above accelerated death benefit of r 3 Lacs

• On assessment of documents submitted during claim assessment, additional documents may be sought by the company

• In case of repudiation / rejection of claim, for any reason whatsoever the company reserves the right to recover the already paid amount. The Claimant is liable to pay such amount within 7 days of receipt of such communication of recovery.

• This feature accelerates the total claim amount. The acceleration of instant claim should not be construed/interpreted as acceptance of the claim.

• The Company’s decision on the claim shall be final and binding on the Claimant. In case the Claimant fails to refund the said amount, appropriate actions may be initiated by the Company for recovery of the said amount.

7. Family Plan Option (Practically not useful)

The Life Insured, at the inception (on payment of additional premium), shall have an option to transfer Legacy Sum Assured to his/her child provided the policy is in-force and the primary Life Insured survives till the end of their policy term. The optional benefit will work as follows:

• Primary Life (Benefits defined for Life Promise /Life Promise Plus option as stipulated in Plan Options)

a) The Primary Life Insured (i.e., Parent) coverage shall be applicable during the Policy Term wherein the available coverage terms for Primary Life are till Age 60 or 65 years as per the base plan.

b) Upon death or terminal illness of the Primary life during the policy term, death or payor accelerated benefit, as applicable, shall be payable and the policy will terminate thereafter.

c) Upon survival of the primary life till the end of the Policy Term, the primary life shall receive Return of Premiums in case of Life Promise Plus options and no benefit shall be applicable under Life Promise option. The Sum Assured (including any Top-up or Life stage option) of the primary life shall be transferred to the secondary life thereafter.

• Secondary Life

a) Upon survival of the primary life till the end of the Policy Term; provided the secondary life (i.e., one Child, as opted at the inception) is alive, the coverage will commence for the secondary Life Insured and shall be covered till the Extended Policy Term.

b) The Extended Policy Term shall start post the coverage period of primary life and will continue till the secondary life reaches Age 60.

c) Upon death of the Secondary Life Insured, the Sum Assured shall be payable and the policy will terminate thereafter.

d) Upon survival of the secondary life during the extended period, no benefit shall be payable, and the policy will terminate thereafter.

Addition clauses applicable

a) This option is available only for Life Promise and Life Promise Plus options.

b) Minimum Age gap between primary and secondary life insured should be 18 years.

c) In case of death of secondary life insured before the policy term, no further addition /

change will be allowed.

d) The Life Insured can opt for the benefit only at policy inception by paying an incremental premium to avail the benefit.

8. Loyalty Reward Program (only for Riders)

If You are a member of the loyalty program administered by a service provider empaneled by the Company, You shall be entitled to the Loyalty Program Reward upon the purchase of the Policy and upon meeting the eligibility criteria. The loyalty programs foster long-term customer relationship and offer redemption benefits through the service provider’s eco-systems based on applicable terms and conditions. Such reward shall accrue as percentage of the Annualized Premium or Single Premium (as applicable) and shall be made available by the service provider to You in the form of benefits (points, coins, etc.) in the first policy year by loyalty program service provider. The quantum of reward shall be determined by the Company’s extant Policy and shall be disclosed in the Company’s website from time to time.

The loyalty program rewards benefit shall be subject to the below:

- The availability of “Loyalty Program Reward” shall be subject to the availability of suitable service provider(s).

- The Loyalty Program reward shall be directly provided by the service provider(s). The rights and liabilities of the Policyholder/ Life Insured with respect to the Loyalty Program, shall be governed by the terms and conditions applicable to loyalty program.

- The Loyalty Program service is being provided by third party service provider(s) and the Company shall not be liable for such services.

- The liability of the Company is limited to the transfer of the value of the reward to the service provider, so empaneled.

- The Company reserves the right to discontinue the service or change the service provider(s) at any time and such changes shall be updated on the Company’s website (www.tataaia.com).

- The eligibility conditions including the quantum of reward shall be determined as per the Company’s extant Policy and subject to change. Please refer our website (www.tataaia.com) for updated list of eligibility conditions, list of empaneled service providers, loyalty programs and the quantum of rewards. Any changes shall be applicable prospectively.

- The Loyalty Program reward shall be applicable post completion of the free-look period, given the policy is still in-force at the time of extending such reward.

- The company reserves the right to recover such reward value in the event of cancellation of the policy by you, within 6 months from the issuance of the policy.

9. Accidental Death Benefit (Additional benefit):

Life Promise / Life Promise Plus: Not applicable

Joint Life Promise / Joint Life Promise Plus options:

In case of simultaneous death of both the first life and second life due to accident for an in-force policy (all due premiums have been paid), Base SA in addition to the death benefit (defined above) shall be payable.

Accidental Death shall mean death which

- is caused by bodily injury resulting from an accident and

- occurs due to the said bodily injury solely, directly and independently of any other causes and

- occurs within 180 days of the occurrence of such accident

The benefit due to accidental death will be payable if the accident occurs within the Benefit Option term even if death occurs beyond the term (however within 180 days of the accident).

An “Accident” means sudden, unforeseen and involuntary event caused by external, visible and violent means.

An “Injury” means accidental physical bodily harm excluding illness or disease solely and directly caused by external, violent and visible and evident means which is verified and certified by a Medical Practitioner

1. Benefits

I. Death Benefit (Majority cases Base SA)

The death benefit will be payable as per the Payout Plan selected by the Policyholder. The death benefit payable under different options is as follows:

a) For Life Promise / Life Promise Plus

In case of death of the Life Insured for an in-force Policy (all due premiums have been paid), the Death benefit payable to the Claimant is as outlined below:

Highest of:

• 1.25 x Single Premium (excluding discount) or DB multiple(1) x Annualised Premium(2) (excluding discount);

• 105% of Total Premiums Paid (excluding loading for modal premiums and discount) up to date of death; or

• An absolute amount assured to be paid on death(3)

(1) DB multiple is 7 in case of Life Promise Option and 10 in case of Life Promise Plus option

(2) in aggregate for Base SA and all tranches of Additional Sum Assured

(3) The absolute amount assured to be paid on death is the Effective Sum Assured applicable (as defined earlier) as on the date of death.

Upon payment of entire sum of the Death benefit, the Policy shall terminate, and no further benefits shall be payable.

b) Joint Life Promise / Joint Life Promise Plus options

In case of first death of any of the Life Insureds or simultaneous deaths of both Life Insureds for an in-force Policy (all due premiums have been paid), the Death Benefit payable to the Claimant is as outlined below:

Highest of:

• x Single Premium (excluding discount) or DB multiple(1) x Annualised Premium (excluding discount);

• 105% of Total Premiums Paid (excluding loading for modal premiums and discount) up to date of death; or

• An absolute amount assured to be paid on death(2)

(1) DB multiple is 7 in case of Joint Life Promise and 10 in case of Joint Life Promise Plus option

(2) The absolute amount assured to be paid on death is the Effective Sum Assured applicable (as defined earlier) as on the date of death.

In case of first death of either of the Life Insureds or simultaneous deaths of both the Life Insureds, the Policy shall terminate upon payment of the entire sum of Death benefit.

The “Base SA” of the policy would be the sum of the amount payable as lumpsum and discounted value of the staggered benefit stream, as computed using the discount factor (as mentioned under Section 7, Flexible Payout Option) as at policy inception.

“Total Premiums Paid” means total of all the premium paid under the base product, excluding any extra premium and taxes, if collected explicitly.

“Annualised Premium” shall be the premium payable in a year under a non-single pay option chosen by the policyholder, excluding the taxes, rider premiums, underwriting extra premiums, loading for modal premiums, if any.

“Single Premium” shall be the premium payable under a single pay option chosen by the policyholder, excluding the taxes, rider premiums, underwriting extra premiums if any.

Common for all options under Death Benefit

At the time of purchase, the Policyholder may stipulate that the Claimant named in the Policy shall receive a chosen portion (up to 100%) of the death benefit as lump sum and remaining as a staggered benefit stream over a pre-decided staggered period. The Claimant also has an option to receive the commuted value of the future staggered benefit stream as a lumpsum.

In case of death during Grace Period but before the payment of premium due, the Policy shall be valid and the above benefits shall be paid after deductions of the said unpaid premium and also the balance premium(s), if any, falling due from the date of death and before the next Policy Anniversary.

In case of death after a valid claim under the Payor Accelerator Benefit, the above benefit payable on death would be reduced by the amount already paid under Payor Accelerator Benefit.

II. Accidental Death (Additional benefit — as of now not available)

Life Promise / Life Promise Plus: Not applicable

Joint Life Promise / Joint Life Promise Plus options:

In case of simultaneous death of both the first life and second life due to Accident for an in-force Policy (all due premiums have been paid), the amount payable in addition to the death benefit (defined above) shall be equal to Base SA.

The benefit shall be payable in lumpsum payout on accidental death of both Life Insureds simultaneously under Joint Life Promise options (Joint Life Promise / Joint Life Promise Plus).

Accidental Death shall mean death which

• is caused by bodily injury resulting from an accident and

• occurs due to the said bodily injury solely, directly and independently of any other causes and

• occurs within 180 days of the occurrence of such accident

The benefit due to accidental death will be payable if the accident occurs within the Benefit Option term even if death occurs beyond the term (however within 180 days of the accident).

An “Accident” means sudden, unforeseen and involuntary event caused by external, visible and violent means.

An “Injury” means accidental physical bodily harm excluding illness or disease solely and directly caused by external, violent and visible and evident means which is verified and certified by a Medical Practitioner

III. Terminal Illness

Terminal Illness payout is payable in lumpsum on the confirmed diagnosis of the Terminal Illness as per the option chosen by the Policyholder and as detailed below:

a) Life Promise/ Life Promise Plus

In case of confirmed diagnosis of terminal illness of the Life Insured for an in-force Policy, where all due premiums have been paid, 50% of Base SA shall be payable under the “Payor Accelerator Benefit” and all the future premiums (towards base benefit option and Life Stage or Top-Up SA, if opted) shall be waived off. The Policy will continue to remain in-force for the remaining applicable benefit(s).

b) Joint Life Promise / Joint Life Promise Plus:

In case of first confirmed diagnosis of terminal illness of either Life Insureds for an in-force policy, where all due premiums have been paid, 50% of Base SA shall be payable under the “Payor Accelerator Benefit” and all the future premiums (towards base benefit option and Life Stage or Top-Up SA, if opted) shall be waived off. The policy will continue to remain in-force for the remaining applicable benefits.

The Company reserves the right for independent assessment of the Terminal Illness.

IV. Maturity Benefit

Maturity benefit is payable as a lumpsum payout on survival of the Life Insured/s until the Date of Maturity of Policy, as below:

a) Life Promise Plus

An amount equal to the 100% of the Total Premiums Paid (excluding loading for modal premiums and discount) towards base benefit option and “Life Stage” or “Top-up SA”, if opted and applicable, shall be payable at the end of the Policy Term, provided the Life Insured survives till Date of Maturity of Policy and the Policy is not terminated earlier.

The Total Premiums Paid in the above formula shall be towards the base benefit option excluding loading for modal premiums and discount.

b) Joint Life Secure Plus

An amount equal to the 100% of the Total Premiums Paid (excluding loading for modal premiums and discount) towards the base benefit option and “Life Stage” or “Top-up SA”, if opted and applicable shall be payable at the end of the Policy Term, provided both the Life Insureds survive till Date of Maturity of Policy and the Policy is not terminated earlier.

V. Additional Benefits/ Features:

i) Value-added Service Feature:

Health Management Services:

Eligible Life Insureds of TATA AIA Sampoorna Raksha Promise may avail Health Management Services from service provider(s) associated with the Tata AIA Life Insurance Co. Ltd. The Insurer may also facilitate additional discounts and redeemable vouchers through such service provider, wherever available.

Life Insureds of TATA AIA Sampoorna Raksha Promise, who are eligible for the Health Management Services, will be eligible to avail second opinion/personal medical case management services/medical consultation from the service provider/s affiliated to/registered with Us. The services are expected to assist the Life Insured with an independent diagnosis of the medical condition, thus helping the Life Insured to take the required steps.

Health Management Services are complimentary services in the areas of prevention, diagnosis, treatment or recovery which may include services such as medical consultation, coaching, second opinion, personal medical case management with the objective of health management and improvement.

These services are subject to:

– the availability of a suitable service provider/s;

– primary diagnosis (wherever applicable) has been done by a registered medical practitioner as may be authorized by a competent statutory authority;

– Health Management Service is available to be utilized throughout the policy term, subject to prevailing eligibility conditions;

– the eligibility conditions of the Life Insured will be determined as per the Company’s extant Underwriting Policy;

– the eligibility will be reviewed periodically, and changes shall apply without any discrimination to all existing and new customers of the product.

– In case of any change, the eligibility details will be displayed on Our website (www.tataaia.com) or You may contact Our helpline number 1-860-266-9966 (Call charges apply), before using the services;

– Whenever the eligibility criteria changes or the service is withdrawn, the same shall be communicated to all the policyholders. Prior to effecting any changes, we shall inform the same to IRDAI.

Note:

– These services are aimed at improving Policyholder engagement.

– These Value-added Services are completely optional for the eligible Life Insured to avail.

– For Life Insured availing such services, they are offered at no additional cost.

– The Premiums charged shall not depend on whether such a service(s) is offered or availed.

– The Life Insured may exercise his/her own discretion to avail the services.

– These services shall be directly provided by the service provider(s).

– The services can be availed only where the Policy / rider is in-force.

– All the supporting medical records should be available to avail the service.

– We reserve the right to change the service provider(s) at any time.

– The services are being provided by third party service provider(s) and We will not be liable for any liability.

Riders:

The below mentioned rider(s) would be available with the base product:

• Tata AIA Life Insurance Non-Linked Comprehensive Protection Rider (UIN:110B033V04 or any subsequent version)

• Tata AIA Life Insurance Non-Linked Comprehensive Health Rider (UIN: 110B031V04 or any subsequent version)

• Tata AIA Vitality Protect (UIN: 110B046V04 or any subsequent version)

• Tata AIA Vitality Health (UIN: 110B045V03 or any subsequent version)

These riders can be subject to the rider premium payment term and the policy term shall not be more than the outstanding premium payment term and outstanding policy term for the base plan.

Any minimum and maximum sum assured limits on the above riders will remain applicable, irrespective of the fact that lower or higher sum assured might be chosen as the base cover under this plan.

If there is overlap in benefit offered under different riders with the base product, then that benefit under the rider will not be offered.

The sum assured for any attaching rider(s) will not exceed the Basic Sum Assured except for accidental death benefit rider.

Flexible premium payment modes

You have an option to pay the premiums either as Single Pay or pay Annually, Half Yearly, Quarterly or Monthly modes. Loading on premiums will be applicable as mentioned below

Modal loading is as follows:

Single Premium Rate : Multiply Single premium rate by 1(i.e. No loading)

Annual Premium Rate : Multiply Annual Premium Rate by 1 (i.e. No loading).

Half Yearly Premium Rate : Multiply Annual Premium Rate by 0.51

Quarterly Premium Rate : Multiply Annual Premium Rate by 0.26

Monthly Premium Rate : Multiply Annual Premium Rate by 0.0883

If the chosen premium paying term is not in integer years, the permissible mode of premium payment shall be restricted to Single or Monthly only

Product offers discount such as:

• Salaried Discount – Discount is offered to Salaried customers opting for Base sum assured greater than equal to R 50 lacs. you will be offered a premium discount of 1% of single premium or 5% on first year premiums for regular and limited pay.

• Staff Discount – Discount is offered to a staff member and spouse of staff member. Staff shall include Employees of the promoter group namely, the Tata and the AIA group, its Subsidiaries, fellow subsidiaries, Joint Ventures (which shall include Tata AIA Life Insurance Company Limited amongst others) and their Associates;

• Existing Customer Discount – Discount is offered to an existing customer of TATA AIA Life’s Insurance products as on the date of the application.

• Specific Event Discount – Discount is offered for a special event (Example – First Job), celebratory event (Example – Marriage, Birth/Adoption of child) etc.

4. PART D: GENERAL PROVISIONS

4.1. THE POLICY CONTRACT

This Policy is made in consideration of Your proposal and payment of the required premium. The Policy, proposal for it, the Policy Schedule and any attached endorsements constitute the entire contract. The terms and conditions of this Policy cannot be changed or waived except by endorsement duly signed by Our authorized officer.

Your Policy consists of the basic insurance plan and any endorsements which may be attached to it.

4.2. FRAUD, MIS-STATEMENT OR SUPPRESSION

Any fraud, mis-statement or suppression of a material fact under the Policy shall be dealt in accordance with Section 45 of the Insurance Act, 1938 as amended from time to time. The simplified version of the provisions of Section 45 is enclosed in annexure – (3) for reference.

4.3. EXCLUSION (Must See)

4.3.1 SUICIDE EXCLUSION

Suicide provisions will be applicable as per the Option selected by Policyholder and detailed as mentioned below:

i) Life Secure and Life Promise Plus

In case of death due to suicide within 12 months:

• From the date of commencement of risk under the policy or from the date of revival of the policy, as applicable, the nominee or beneficiary of the policyholder shall be entitled to at least 80% of the Total Premiums Paid (including additional premium paid for Family Plan Option benefit, if applicable) till the date of death or the surrender value available as on the date of death whichever is higher, provided the policy is in force; or

• From the date of exercising the Life Stage Option (if applicable), the nominee or beneficiary of the policyholder shall be entitled to 80% of the premiums paid (excluding any extra premium, any rider premium and taxes) for the increased tranche(s). The original death benefit (based on the sum assured chosen at the time of purchase) and any increased death benefit purchased by exercising the Life Stage Option subsequently but prior to 12 months from the date of death (due to suicide) will remain payable in full.

If the policyholder has opted for Family Plan option, post the payment of the suicide claim the policy will terminate and no transfer of coverage shall be applicable for Secondary life.

ii) Joint Life Promise and Joint Life Promise Plus:

In case of death due to suicide within 12 months:

• From the date of commencement of risk under the policy or from the date of revival of the policy, as applicable, of either or both of the life assureds, the nominee or beneficiary of the policyholder shall be entitled to at least 80% of the Total Premiums Paid till the date of earlier death or the surrender value available as on the date of death whichever is higher, provided the policy is in force.

4.3.2 TERMINAL ILLNESS BENEFIT

No claim will be payable if the Terminal Illness arises directly or indirectly as a result of attempt to suicide in the first year from inception or Revival of policy.

In case a Terminal Illness claim is not payable due to the above exclusion, the policy will continue with the applicable death cover.

The benefit will not commence till two years are completed from the date of issuance of the policy.

4.3.3 WAITING PERIOD (Applicable only if the Policy is availed under Point-of-Sale product norms) — natural causes.

i) Life Promise, Life Promise Plus:

If death of the Life Assured occurs during the first 90 days from the Date of commencement of risk, we shall refund Total Premiums Paid and the policy will terminate with immediate effect.

ii) Joint Life Promise, Joint Life Promise Plus:

If death of the either or both of the Life Insureds occur during the first 90 days from the Date of commencement of risk, we shall refund Total Premiums Paid and the policy will terminate with immediate effect.

Waiting period of 90 days is not applicable for death due to accident provided all due premiums have been paid.

Here’s a quick breakdown:

✅ What is typically covered:

- Death due to illness (e.g., cancer, heart disease, kidney failure, etc.)

- Death due to infections (e.g., COVID-19, sepsis, pneumonia, etc.)

- Death due to natural causes

4.3.4 Accidental Death Benefit:

Accidental Death Benefit shall not be payable for any losses caused directly or indirectly, wholly or partly, by any one of the following occurrences:

• Death because of any disease or infection

• Death arising due to any condition other than death solely and directly as a result of an accident

• Any Pre-existing condition or Disability arising out of a Pre-existing Diseases or any complication arising therefrom. Wherever the proximate cause is accident which has occurred after the rider inception date, this exclusion shall not apply.

• Suicide, attempted suicide, intentional self-inflicted injury, acts of self-destruction, irrespective of mental condition.

• Death arising from or caused due to use, abuse or a consequence or influence of an abuse of any substance, intoxicant, drug, alcohol or hallucinogen

• Death arising out of or attributable to foreign invasion, act of foreign enemies, hostilities, war like operations (whether war be declared or not or while performing duties in the armed forces of any country during war or at peace time), participation in any naval, military or air-force operation, civil war, public defense, rebellion, revolution, insurrection, military or usurped power.

• Death caused by participation of the insured person in any flying activity, except as a bona fide, fare-paying passenger of a recognized airline on regular routes and on a scheduled timetable.

• Insured Person whilst engaging in a speed contest or racing of any kind (other than on foot), bungee jumping, parasailing, ballooning, parachuting, skydiving, paragliding, hang gliding, mountain or rock climbing necessitating the use of guides or ropes, potholing, abseiling, deep sea diving using hard helmet and breathing apparatus, polo, snow and ice sports in so far as they involve the training for or participation in competitions or professional sports, or involving a naval, military or air force operation and is specifically specified in the Policy Schedule.

• Working in underground mines, tunnelling or explosives, or involving electrical installation with high tension supply, or as jockeys or circus personnel, or engaged in Hazardous Activities

• Death arising or resulting from the Insured Person committing any breach of law or participating in an actual or attempted felony, riot, crime, misdemeanor, or civil commotion with criminal intent.

• Death arising from or caused by ionizing radiation or contamination by radioactivity from any nuclear fuel (explosive or hazardous form) or resulting from or from any other cause or event contributing concurrently or in any other sequence to the loss, claim or expense from any nuclear waste from the combustion of nuclear fuel, nuclear, chemical or biological attack.

🔍 Key Concepts in the Clause:

- Ionizing radiation

→ Radiation that can remove tightly bound electrons from atoms, potentially causing harm to living tissue.- Contamination by radioactivity

→ The presence of radioactive substances that could lead to health issues.- Nuclear fuel (explosive/hazardous form)

→ Material used in nuclear reactors or weapons.- Nuclear waste

→ Byproduct of nuclear reactions, often radioactive and hazardous.- Nuclear, chemical, or biological attack

→ Types of attacks involving weapons of mass destruction (WMD).📌 What is the clause saying?

Insurance does not cover death, loss, or expense arising from:

- Ionizing radiation or radioactive contamination

- Any use or presence of nuclear fuel or its waste

- Any event (like war, explosion, or accident) that triggers these risks

- Attacks involving nuclear, chemical, or biological weapons

4.4. MISSTATEMENT OF AGE AND GENDER

This Policy is issued at the age and gender shown on the Policy Schedule which is the Insured’s declared age at last birthday and declared gender in the proposal. If the age and/or gender is misstated and higher premium should have been charged, the benefit payable under this Policy shall be after deduction of such difference of premium along with interest thereon. In such cases, the policy shall be subject to re- underwriting and the Sum Assured shall be subject to Your eligibility as per Our Underwriting norms and the premium to be deducted shall be calculated proportionately on such Sum Assured payable. If the Insured’s age/gender is misstated and lower premium should have been charged, the Company will refund any excess premiums paid without interest. If at the correct age/gender the Insured is not insurable under

this Policy pursuant to our Underwriting rules, the Policy shall be void- ab-initio and the Company will refund the Total Premiums paid without interest after deducting all applicable charges like medical, Stamp duty, Risk, applicable taxes, cesses and levies etc., incurred by the Company under the Policy.

4.5. THE POLICYHOLDER

Only You can, during the Policy Term, exercise all rights, privileges and options provided under this Policy subject to any Nominee’s vested interest or Assignee’s rights.

4.6. NOMINEE

Nomination allowed as per provisions of Section 39 of the Insurance Act 1938 as amended from time to time.

The simplified version of the provisions of Section 39 is enclosed in Annexure 2 for reference.

4.7. ASSIGNMENT

Assignment allowed as per provisions of Section 38 of the Insurance Act 1938 as amended from time to time.

The simplified version of the provisions of Section 38 is enclosed in Annexure 1 for reference.

4.8. CURRENCY AND PLACE OF PAYMENT

All amounts payable either to or by Us will be paid in the Indian currency. Such amounts will be paid by a negotiable bank draft or cheque drawn on a bank or NEFT (National Electronic Funds Transfer) or electronic clearing systems. All amounts due from Us will be payable from Our office shown on the Policy Schedule.

4.9. FREEDOM FROM RESTRICTIONS

Unless otherwise specified, this Policy is free from any restrictions upon the Insured as to travel, residence or occupation. Even though there are no restrictions under this Policy, the attached riders (if any) may have occupational exclusions for the cover as specified in the rider terms and conditions.

4.10. CLAIM PROCEDURES

Notice of Claim

All cases of death must be notified immediately to us in writing. However, any delay in notifying shall require to be substantiated to Our satisfaction. In case of any delay on the part of the Company to process the claim within extant regulatory timeline, We shall pay interest as may be prescribed by the IRDAI from time to time.

Please note that all death claims will be payable to the nominee/legal heir of the Insured policy holder.

Filing Proof of Claim

Affirmative proof of loss and any appropriate forms as required by us must be completed and furnished to us, at the claimant’s expenses, within 90 days after the date the Insured event happens, unless specified otherwise. A list of primary claim documents listing the normally required documents is attached to the Policy. Submission of the listed documents, forms or other proof, however, shall not be construed as an admission of liabilities by the Company.

In case of diagnosed Terminal Illness, We would require evidence of the advance stage of the medical condition certified by two physicians or registered medical practitioners and any forms as required by us must be completed and furnished to us, at the claimant’s expenses.

We reserve the right to require any additional proof and documents in support of the claim.

Proof of Continuing Loss

In the case of disability or other losses as We deem appropriate, We will require, at reasonable intervals, proof of continuing disability or loss. If such proof is not submitted as required, or such disability or loss ceases, claims for such disability or loss will not be considered.

• Turn Around Time (TAT) for claims settlement and brief procedure :

30 days from receiving all the documents,

90 days from the day of the claim intimation, if further investigation required.

Brief procedure :

i. Intimate claim to us via email/call/or at any one of the branch offices.

ii. Submit all relevant documents along with claim. Please refer to www.tataaia.com for more details.

iii. Documents shall be verified and processed.

iv. We shall contact you in case of any queries or further information required.

v. Claim amount shall be disbursed if claim is acceptable.

vi. For the detailed procedure, please refer to our website www.tataaia.com.

• Helpline/Call Centre number : 1-860-266-9966 (local charges apply)

• Contact details of the insurer : Email – Customercare@tataaia.com

Call our helpline number 1-860-266-9966 (local charges apply)

Write directly to us on following address:

Tata AIA Life Insurance Company Limited B – Wing, 9th Floor, I-Think Techno Campus, Behind TCS, Pokhran Road No.2, Close to Eastern Express Highway, Thane (West) – 400 607, Maharashtra.

• Link for downloading claim form and list of documents required including bank account details www.tataaia.com

4.11. CLAIMS REQUIREMENTS

4.11.1. Death claims requirements

For processing the claim request under this Policy, we will require the following documents:

| Type of Claim | Requirement |

| Death (all causes of death other than the Accidental Death) | a) Claim Forms Part I: Application Form for Death Claim (Claimant’s Statement) along with NEFT form Part II: Physician’s Statement – to be filled by last attending physician |

| b) Death Certificate issued by a local government body like Municipal Corporation | |

| c) Medical Records (Admission Notes, Discharge/Death Summary, Indoor Case Papers, Test Reports etc) | |

| d) Claimant’s Photo ID with age proof & relationship with the Insured along with Address proof of the claimant and Cancelled cheque with name and account number printed or cancelled cheque with copy of Bank Passbook / Bank Statement. If no nomination – Proof of legal title to the claim proceeds (e.g. legal succession paper) | |

| If Death due to Accident or unnatural death (to be submitted in addition to the above) | Copy of the First Information Report (FIR) or Panchanama/ Police complaint/ Inquest #Copy of Post-Mortem report (PMR)/ Autopsy and Viscera report #Copy of the Final Police Investigation report (FPIR)/Charge sheet# |

# Medical records shall be required if Life Insured was in hospital at the time of death or any time prior to the date of death. Please submit copies certified/attested by the issuing or competent authority. Original Seen Verified (OSV) by Branch Personnel will also be accepted.

4.12. Claims Intimation Process

Please inform the company immediately upon occurrence of death.

A claim can be made through any of the following avenues: –

a. Online at www.tataaia.com

b. Email – claims@tataaia.com

c. Call our helpline number 1-860-266-9966 (Call charges apply)

d. Walk into any of the Company branch office.

e. Write directly to us on following address:

Claims Department: Tata AIA Life Insurance Company Limited, 9th Floor, B – Wing, I-Think Techno Campus (Lodha) Behind TCS, Pokhran Road No.2, Thane (West), Mumbai – 400 607

f. Write to your Agent/Intermediary

4.13. TAXES

All Premiums, Charges, and interest payable under the policy are exclusive of applicable taxes, duties, surcharge, cesses or levies which will be entirely borne/ paid by the Policyholder, in addition to the payment of such Premium, charges or interest. Tata AIA Life shall have the right to claim, deduct, adjust and recover the amount of any applicable tax or imposition, levied by any statutory or administrative body, from the benefits payable under the Policy.

Tax Benefit:

Income Tax benefits would be available as per the prevailing income tax laws, subject to fulfilment of conditions stipulated therein. Income Tax laws are subject to change from time to time. Tata AIA Life Insurance Company Ltd. does not assume responsibility on tax implication mentioned anywhere in this document. Please consult your own tax consultant to know the tax benefit available to you.

4.14. FREE LOOK PERIOD

If the policyholder is not satisfied with the terms & conditions of the policy, the policyholder has the right to cancel the Policy by providing written notice to the Company and receive a refund of all premiums paid without interest after deducting

a) Proportionate risk premium for the period on cover,

b) Stamp duty and medical examination costs (including goods and services tax) which have been incurred for issuing the Policy.

Such notice must be signed by the policyholder and received directly by the Company within 30 days after the policyholder receives the Policy Document whether the policy is sourced electronically or otherwise.

The Proportionate risk premium will be determined as under:

Effective Sum Assured x (mortality rate) x (number of days for the period on cover /365)

4.15. CHANGE IN BASIC SUM ASSURED

Increase / Decrease in Basic Sum Assured is not allowed in this Policy.

4.16. CHANGE IN ADDRESS OF POLICYHOLDER OR NOMINEE

In order to provide You better services, We request You to intimate us in the event of any change in the address of the Policyholder or the nominee.

4.17. CHANGE IN MODE OF PREMIUM PAYMENT/ NOMINEE/ ASSIGNEE/ APPOINTEE/ DOB CHANGE OR CORRECTION

In order to provide You better services, We request You to intimate us in the event of any change in the address of the Policyholder or the nominee.

4.18. PLAN CHANGE / CONVERSION OPTION

Plan change/ Conversion is not allowed under this Policy.

5. PART E

Not Applicable for this Product.

6. PART F: GENERAL CONDITIONS

6.1. LOSS OF POLICY DOCUMENT

If the Policy document is lost or destroyed, then at the request of the Policyholder, the Company will issue a duplicate Policy document duly endorsed to show that it is issued following the loss or destruction of the original Policy document. Upon the issuance of the duplicate Policy document, the original Policy document immediately and automatically ceases to have any validity. The Company will charge a fee of Rs. 250/- along with the applicable tax and surcharge/cess, for the issuance of a duplicate Policy document. These charges are subject to revision by the Company from time to time.

6.2. PREMIUM PROVISIONS

6.2.1. PAYMENT OF PREMIUM

a. All premiums are payable on or before their due dates to us either at our issuing office or to our authorized Officer or Cashier.

b. Collection of advance premium shall be allowed, if the premium is collected within the same financial year.

c. The Premium so collected in advance shall only be adjusted on the due date of the premium.

6.2.2. CHANGE OF FREQUENCY OF PREMIUM PAYMENT

You may change the frequency of premium payments by written request. Subject to our minimum premium requirements, premiums may be paid on an annual, semi-annual, quarterly or monthly mode at the premium rates applicable on the Issue Date.

6.2.3. DEFAULT

After payment of the first premium, failure to pay a subsequent premium on or before its due date will constitute a default in premium payment.

6.3. GRACE PERIOD

A Grace Period of fifteen (15) days for monthly mode and thirty (30) days for all other modes, from the due date will be allowed for payment of each subsequent premium.

The Policy will remain in force during this period. If any premium remains unpaid at the end of its Grace Period, the Policy shall lapse and have no further value except as may be provided under the Non-Forfeiture Provisions.

In case of death of the Life Insured during the Grace Period but before the payment of the premium then due, the policy will still be valid and the benefits shall be paid after deductions of the said unpaid premium and also the balance premium(s), if any, falling due from the date of death and before the next policy anniversary.

6.4. DEDUCTION OF PREMIUM AT CLAIM

If a claim is payable under this Policy, any balance of the premiums due for the full policy year in which death occurs shall be deducted from the proceeds payable under the Policy.

6.5. REVIVAL

If a premium is in default beyond the Grace Period and subject to the Policy not having been surrendered, it may be revived, within five years after the due date of the first unpaid premium and before maturity subject to:

(i) Your written application for revival;

(ii) production of Insured’s current health certificate and other evidence of insurability satisfactory to Us;

(iii) payment of all overdue premiums with interest.

Interest on premiums will be compounded at an annual rate which We shall determine.

Any evidence of insurability and medical requirement requested at the time of revival will be based on the prevailing underwriting guidelines duly approved by the Board and as per the health declaration submitted by the Life Insured.

Any revival shall only cover loss or Insured event which occurs after the Revival Date.

The applicable interest rate for revival is determined using the State Bank of India (SBI) domestic term deposit rate (for tenure ‘1 year to less than 2 years’), plus 2% and will be reviewed semi- annually. The current interest rate on revival from 1st October 2024 is 8.98% p.a. (i.e. SBI interest rate of 6.98% + 2%) plus applicable taxes.

The interest rate applicable is reviewed every 6 months and any alteration in the formula will be subject to prior approval of IRDAI.

6.6. LOAN

Loan is not available under this Policy.

6.7. NON-FORFEITURE PROVISIONS

Non-Forfeiture Benefit on Premium Discontinuance:

If any due premium for a non-single pay Policy remains unpaid at the end of the Grace Period, the cover ceases to exists and the following benefit shall be payable:

| Premium Paying options | Life Coverage | Size of benefits/policy monies | ||

| Before 2 years’ premium paid | After 2 years’ premium paid | |||

| Life Promise Option | Regular Pay | Cover cease to exist | Cover cease to exist | No amount is payable |

| Limited Pay | Cover cease to exist | Cover cease to exist | Unexpired Risk Premium Value is paid out on the earlier of the following events after which the policy terminates: 1. Policyholder terminates voluntarily. 2. Death of the Life Assured 3. Expiry of Revival Period 4. Maturity | |

| Joint Life Promise | Regular Pay | Cover cease to exist | Cover cease to exist | No amount is payable |

| Limited Pay | Cover cease to exist | Cover cease to exist | Unexpired Risk Premium Value is paid out on the earlier of the following events after which the policy terminates: 1. Policyholder terminates voluntarily. 2. First death of any of the Life Assureds or simultaneous death of both Life Assureds 3. Expiry of Revival Period 4. Maturity | |

| Premium Paying options | Life Coverage | Size of benefits/policy monies | ||

| Before 1 full years’ premium paid | After 1 full years’ premium paid | |||

| Life Promise Plus Option | Regular or Limited Pay | Cover cease to exist | Cover continues with Reduced Paid-Up Sum Assured | 1. Death Benefit as defined below is payable on death of the life assured. 2. Payor accelerator benefit is payable on confirmed diagnosis of terminal illness of the life assured. 3. Surrender Value / Unexpired Risk Premium as defined below is payable. 4. Maturity / Survival as defined above |

| Joint Life Promise Plus | Regular or Limited Pay | Cover cease to exist | Cover continues with Reduced Paid-Up Sum Assured | 1. Death Benefit is payable on first death of any of the life assureds or simultaneous deaths of both life assureds. 2. Benefit as defined below is payable on simultaneous death of both life assureds due to accident. 3. Payor Accelerator Benefit is payable on first confirmed diagnosis of Terminal Illness of any of the life assureds. 4. Surrender Value as defined below is payable. 5. Maturity Value is payable at maturity on survival of both life assureds |

Such discontinued policies can be revived within the period of 5 years from the due date of first unpaid premium by payment of all due premiums together with interest. Upon Revival of the Policy, all benefits shall be restored and be applicable with effect from the date of Revival.

Under Life Promise Plus and Joint Life Promise Plus Options when a policy is converted to Reduced Paid-up on premium discontinuance after 1 full years’ premium paid:

o The coverage shall continue in reduced paid-up status till Date of Maturity of Policy unless the Policy is revived earlier.

o The Death Benefit shall be re-set to the Reduced Paid-Up Sum Assured (as computed below) and shall be payable on death. In case the Life Insured has opted for Family Plan Option benefit (Refer Part C), the death benefit applicable for secondary Life Insured shall continue to be the Reduced Paid-Up Sum Assured till the end of extended Policy Term.

o The Accidental Death Benefit shall be re-set to the Reduced Paid-Up Accidental Death Sum Assured (as computed below) and shall be payable on:

Joint Life Promise Plus: Simultaneous accidental death of both Life Insureds.

o In case of Terminal Illness claim, the amount payable under this benefit is:

Life Promise Plus and Joint Life Promise Plus – 50% * Reduced Paid-up Factor * Base SA

o Any benefit paid for the Payor Accelerated Benefit shall be adjusted from the computation of remaining reduced paid-up applicable benefits. No survival benefits are payable under a paid-up Policy during the Policy Term prior to the Date of Maturity of Policy.

o On survival till the Date of Maturity of Policy, the Maturity Benefit as set out in Part C shall be payable.

Reduced Paid-up Sum Assured = Reduced Paid-up Factor * Base SA

Reduced Paid-Up Accidental Death Sum Assured = Reduced Paid-up Factor * Accidental Death SA

Where, Reduced Paid-up Factor = Number of Premiums Paid / Number of Premiums Payable