1. What is this Policy About?

This is a life insurance and savings plan that ensures financial security while also offering guaranteed income in the future.

- Life Insurance: If the insured person passes away, a sum of money is given to their family.

- Savings Plan: It provides a steady income after a certain period.

- Non-linked, Non-participating: This means the plan is not connected to the stock market, and you won’t get extra bonuses like some other policies.

- Get a regular income for a chosen number of years.

- Get your invested premium back at the end of the policy.

- Protect your family financially in case of death.

- (Optional) Get coverage for critical illnesses so that you don’t have to pay future premiums if diagnosed with a serious disease.

- You can choose between two options:

- Regular Income – You get guaranteed income for a set period.

- Regular Income + Critical Illness Benefit – Same as above, but also covers major illnesses and waives off future premium payments if diagnosed.

- You can buy it as a single individual or as a joint life policy (for Single Pay option).

2. What are the key benefits? (Part C)

A. This policy has two options:

Option 1: Regular Income

- You pay for the policy as per the selected payment mode.

- Guaranteed Annual Regular Income

- You will receive a fixed amount every year or month after the policy term ends.

- Return of Premium Benefit

- The total amount of premiums you paid will be returned at the end.

Option 2: Regular Income + Critical Illness Benefit

- Includes all the benefits of Option 1.

- If diagnosed with a 40 specified critical illness (like heart attack, cancer, stroke, kidney failure etc..), you get an income immediately, upon diagnosis. and you don’t have to pay future premiums.

- A waiting period of 90 days applies.

Note: If diagnosed with a critical illness, you won’t have to pay premiums, and the regular income starts earlier.

B. Death Benefit: (Both Options)

Pays the highest of:

- 1.25x Single Premium OR 10x Annualised Premium,

- 105% of Total Premiums Paid,

- Basic Sum Assured.

Note:

- Death Benefit: If the insured person dies, the nominee will receive a lump sum amount.

- If the policyholder dies by suicide within 12 months, the nominee will only get 80% of the premiums paid.

- For Joint Life Policies, the benefit is paid twice—once on the first person’s death and again on the second person’s death.

C. Value-Added Services:

Eligible policyholders can access second opinions and medical consultations.

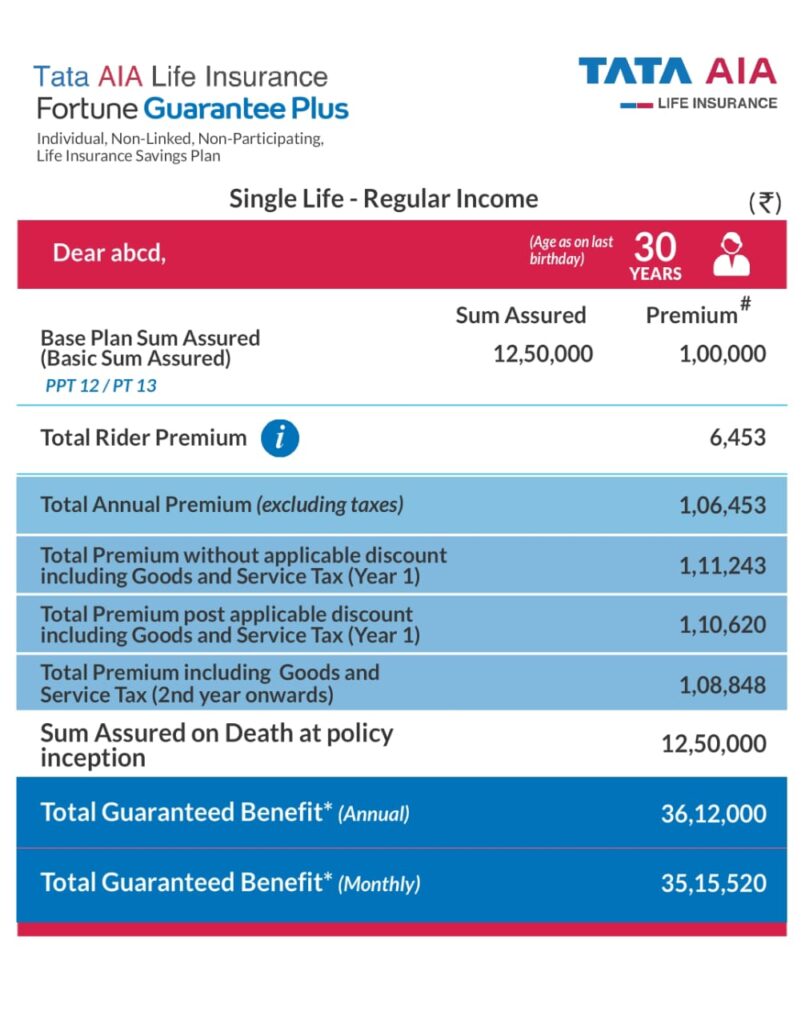

4. Premium Payments and Other Financial Terms

- You can pay in one go (Single Pay) or Limited Pay (pay for 5-12 years), Regular Pay (pay for the full policy term).

- You can pay the premium monthly, quarterly, half-yearly, yearly, or as a one-time lump sum.

- If you miss a payment, you get a grace period to pay without losing benefits.

- If you stop paying after 2 years, the policy continues with reduced benefits.

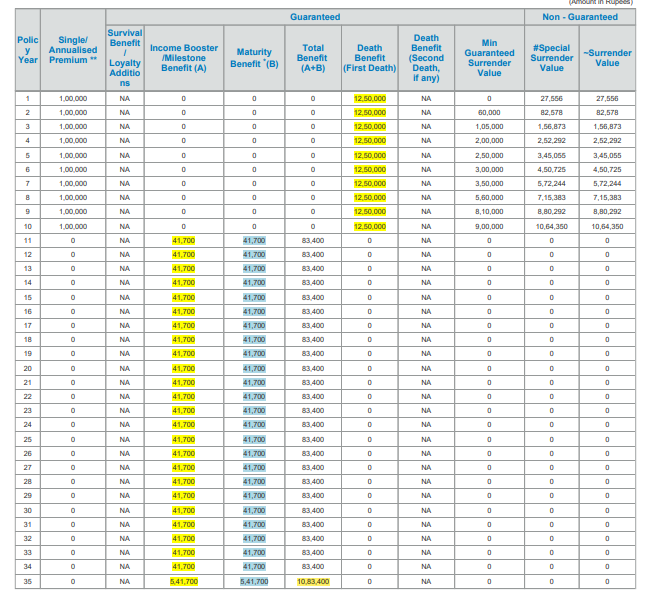

- If you want to surrender (exit) before maturity, you will get a surrender value, but it might be lower than expected.

5. What Happens If You stop paying premiums? Non-Forfeiture Provisions (Part D)

- Surrender Benefits:

- Available only if at least two full years’ premiums have been paid (except for Single Pay policies).

- Surrender Value = Higher of Guaranteed Surrender Value (GSV) or Special Surrender Value (SSV).

- If you don’t pay within the Grace Period (30 days for yearly/quarterly payments, 15 days for monthly payments):

- If you haven’t completed at least 2 years of premium payments, the policy lapses (ends) and you won’t get anything.

- If you have paid at least 2 years’ premiums, the policy continues but with Reduced Paid-Up benefits (meaning, the benefits will be lower).

- Maturity, Death, and Critical Illness Benefits are proportionally reduced.

- You can revive a lapsed policy within 5 years by paying the due premiums plus interest.

6. Loans Against the Policy (Part D)

- Available if the policy has a Surrender Value.

- You can take a loan up to 80% of the surrender value of the policy.

- Interest on the loan is based on SBI’s interest rate + 2% (eg : 8.98% per year)

7.Can you cancel the policy?

- Free Look Period: If you change your mind, you can cancel within 15 days (30 days for electronic/Distance Marketing) and get a refund after deducting medical charges and stamp duty, admin charges.

- Surrender (Exit Early): You can exit the policy after 1 or 2 years, but you’ll get back a lower amount based on surrender value.

8. What happens in case of death?

- Your nominee gets the highest of these amounts:

- 105% of total premiums paid OR

- 10 times the annual premium OR

- Basic Sum Assured (Fixed coverage amount).

- For joint life policies, the policy continues after the first death and ends after the second death.

9. Exclusions (When the Policy Won’t Pay) (Part F)

- Suicide: If the insured person dies by suicide within 12 months, the nominee will only get back 80% of the premiums paid or Surrender Value is payable.

- Misstatement of Age: If the actual age is outside insurable limits, the policy will be void.

- Critical Illness Benefit Exclusions:

- If the illness is diagnosed within the first 90 days of the policy, no benefit is paid.

- Some conditions, like alcohol-related liver failure, Self-inflicted injuries, drug/alcohol abuse, congenital diseases, are not covered.

10. What about taxes?

- You may get tax benefits under current tax laws.

- Premiums are exclusive of taxes, meaning you have to pay extra for GST.

11. Other Important Points

- Nomination & Assignment – You can choose a nominee who will receive benefits in case of death.

- Policy Revival – If your policy lapses, you have 5 years to restart it by paying the missed premiums with interest.

- Advance Premium Payment – You can pay premiums up to 3 months in advance but it will be adjusted only on the due date.

12 . Claims Process (Part F)

To get the benefits, the nominee or insured person needs to:

- Notify the company about the claim within 90 days.

- Submit documents, including:

- Death certificate (for death claims).

- Medical reports (for critical illness claims).

- Claims for unnatural deaths require FIR, Post-Mortem Report, and Final Investigation Report.

- Proof of identity and bank details.

- The insurance company may ask for additional documents if needed.

If the company delays the claim process, they must pay interest.

13. Complaints and Grievances (Part G)

If you have issues, you can:

- Contact Tata AIA Life Insurance through phone, email, or branch offices.

- If not resolved, escalate to a Escalation Mechanism includes the Grievance Redressal Officer (GRO) and IRDAI Grievance Cell.

- If still unsatisfied, approach IRDAI (insurance regulator).

- As a last resort, contact the Insurance Ombudsman for legal help.

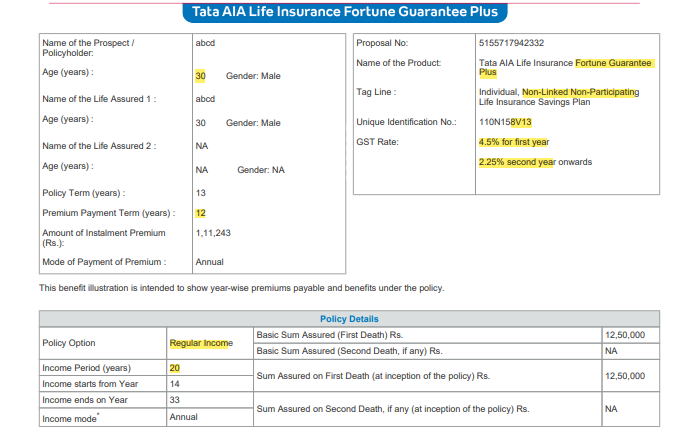

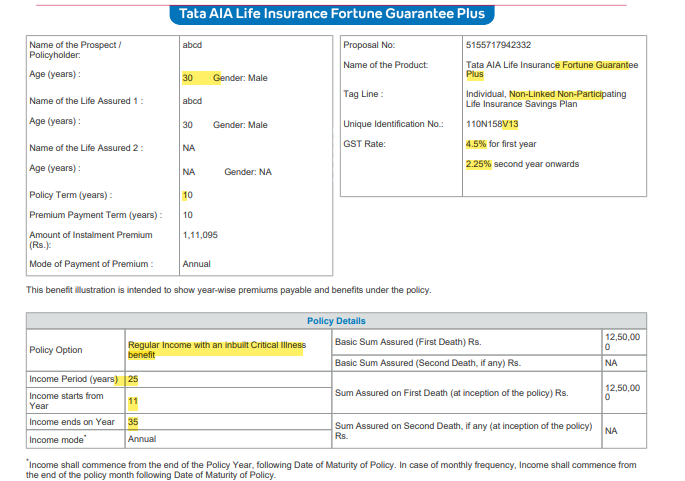

| Fortune Guarantee Plus | ||

| Coverage For | 1. Single Life 2. Joint Life (only Single Pay) | |

| Age | 1 – 60 | Proposer and Insurer concept available |

| Plan Option | Regular IncomeRegular Income + Critical Illness | |

| Option 1: Regular Income | ||

| Premium Payment Opton | 1. Single 2. LP 3. RP | |

| Annualizes Premium | Min 24,000 | |

| PPT | 5 – 12 | |

| PT | PPT + 1 — 5 | |

| Income Term | 20 -45 (after PT) | |

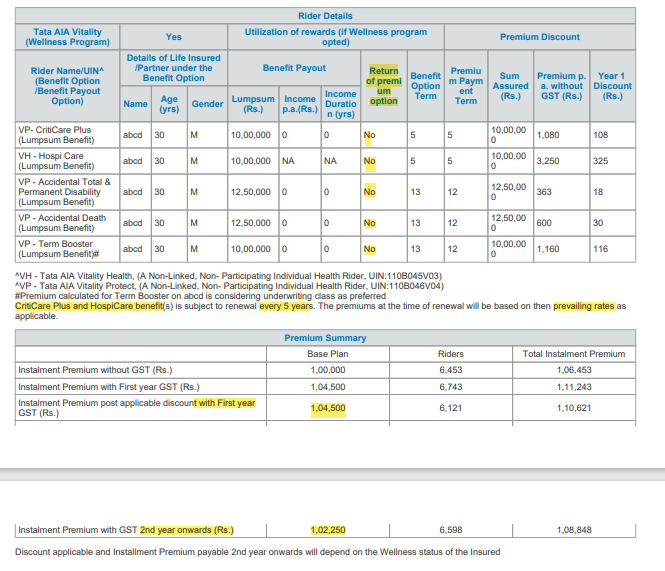

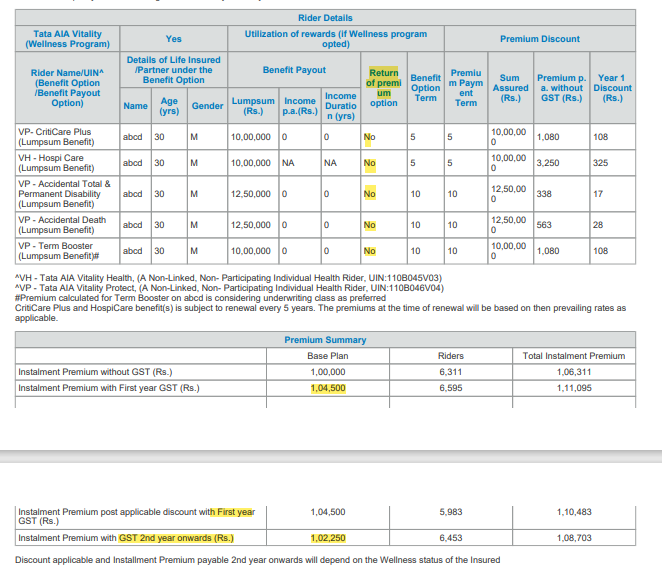

| Riders (Optional) | 1.TB 2.AD 3.ATPD 4.Hospicare 5.Criticare Plus 6.BPR | Hospi Care: Pay fixed amount of Hospitalization, ICU benefits and also Recuperation Benefit in case of Hospitalization for 7 or More Days. Criticare Plus: 40 critical illness including Cancer and cardiac Conditions |

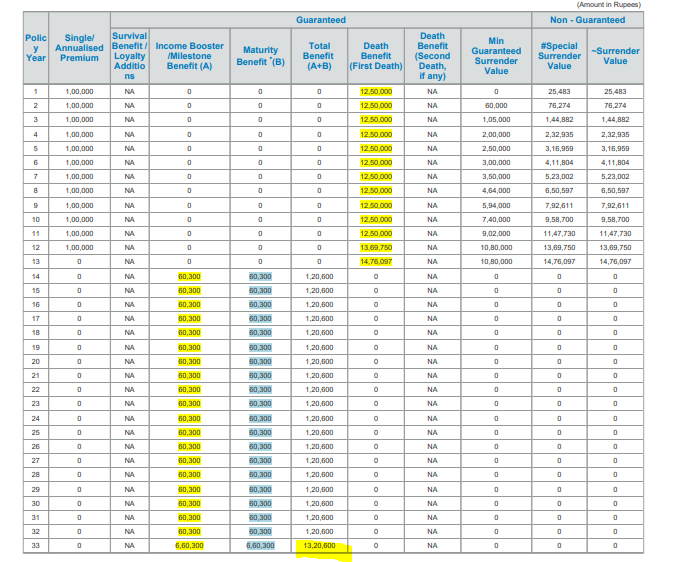

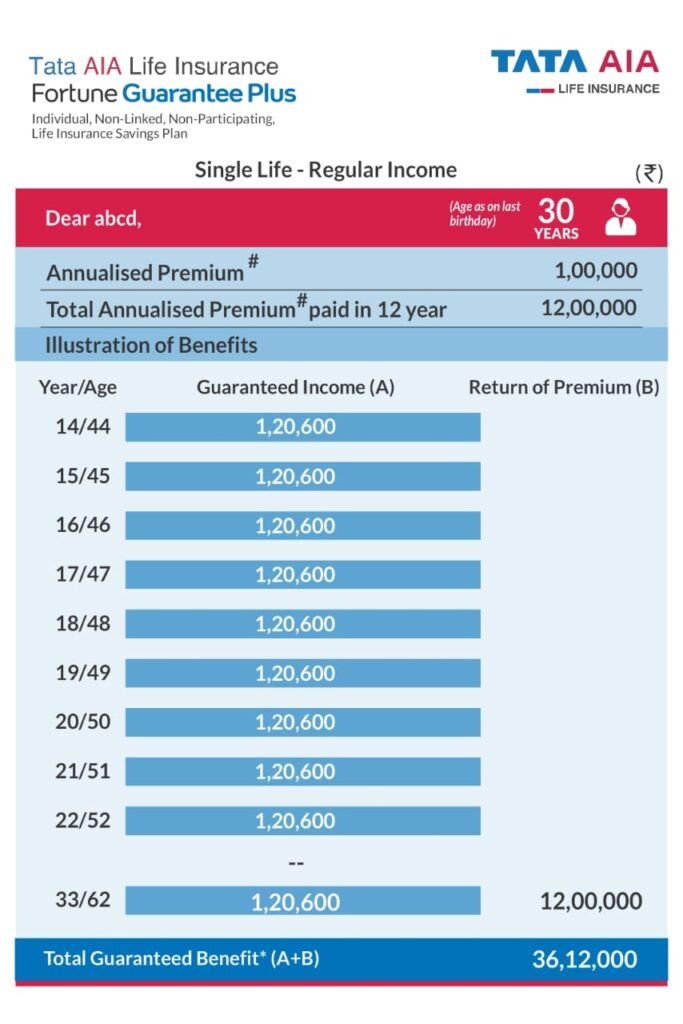

| Benefit | Pay : First year GST (Rs.) 1,04,500 2nd year onwards (Rs.) 1,02,250 till 12 years Get: 1,16,020 from 14 th years onward till 32 years and 13,16,020 (including 12lakhs Principle) on 33rd years Death Benefit (First Death): Till 13 th years 10,00,000 | |

| Option2: Regular Income + Critical Illness | ||

| Premium Payment Opton | RP only | |

| Annualizes Premium | Min 24,000 | |

| PPT | 5 – 10 | |

| PT | PPT | |

| Income Term | 25 (after PT) | |

| Riders (Optional) | 1.TB 2.AD 3.ATPD 4.Hospicare 5.Criticare Plus 6.BPR | Hospi Care: Pay fixed amount of Hospitalization, ICU benefits and also Recuperation Benefit in case of Hospitalization for 7 or More Days. Criticare Plus: 40 critical illness including Cancer and cardiac Conditions |

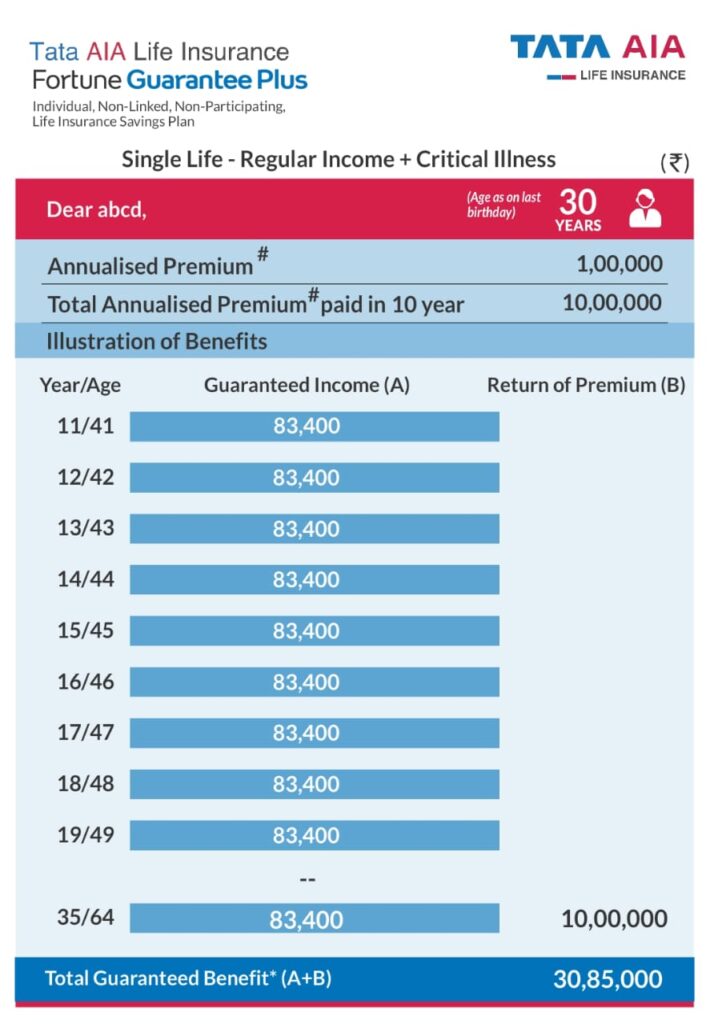

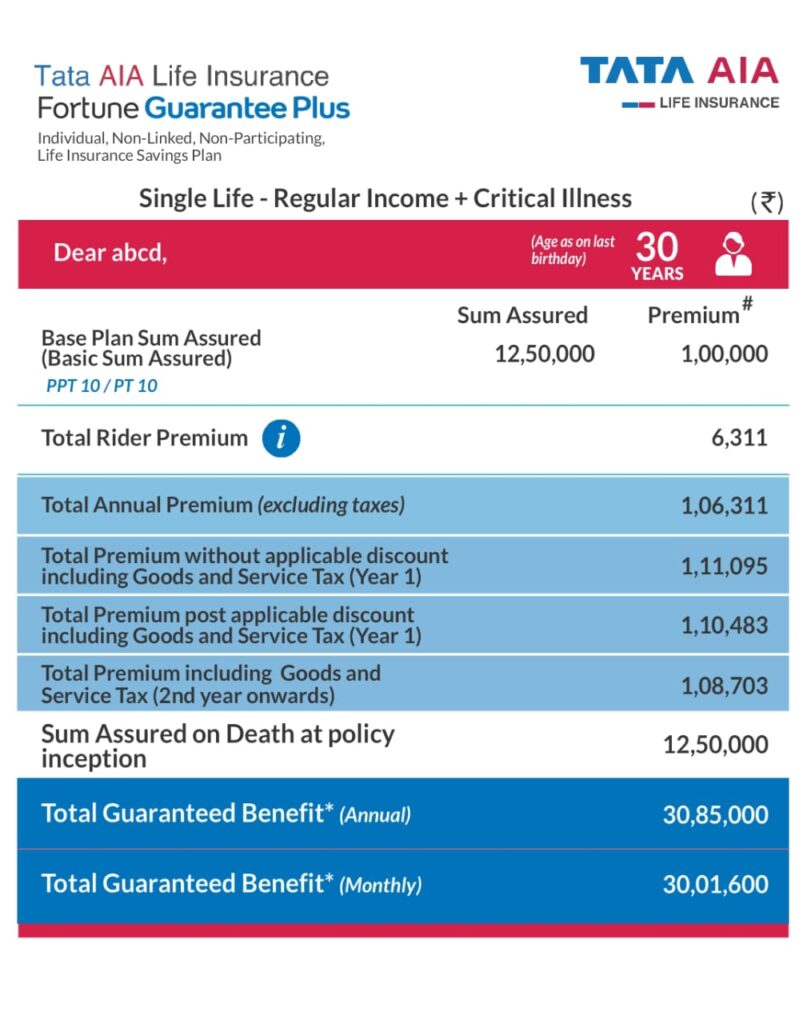

| Benefit | *In case of diagnosis of critical illness, all future premiums will be waived off. | Pay : First year GST (Rs.) 1,04,500 2nd year onwards (Rs.) 1,02,250 till 10 years Get: 66,080 from 11 th years onward till 34th years and 10,66,080 (including 10 lakhs Principle) on 35th years Death Benefit (First Death): Till 10 th years 10,00,000 |

Option 1: Regular Income

Option2: Regular Income + Critical Illness

Product Disclaimers:

- Tata AIA Life Insurance Fortune Guarantee Plus (Individual, Non-Linked, Non-Participating, Life Insurance Savings Plan) ¿ UIN: 110N158V13

- ++Guaranteed Income shall be a fixed percentage of the Annualized Premium / Single Premium (excluding discount) payable in a year. Guaranteed Annual Income as per the chosen Income Frequency shall commence after maturity till the end of the Income Period, irrespective of survival of the life insured(s) during the Income Period. Income is payable for chosen income period of 20 to 45 years, please refer brochure for details.

- $Return of Premium shall be the return of Total Premiums Paid (excluding loading for modal premiums, discount, any extra premium, rider premium and taxes) by the policyholder and shall be payable at the end of the Income Period irrespective of survival of the life insured(s) during the Income Period.

- #Other options are available under this plan. Please Refer Sales Brochure for details.

- ~Applicable for specific plan options. Please refer brochure for additional details.

- ^^^Income Tax benefits would be available as per the prevailing income tax laws, subject to fulfillment of conditions stipulated therein. Income Tax laws are subject to change from time to time. Tata AIA Life Insurance Company Ltd. does not assume responsibility on tax implication mentioned anywhere in this document. Please consult your own tax consultant to know the tax benefits available to you.

- &The Company may offer a premium discount on the policies sourced by the company to the Existing Customers of Tata AIA Life¿s Insurance Products as on the date of application. This premium discount shall be applicable on the premiums payable in the first policy year only and may range from 1.5% to 20% depending on the Policy term and Premium payment term opted.

- **Individual Death Claim Settlement Ratio is 99.13% for FY 2023-24 as per the latest annual audited figures.

- ~~At the time of purchase, if the policyholder chooses to opt for a Return of Balance Premium option with Tata AIA Vitality Protect and Tata AIA Vitality Health, an amount equal to the Total Premiums Paid towards the respective benefit option (excluding loading for modal premiums), less any claim amount already paid out under the respective benefit option and any premium discounts availed under the Wellness Program as premium discounts or premium cashback, shall be payable at the end of the benefit option term, provided the benefit option is not terminated.

- ^^Tata AIA Vitality is a Wellness Program that offers you an upfront discount at policy inception. You can also earn premium discount / cover booster (as applicable) for subsequent years on policy anniversary basis your Vitality Status (tracked on TATA AIA Vitality app). The Tata AIA Vitality Wellness Program is available with Tata AIA Vitality Health (UIN: 110B045V03) and Tata AIA Vitality Protect (UIN: 110B046V04). Vitality is a trademark licensed to Tata AIA Life by Amplify Health Assets PTE. Limited, a joint venture between Vitality Group International, INC. and AIA Company Limited. The assessment under the wellness program shall not be considered as a medical advice or a substitute to a consultation/treatment by a professional medical practitioner.

- ©Riders are not mandatory and are available for a nominal extra cost. For more details on benefits, premiums and exclusions under the Rider, please contact Tata AIA Life’s Insurance Advisor/Intermediary/ branch. Tata AIA Vitality Health (UIN: 110B045V03 or any other later version), Tata AIA Vitality Protect (UIN: 110B046V04 or any other later version) are available with this plan.

- This product is underwritten by Tata AIA Life Insurance Company Ltd.

- The plan is not a guaranteed issuance plan and it will be subject to company¿s underwriting and acceptance.

- Insurance cover is available under this product.

- For more details on risk factors, terms and conditions please read sales brochure carefully before concluding a sale. The precise terms and condition of this plan are specified in the Policy Contract.

- Buying a Life Insurance Policy is a long-term commitment. An early termination of the Policy usually involves high costs and the Surrender Value payable may be less than the all the Premiums Paid.

- In case of non-standard lives and on submission of non-standard age proof, extra premiums will be charged as per our underwriting guidelines.

- Risk cover commences along with policy commencement for all lives, including minor lives.

- L&C/Advt/2024/Nov/3560