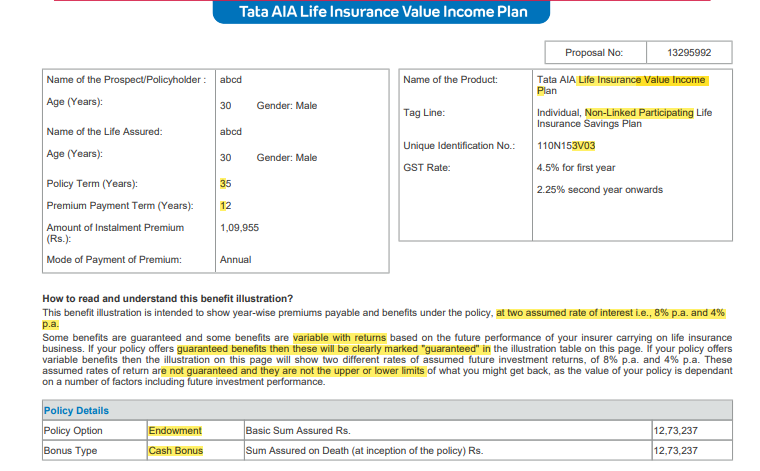

Individual, Non-Linked, Participating Life Insurance Savings Plan

1. What is the Tata AIA Life Insurance Value Income Plan?

It is a non-linked, participating life insurance savings plan that offers:

- life coverage, financial security, and savings benefits

- The option to receive or accumulate cash bonuses for future use (if declared)

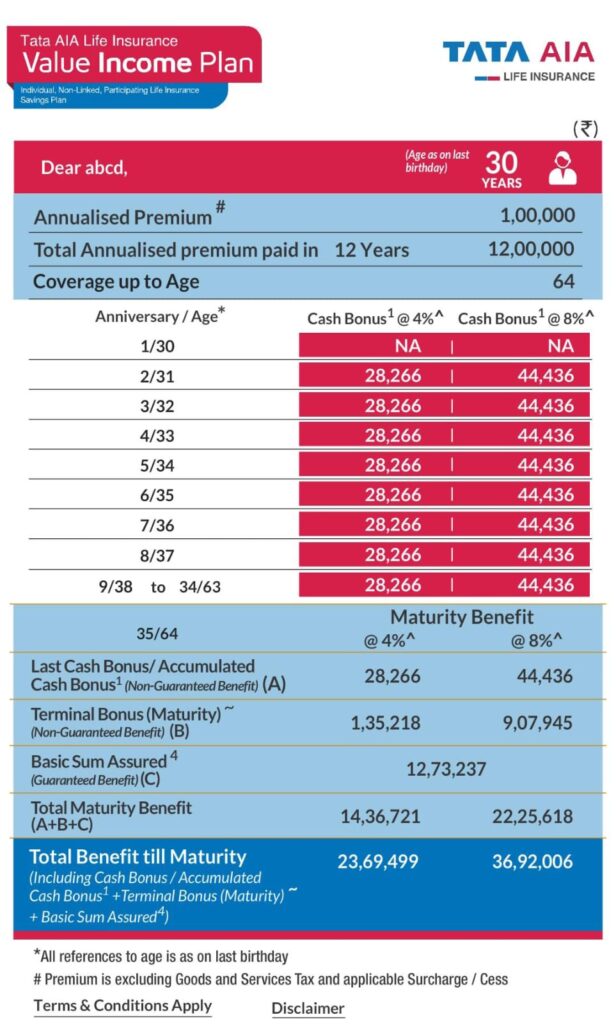

- Flexible policy terms and premium payment terms

- Guaranteed maturity benefits

- Tax benefits under applicable laws

2. What are the key benefits of this plan?

- Flexibility to choose between two plan options:

- Endowment Plan

- Endowment with Extended Life Cover till Age 100

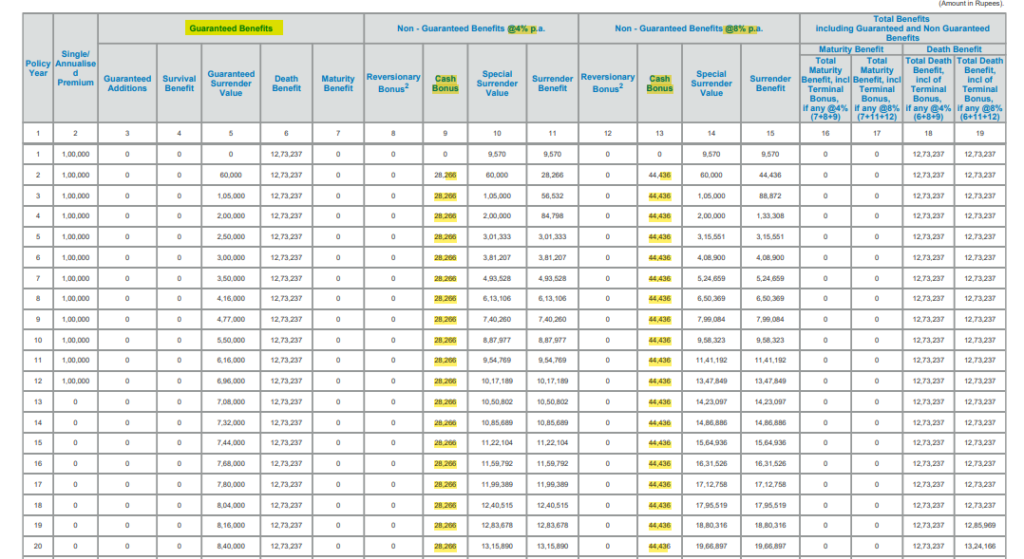

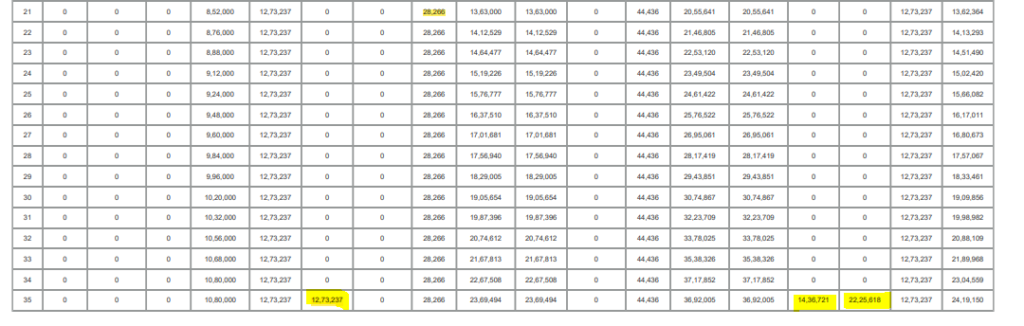

- Guaranteed Maturity Benefit along with cash bonuses (if declared)

- Cash Bonus Option: Receive yearly cash bonuses (if declared) or accumulate them for future payouts

- Multiple Policy Terms & Premium Payment Terms

- Additional coverage options with riders for enhanced protection

- Tax benefits under Sections 80C and 10(10D) of the Income Tax Act

3. What are the available policy terms and premium payment terms?

- Policy Term: 10 to 40 years

- Premium Payment Term (PPT): 5 to 15 years

4. What is the eligibility to purchase this policy?

- Minimum Entry Age: 30 days

- Maximum Entry Age:

- 55 years for PPT of 5 years

- 58 years for PPT of 6 years

- 62 years for PPT of 7 years

- 65 years for PPT of 8-15 years

- Maturity Age: 18 to 80 years

5. How does the cash bonus option work?

- If declared, cash bonuses can be received annually from the 2nd policy year onwards or

- Accumulated at a company-declared interest rate.

- The accumulated cash bonus (if any) with interest, is payable upon maturity, death, or surrender.

6. What is the death benefit under this plan?

In case of the policyholder’s death during the policy term, the nominee will receive the

Sum Assured on Death, which is the highest of the following:

- 11 times the annualized premium

- 105% of the total premiums paid

- Guaranteed Maturity Benefit

- Basic Sum Assured

Additionally, accumulated cash bonus and terminal bonus (if any) will be paid.

- If the Extended Life Cover (ELC) option is chosen, an additional payout of Basic Sum Assured will be made if the insured passes away before 100 years of age.

7. What is the maturity benefit?

If the policyholder survives the policy term, the following benefits are payable:

- Guaranteed Maturity Benefit

- Terminal Bonus (if any)

- Accumulated Cash Bonus (if opted)

8. Can I take a loan against this policy?

Yes, after the policy acquires a Surrender Value you can avail of a policy loan up to 80% of the surrender value. Interest on the loan is linked to SBI’s domestic term deposit rate plus 2%.

9. What happens if I stop paying premiums?

- If premiums are not paid within the grace period (15 days for monthly mode, 30 days for others), the policy will lapse.

- If premiums are not paid within the grace period, the policy will lapse.

- If at least one year’s premium is paid, the policy acquires a surrender value.

- A lapsed policy can be revived within 5 years from the first unpaid premium date.

10. What are the tax benefits available?

- Premiums paid are eligible for tax benefits under Section 80C of the Income Tax Act.

- Maturity and death benefits are tax-free under Section 10(10D) (subject to conditions).

11. Can I surrender my policy?

Yes, you can surrender the policy after one full year’s premium is paid. The surrender value is the higher of:

- Guaranteed Surrender Value (GSV)

- Special Surrender Value (SSV) (which is company-determined)

Accumulated Cash Bonus (if any) will also be paid upon surrender.

12. What happens if I choose the Extended Life Cover (ELC) option?

- Under Option 2 (ELC), after policy maturity, the policyholder remains covered until age 100.

- After policy maturity, the Basic Sum Assured is paid if:

- The policyholder dies before age 100

- The policyholder survives till age 100

- If the policyholder dies during this period, the Basic Sum Assured is paid.

- No bonuses are paid during the ELC period.

13. What happens if the policyholder commits suicide?

If the policyholder dies due to suicide within 12 months of policy inception or revival, the nominee will receive:

- 80% of premiums paid (if policy is in force), or

- The higher of 80% of premiums paid or surrender value (if revived).

14. What are the available premium payment modes?

Premiums can be paid in the following modes:

- Annual (1x of premium rate)

- Half-Yearly (0.51x of annual premium)

- Quarterly (0.26x of annual premium)

- Monthly (0.0883x of annual premium)

15. What is the free-look period?

You have 30 days from the date of receiving the policy to review and return it if you disagree with the terms. You will get a refund after deductions for risk premium, stamp duty, and medical expenses.

16. Can I assign or nominate a beneficiary?

Yes, as per Sections 38 and 39 of the Insurance Act, you can:

- Assignment (changing ownership to someone else) is allowed under Section 38 of the Insurance Act.

- Nomination (choosing a beneficiary to receive benefits in case of your death) is allowed under Section 39 of the Insurance Act.

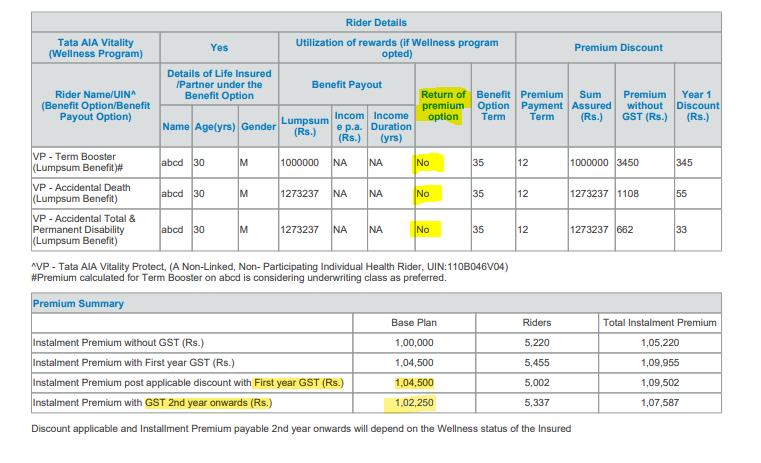

17. What are the additional riders available?

You can enhance your policy with the following riders:

- Tata AIA Life Insurance Non-Linked Comprehensive Protection Rider

- Tata AIA Vitality Health Rider

- Tata AIA Vitality Protect Rider

- Tata AIA Benefit Protection Rider

18. How can I revive a lapsed policy?

A lapsed policy can be revived within 5 years by:

- Submitting a written revival request

- Providing satisfactory health and financial proof

- Paying overdue premiums with interest (linked to SBI’s 1-year deposit rate + 2%)

What happens if the policy is not revived?

- If premiums remain unpaid beyond the grace period, and the policy has not acquired a surrender value, it lapses with no benefits payable.

- If the policy has acquired a Surrender Value, it will be converted to a Reduced Paid-Up (RPU) Policy where:

- No cash bonuses will be paid.

- Sum Assured on Death & Maturity Benefit will be reduced proportionally.

19. What is the penalty for offering or accepting rebates?

Under Section 41 of the Insurance Act, 1938, any person involved in rebates on premiums can be penalized up to ₹10 lakhs.

20. Where can I contact Tata AIA Life for assistance?

You can reach Tata AIA Life through:

- Phone: 1-860-266-9966

- Email: customercare@tataaia.com

- Website: www.tataaia.com

- Nearest Tata AIA branch

- Escalation: If unsatisfied, contact IRDAI Grievance Call Centre (155255 or 1800-425-4732) or Insurance Ombudsman.

21. Are there any exclusions?

- Suicide clause: If death occurs due to suicide within 12 months, only 80% of premiums paid will be refunded.

- Other exclusions depend on the rider terms and conditions.

22. What is the claim settlement process?

The nominee must submit:

✔ Claim form

✔ Death certificate

✔ Original policy document

✔ Identity & address proof of nominee

✔ Bank details for payout

✔ Medical records (if applicable)

✔ Police FIR/Postmortem Report (for accidental death)

⏳ Timeframe for Claim Submission: Within 90 days of the event (exceptions allowed if delay is justified).

| Value Income Plan (Non-Linked, Participating) | ||

| Age | 0 – 65 | |

| Gender | M / F | |

| Plan Options | ||

| PPT | 5 – 15 | |

| PT | 20– 40 | |

| Whole life coverage option | Available | |

| Annualized Premium | Min 24,000 | |

| Bonus option | Cash on BirthdayCash on policy AnniversaryAccumulated Cash Bonus | |

| Spl Date | Available | |

| Riders (Optional) | TB: Terminal IllnessADATPDHospicareCriticare Plus No BPR | Hospi Care: Pay fixed amount of Hospitalization, ICU benefits and also Recuperation Benefit in case of Hospitalization for 7 or More Days. Criticare Plus: 40 critical illness including Cancer and cardiac Conditions |

Disclaimer

- The complete name of Tata AIA Value Income Plan is Tata AIA Life Insurance Value Income Plan (UIN: 110N153V03) – Individual, Non-Linked, Participating Life Insurance Savings Plan

- ~Individual Death Claim Settlement Ratio is 99.13% for FY 2023-24 as per the latest annual audited figures.

- ^These bonuses are not guaranteed in nature. The Company may declare Cash Bonus rate annually in advance. The Cash Bonuses if declared will be applicable provided all due premiums have been paid.

- *Guaranteed Maturity Benefit is equal to the Basic Sum Assured

- This product is underwritten by Tata AIA Life Insurance Company Limited. The plan is not a guaranteed issuance plan, and it will be subject to Company’s underwriting and acceptance.

- For more details on risk factors, terms and conditions please read Sales Brochure carefully before concluding a sale.

- $Riders are not mandatory and are available for a nominal extra cost. For more details on benefits, premiums and exclusions under the Rider, please contact Tata AIA Life’s Insurance Advisor/Intermediary/ branch.

- #Income Tax benefits would be available as per the prevailing income tax laws, subject to fulfilment of conditions stipulated therein. Income Tax laws are subject to change from time to time. Tata AIA Life Insurance Company Ltd. does not assume responsibility on tax implication mentioned anywhere in this document. Please consult your own tax consultant to know the tax benefits available to you.

- All Premiums are subject to applicable taxes, cesses & levies which will entirely be borne by the Policyholder along with the payment of Premium. If any imposition (tax or otherwise) is levied by any statutory or administrative body under the Policy, Tata AIA Life Insurance Company Limited reserves the right to claim the same from the Policyholder. Alternatively, Tata AIA Life Insurance Company Limited has the right to deduct the amount from the benefits payable by Us under the Policy.

- Past performance is not indicative of future performance.

- In case of sub-standard lives, extra premiums will be charged as per our underwriting guidelines.

- Insurance cover is available under this product

- The risk factors of the bonuses projected under the product are not guaranteed.

- Past performance doesn’t construe any indication of future bonuses

- These products are subject to the overall performance of the insurer in terms of investments, management of expenses, mortality and lapses.

- L&C/Advt/2025/Jan/0058