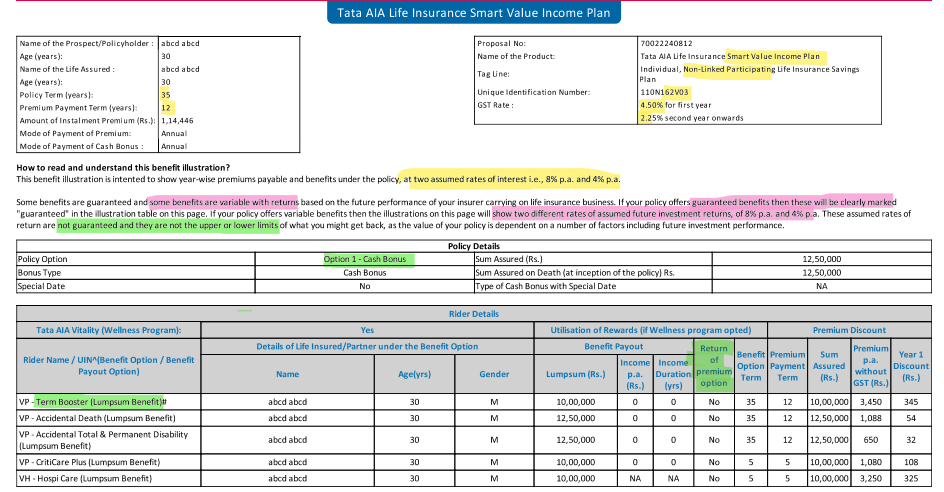

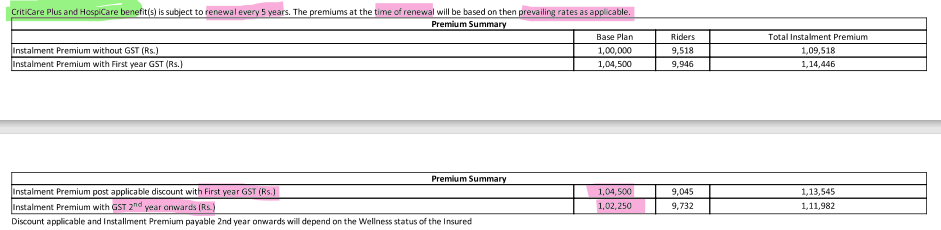

Individual, Non-Linked, Participating Life Insurance Savings Plan.

1. What is the Tata AIA Life Insurance Smart Value Income Plan?

It’s a life insurance policy that also helps you save and grow your money.It offers two main benefits:

- Life Cover – If something happens to you, your family gets a financial payout.

- Savings & Bonus – You get returns in the form of cash bonuses.

Note: It is a non-linked, participating plan, meaning it is not tied to the stock market but participates in the company’s profits.

2. What are the key benefits of this plan?

- Life insurance coverage until the age of 100.

- Two bonus options: Cash Bonus (received regularly) or Accumulating Cash Bonus (paid as a lump sum later).

- Option to enhance protection with riders (additional benefits).

- Tax benefits on premiums and payouts (as per tax laws).

- Life Protect Feature: If you lose your job or income, you may pause your premium payments while keeping life cover.

- Loan Facility: You can take a loan against your policy after one year.

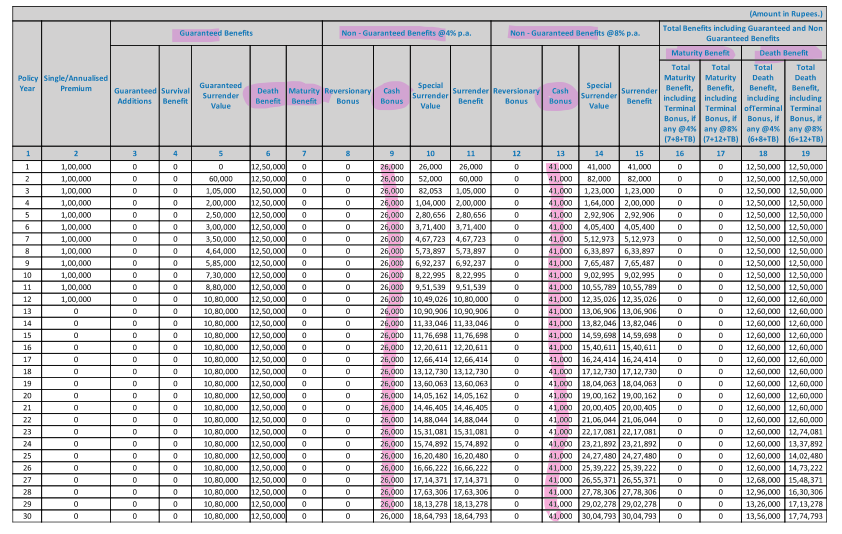

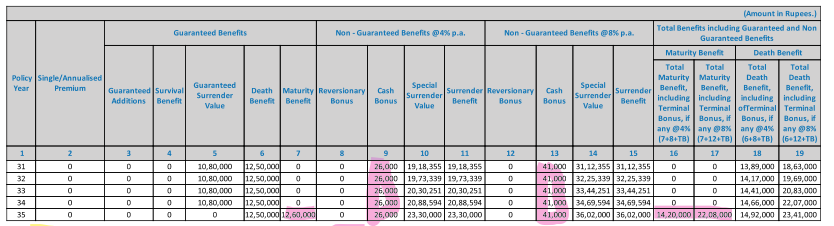

3. What are the two bonus options?

- Option 1: Cash Bonus → Bonus is paid out regularly (monthly, quarterly, or annually).

- Option 2: Accumulating Cash Bonus → Bonus accumulates over time and is paid as a lump sum at maturity.

4.How Does the Plan Work?

- You pay a premium (monthly, yearly, or a one-time payment).

- The company declares a bonus (if applicable), which can either be:

- Paid to you regularly (Cash Bonus Option), or

- Accumulated and paid later (Accumulating Cash Bonus Option).

- If you live till the policy term ends, you get a maturity benefit (final payout).

- If you pass away during the policy term, your family gets a death benefit.

5. Who Can Buy This Plan?

- Minimum age to enter: 30 days old (for newborns).

- Maximum entry age: 65 years.

- The policy can last up to 100 years (depending on the plan).

6. What happens in case of death?

If the policyholder passes away during the policy term, the nominee will receive:

- Sum Assured on Death (a guaranteed amount).

- Bonus amount accumulated (if applicable).

- 105% of total premiums paid (whichever is higher).

7. What is the maturity benefit?

If the policyholder survives till the end of the policy term, they will receive:

- Sum Assured on Maturity (a guaranteed amount).

- Accumulated bonus (if any).

8. Can I withdraw my bonuses?

Yes, under the Cash Bonus option, bonuses can be withdrawn as cash or used to offset future premium payments.

9. What if I can’t pay my premiums on time?

- A grace period of 15 days (monthly mode) or 30 days (other modes) is provided.

- Before 1 year: Policy lapses, and you lose benefits.After 1 year: The policy goes into “Reduced Paid-Up” mode, meaning your benefits reduce but don’t disappear.

- If the policy lapses, you can revive it within 5 years by paying outstanding premiums with interest.

10. Can I take a loan against this policy?

Yes, after one year of policy completion, you can avail a loan up to 80% of the surrender value. Interest applies.

11. Are there any tax benefits?

Yes, premiums paid and benefits received may qualify for tax benefits as per Income Tax laws. However, it’s best to consult a tax advisor.

12. What If You Want to Exit the Policy Early?

- You can surrender the policy, but the payout depends on how long you have been invested.

13. What happens if I surrender the policy?

You can surrender (cancel) the policy after one year, provided at least one full-year premium is paid. The surrender value will be the higher of:

- Guaranteed Surrender Value (GSV)

- Special Surrender Value (SSV) (varies based on market conditions).

14. What happens if I stop paying premiums?

- If less than one year’s premium is paid → Policy lapses, no benefits.

- If at least one year’s premium is paid → Policy becomes Reduced Paid-Up (RPU) with lower benefits.

15. Can I add extra protection to my policy?

Yes, you can add optional riders, such as:

- Comprehensive Protection Rider (extra life cover).

- Comprehensive Health Rider (coverage for critical illnesses).

16. Is there a free-look period?

Yes, you have 30 days to review the policy. If you cancel within this period, you’ll get a refund (minus administrative charges).

17. Exclusions in Tata AIA Smart Value Income Plan

An exclusion in an insurance policy means situations where the insurance company will not pay the benefits. This plan has one main exclusion:

Suicide Clause

- If the policyholder dies by suicide within 12 months from:

- The date the policy started, or

- The date of policy revival (if the policy had lapsed and was restarted),

Then, the nominee (family member or person chosen to receive benefits) will not get the full death benefit.

What Will Be Paid Instead?

Instead of the full Sum Assured (Death Benefit), the insurance company will pay:

- 80% of the total premiums paid till the date of death, OR

- Surrender Value (if applicable), whichever is higher.

This means that if a policyholder takes their own life within the first 12 months, their family will not get the full insured amount but will receive a partial refund of the premiums paid.

| Smart Value Income Plan (Non-Linked, Participating) | ||

| Age | 0 – 65 | |

| Gender | M / F | |

| PPT | Single (SA-1, SA-2)LPRP | |

| Plan Options | ||

| PPT | 5 – 12 | |

| Whole life coverage option | Available | |

| Annualized Premium | Min 24,000 | |

| PT | 20 —50 | |

| Bonus option | cash | |

| Spl Date | Available | |

| Riders (Optional) | TB: Terminal IllnessADATPDHospicareCriticare Plus No BPR | Hospi Care: Pay fixed amount of Hospitalization, ICU benefits and also Recuperation Benefit in case of Hospitalization for 7 or More Days. Criticare Plus: 40 critical illness including Cancer and cardiac Conditions |

Product Disclaimers:

- Tata AIA Life Insurance Smart Value Income Plan – Individual, Non-Linked, Participating Life Insurance Savings Plan (110N162V03).

- 1A monthly mortality charge will be levied. Please refer complete sales brochure for details.

- 2Cash bonuses (if declared) may be opted to be paid out at the end of the chosen pay-out frequency or as premiums offset. Alternatively, the cash bonus (if declared) can be chosen to be accumulated and paid out on maturity, death or surrender. Please refer Brochure for additional details.

- The risk factors of the bonuses projected under the product are not guaranteed.

- Past performance doesn’t construe any indication of future bonuses, and

- These products are subject to the overall performance of the insurer in terms of investments, management of expenses, mortality and lapses.

- ~~~Income Tax benefits would be available as per the prevailing income tax laws, subject to fulfillment of conditions stipulated therein. Income Tax laws are subject to change from time to time. Tata AIA Life Insurance Company Ltd. does not assume responsibility on tax implication mentioned anywhere in this document. Please consult your own tax consultant to know the tax benefits available to you.

- $$Rider is not mandatory and is available for a nominal extra cost. For more details on benefits, premiums, and exclusions under the Rider, please contact Tata AIA Life’s Insurance Advisor/ branch. Tata AIA Life Insurance Non-Linked Comprehensive Protection Rider (UIN: 110A032V04 or any other later version) and Tata AIA Life Insurance Non-Linked Comprehensive Health Rider (UIN: 110B045V03or any other later version) are available under this plan.

- ~The remaining amount you are eligible for will be determined based on the amount of the unpaid debt that needs to be recovered when it is terminated.

- This product is underwritten by Tata AIA Life Insurance Company Ltd. Insurance cover is available under this product. This plan is not a guaranteed issuance plan, and it will be subject to Company¿s underwriting and acceptance. Risk cover commences along with policy commencement for all lives, including minor lives. Buying a Life Insurance Policy is a long-term commitment. An early termination of the Policy usually involves high costs, and the Surrender Value payable may be less than the all the Premiums Paid.

- In case of non-standard lives and on submission of non-standard age proof, extra premiums will be charged as per our underwriting guidelines. All Premiums and interest payable under the policy are exclusive of applicable taxes, duties, surcharge, cesses, or levies which will be entirely borne/ paid by the Policyholder, in addition to the payment of such Premium or interest. Tata AIA Life shall have the right to claim, deduct, adjust, and recover the amount of any applicable tax or imposition, levied by any statutory or administrative body, from the benefits payable under the Policy.

- ~~At the time of purchase, if the policyholder chooses to opt for a Return of Balance Premium option with Tata AIA Life Insurance Non-Linked Comprehensive Protection Rider and Tata AIA Life Insurance Non-Linked Comprehensive Health Rider an amount equal to the Total Premiums Paid towards the respective benefit option (excluding loading for modal premiums), less any claim amount already paid out under the respective benefit option.

- **Individual Death Claim Settlement Ratio is 99.13% for FY 2023-24 as per the latest annual audited figures.

- For more details on risk factors, terms and conditions, please read sales brochure carefully before concluding a sale.

- $Only available with cash bonus option.

- L&C/Advt/2024/Oct/3011