A Non-Linked, Non-Participating, Individual Life Insurance Savings Plan

We, at Tata AIA Life, believe in protecting your dreams at various stages of life without compromising on your basic needs through financial resources. You do not have to think twice to live your dreams as they now come with guaranteed payouts.

We present to you, Tata AIA Life Insurance Smart Income Plus, that meets tomorrow’s requirements along with protecting your loved ones and dreams as it ensures you of guaranteed returns for the money invested.

Investment in this plan helps you fulfill your medium to long term goals such as Child’s Education/ Marriage / Business Start-up and Retirement planning.

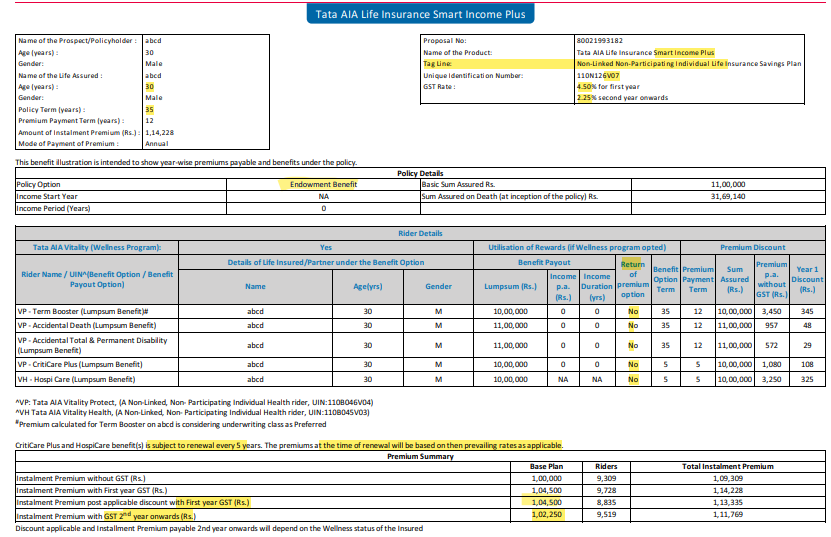

| Smart Income Plus | ||

| Age | 0 – 65 | Proposer and Insurer concept available |

| Gender | M / F | |

| Plan Options | 1.Regular Income 2.Endowment | |

| Option 1: Regular Income | ||

| Annualized Premium | Min 18000 | |

| PPT | 5 – 12 | |

| PT | 11 – 51 | |

| Income Period | Min 5 years | **Income Defer Max 5 Years. **1 year Compulsory Gap after PPT |

| Riders (Optional) | 1. TB: Terminal Illness 2. AD 3. ATPD 4. Hospicare 5. Criticare Plus 6. BPR | Hospi Care: Pay fixed amount of Hospitalization, ICU benefits and also Recuperation Benefit in case of Hospitalization for 7 or More Days. Criticare Plus: 40 critical illness including Cancer and cardiac Conditions |

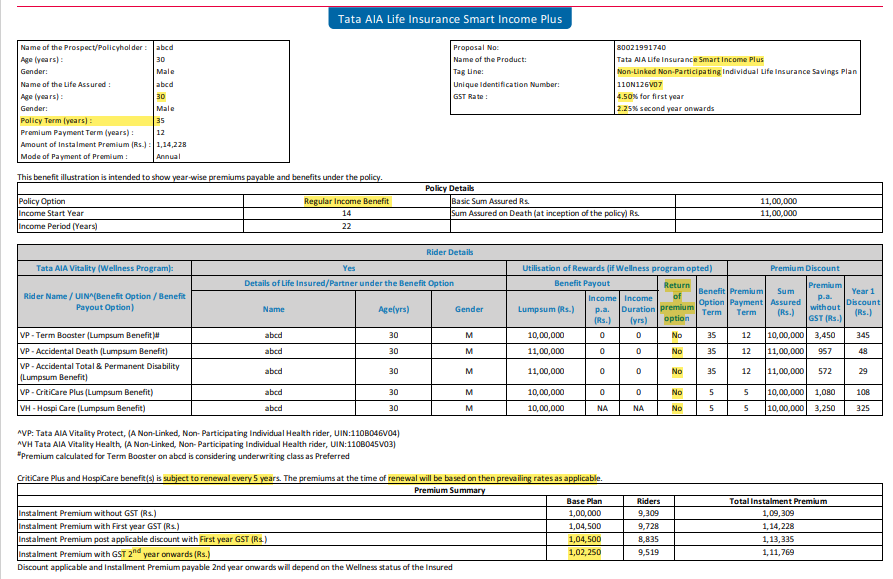

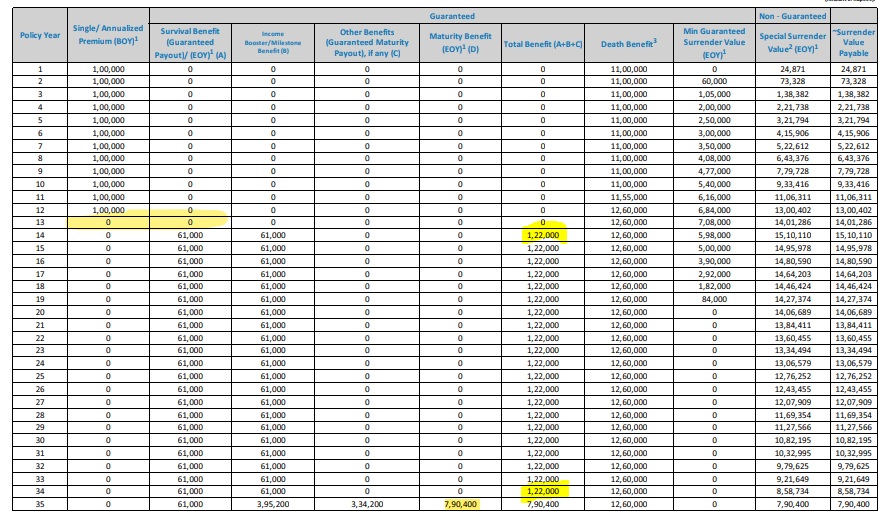

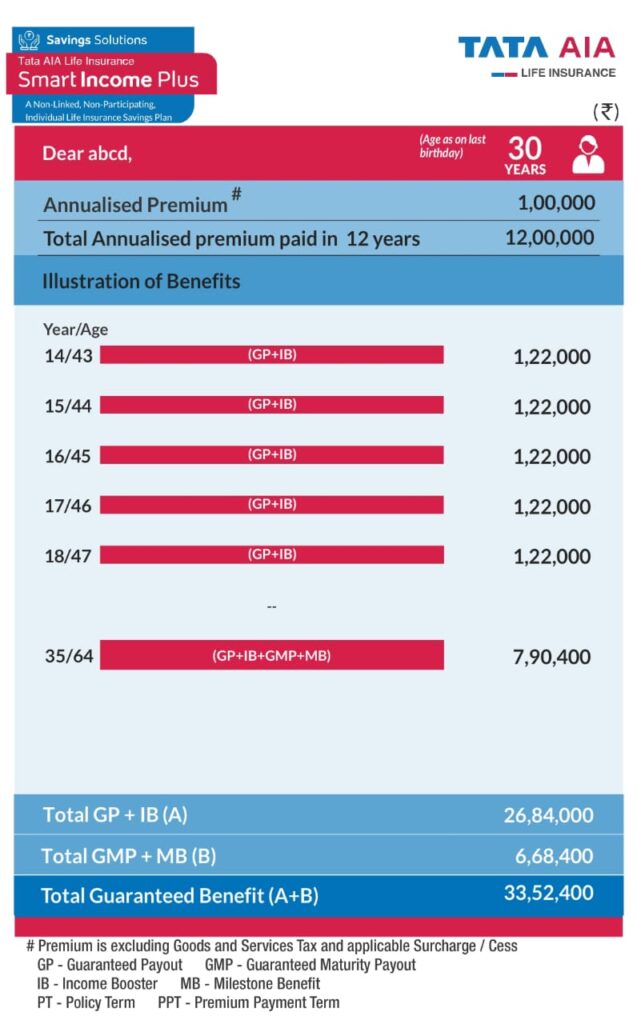

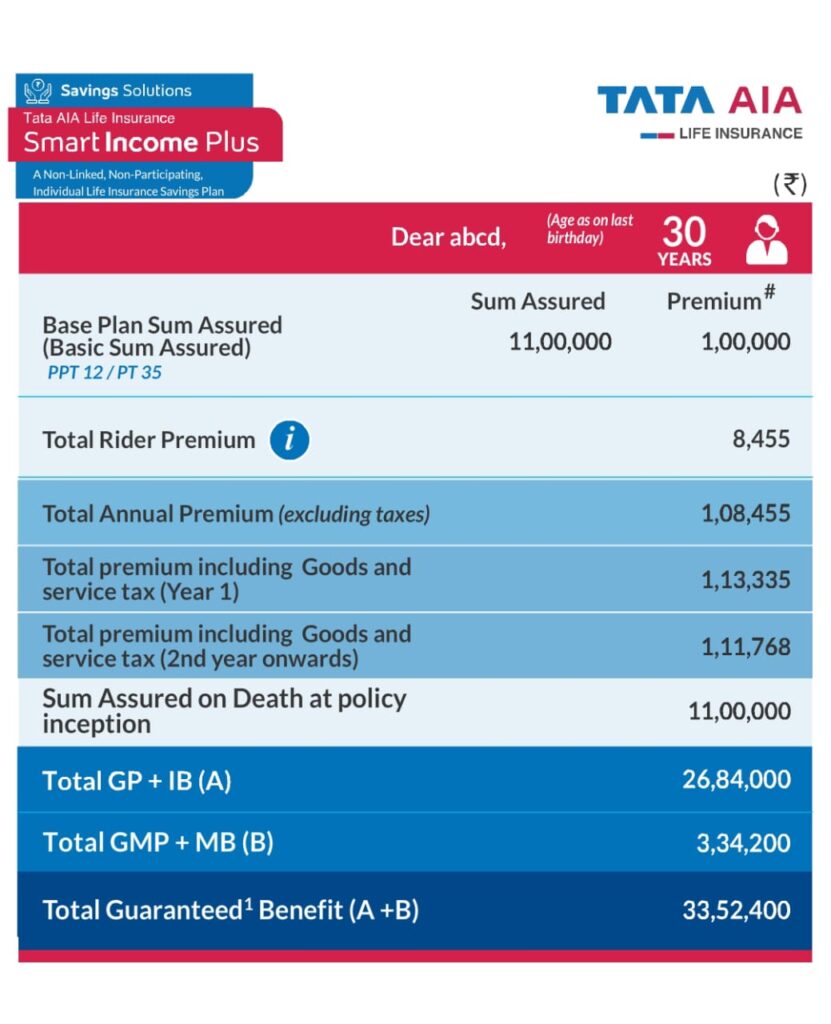

| Pay: First year GST(Rs.) 1,04,500 2 nd year onwards (Rs.) 1,02,250 till 12 th Year. Get: 1,35,000 from 14 th year onwards till 29 th years 6,54,600 on 30th years | ||

| Option 2: Endowment | ||

| Annualized Premium | Min 36,000 | |

| PPT | 5 – 12 | |

| PT | 12 – 35 | |

| Pay: First year GST(Rs.) 1,04,500 2 nd year onwards (Rs.) 1,02,250 till 12 th Year. Get: 22,52,160 on 29 th years 22,52,160 on 30th years | ||

In depth About the Product (No need to see)

1. Policy Overview

- A Limited Premium Paying Non-Linked, Non-Participating, Individual Life Insurance Savings Plan.

- Offers guaranteed payouts after a defined policy period.

- Provides life insurance coverage along with periodic income.

2. Definitions

- Beneficiary: The person entitled to receive policy benefits (Policyholder, nominee, assignee, legal heir, etc.).

- Accident: An unforeseen event caused by external, violent, and visible means.

- Accidental Death: Death due to bodily injury directly resulting from an accident within 90 days.

- Annualised Premium: The total premium payable in a year, excluding taxes, rider premiums, and extra loadings.

- Assignment: The process of transferring policy rights to another person.

- Basic Sum Assured: The guaranteed benefit amount payable on death.

- Maturity Date: The date on which maturity benefits become payable.

- Nominee: The person designated to receive benefits upon the insured’s death.

- Policyholder: The person who owns the policy and is responsible for premium payments.

- Policy Term: The duration of the policy.

- Premium Payment Term: The number of years for which premiums must be paid.

- Revival Date: The date on which a lapsed policy is reinstated.

- Total Premiums Paid: The sum of all premiums paid, excluding extra premiums, rider premiums, and taxes.

3. Benefits & Payouts

Guaranteed Payouts (GP):

3.1 Guaranteed Payouts (GP)

- Eligibility: The policy must be in force with all due premiums paid.

- Payment Start: GP begins at the end of a defined policy year, chosen at inception. Cannot be changed after selection.

- Fixed Nature: Once the income start year is selected, it cannot be changed.

- Factors Affecting GP: Varies based on premium paying term, policy term, and selected payout start year.

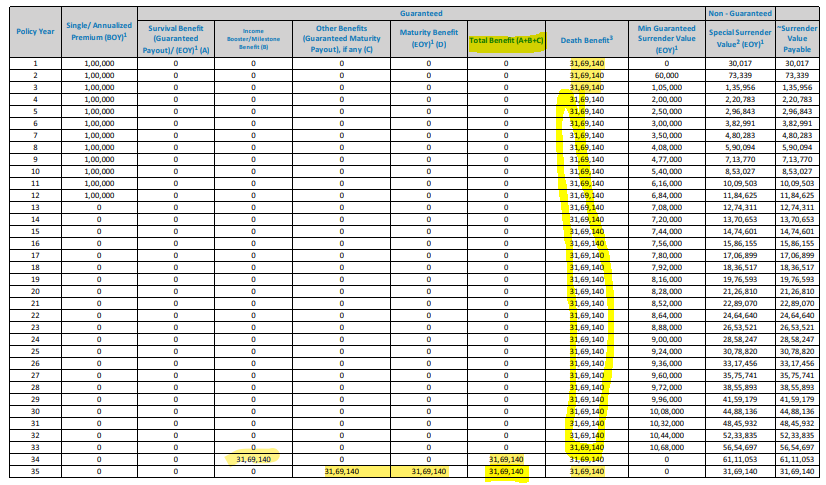

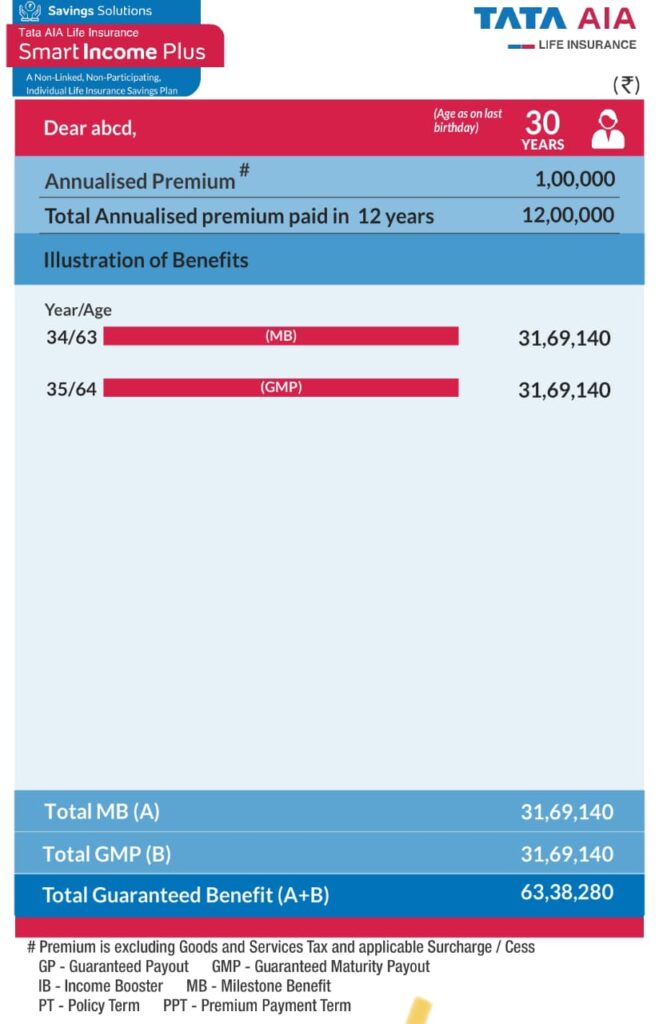

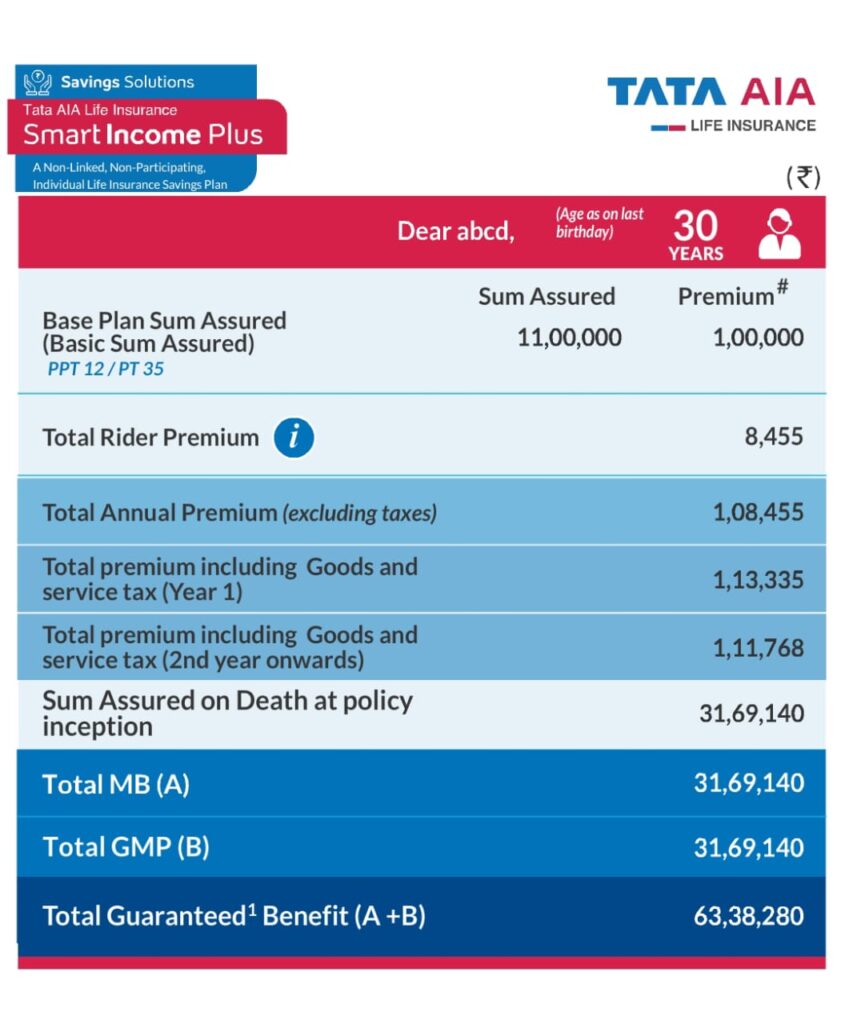

3.2 Maturity Benefit

- Guaranteed Maturity Payout (GMP): Paid at policy maturity.

- Calculation: GMP = GMP Factor × Annualised Premium.

- Minimum Guaranteed Sum Assured on Maturity: Equal to GMP.

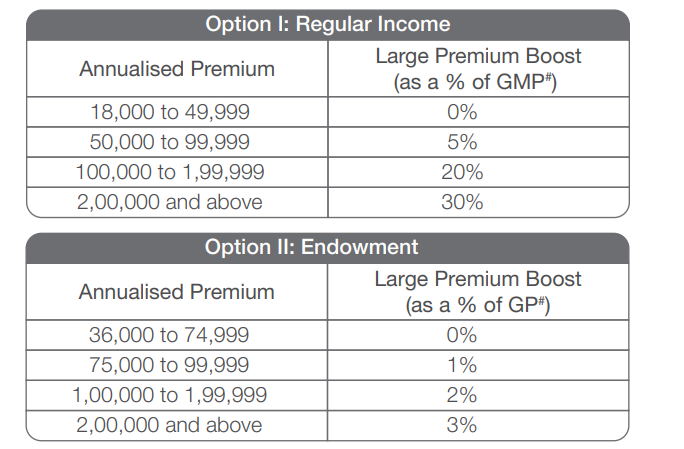

3.3 Large Premium Boost

- Additional benefits are given for higher premium payments.

- ₹50,000 – ₹99,999 → 5%

- ₹1,00,000 – ₹1,99,999 → 20%

- ₹2,00,000 & above → 30%

3.4 Death Benefit

- Sum Assured on Death: Higher of:

- 11 times the Annualised Premium.

- 105% of Total Premiums Paid.

- Minimum Guaranteed Sum Assured on Maturity.

- Absolute amount assured on death.

- Policy Termination: The policy terminates upon death benefit payout.

4. Premium Payment and Policy Lapse

4.1 Free-Look Period

- Policyholder’s Right: Can cancel the policy within 15 days (30 days for distance marketing/electronic purchases).

- Refund: Total premiums paid minus risk premium, stamp duty, and medical costs.

4.2 Revival of Policy

- Grace Period: 15 days (monthly mode) or 30 days (other modes).

- Revival Window: Within five years from the first unpaid premium date plus interest..

- Requirements: Application for revival, health certificate, and payment of all due premiums + interest.

- Interest Rate: SBI domestic term deposit rate (1 year to less than 2 years) + 2% (Currently 8.98% p.a.).

4.3 Policy Loan

- Eligibility: Policy must have acquired a Surrender Value.

- Maximum Loan Amount: Up to 65% of Surrender Value.

- Interest Rate: SBI deposit rate + 2% (currently 8.98% p.a.).

- Repayment: If loan + interest exceeds surrender value, the policy lapses

4.4 Surrender & Reduced Paid-Up Policies

- Surrender Eligibility: Allowed after two full years of premium payment.

- Surrender Value: Higher of:

- Guaranteed Surrender Value (GSV): (Total Premiums Paid × GSV Factor) – Survival Benefits Paid.

- Special Surrender Value (SSV): Factor × [(No. of Premiums Paid ÷ Total Payable Premiums) × (Survival Benefits + Maturity Benefits)] – Survival Benefits Paid.

- Reduced Paid-Up (RPU) Policy: If at least two years’ premiums are paid but further premiums are unpaid, the policy becomes RPU with reduced benefits.

5. Exclusions & Conditions

5.1 Suicide Clause

- If the insured dies due to suicide within 12 months from the policy start or revival date:

- Payout: 80% of Total Premiums Paid or Surrender Value (whichever is higher).

5.2 Misstatement of Age & Gender

- Higher Premium Should Have Been Charged: Benefits are reduced.

- Lower Premium Should Have Been Charged: Excess premium refunded without interest.

- Ineligible at Correct Age: Policy is void, and premiums are refunded (excluding charges).

6. Nomination & Assignment

6.1 Nomination (Section 39 of Insurance Act, 1938.)

- Who Can Be Nominated? Parents, spouse, children, or a combination.

- Change of Nominee: Allowed before policy maturity.

- Effect of Nomination: If the nominee dies before the policyholder, proceeds go to legal heirs.

6.2 Assignment (Section 38 of Insurance Act, 1938.)

- Definition: Transfer of policy rights to another person.

- Process: Requires a written agreement and insurer’s acknowledgment.

- Restrictions: The insurer may refuse assignments that are not bona fide.

6.3 Force Majeure Clause:

- The company is not liable for obligations if prevented by circumstances beyond control.

7. Claims & Grievance Redressal

7.1 Claim Process

- Notification Deadline: Death claims must be reported within 30 days.

- Required Documents:

- Death certificate

- Policy document

- Claimant’s ID & address proof

- Bank details

- Additional Documents for Unnatural Deaths:

- FIR

- Postmortem report

- Final Police Investigation Report

7.2 Grievance Redressal

- Levels of Escalation:

- Tata AIA Customer Service.

- Grievance Redressal Officer (GRO).

- IRDAI Grievance Cell.

- Insurance Ombudsman.

1.Regular Income

2.Endowment

Product Disclaimers:

- Tata AIA Life Insurance Smart Income Plus – A Non-Linked, Non-Participating, Individual Life Insurance Savings Plan (UIN 110N126V07).

- *Guaranteed Returns are defined as Guaranteed Payout (GP)/ Guaranteed Maturity Payout (GMP) under both Plan Options. GP and GMP are calculated as a percentage of Annualised Premium (AP), provided the policy is in-force and all due premiums have been paid. Table of GP/GMP factors is available on company’s website.

- 1Riders are not mandatory and is available for a nominal extra cost. For more details on benefits, premiums and exclusions under the Riders, please contact Tata AIA Life’s Insurance Advisor/ branch. Tata AIA Vitality Protect (UIN:110B046V04 or any other later version) and Tata AIA Vitality Health (UIN: 110B045V03 or any other later version) are available under this plan.

- ^^^Income Tax benefits would be available as per the prevailing income tax laws, subject to fulfillment of conditions stipulated therein. Income Tax laws are subject to change from time to time. Tata AIA Life Insurance Company Ltd. does not assume responsibility on tax implication mentioned anywhere on this site. Please consult your own tax consultant to know the Tax Benefits available to you.

- Buying a Life Insurance policy is a long-term commitment. An early termination of the policy usually involves high costs and the Surrender Value payable may be less than all the Premiums Paid.

- This product is underwritten by Tata AIA Life Insurance Company Ltd. This plan is not a guaranteed issuance plan and it will be subject to Company’s underwriting and acceptance.

- Insurance cover is available under this product.

- In case of non-standard lives and on submission of non-standard age proof, extra premiums will be charged as per our underwriting guidelines.

- For more details on risk factors, terms and conditions, please read the sales brochure carefully before concluding a sale

- **Individual Death Claim Settlement Ratio is 99.13% for FY 2023-24 as per the latest annual audited figures.

- ^Tata AIA Vitality is a Wellness Program that offers you an upfront discount at policy inception. You can also earn premium discount / cover booster (as applicable) for subsequent years on policy anniversary basis your Vitality Status (tracked on Vitality app). The TataAIA Vitality Wellness Program is available with Tata AIA Vitality Health (UIN: 110B045V03) and Tata AIA Vitality Protect (UIN: 110B046V04). Vitality is a trademark licensed to Tata AIA Life by Amplify Health Assets PTE. Limited, a joint venture between Vitality Group International, INC. and AIA Company Limited. The assessment under the wellness program shall not be considered as a medical advice or a substitute to a consultation/treatment by a professional medical practitioner.

- On enrolling into the Wellness Program, you get an upfront discount of 5% on 1st year premium for Accidental Death, Accidental Total & Permanent Disability and of 10% on 1st year premium for CritiCare Plus, and HospiCare benefit. The rewards are offered on cumulative basis and in any year, the maximum rewards in view of both the Up-front Rewards and Annual Rewards Flex together shall be 15% for Accidental Death, Accidental Total & Permanent Disability and 30% for a CritiCare Plus and HospiCare benefit. Discount is driven by accumulated points which is achieved through wellness status. Please refer policy document for more details.

- ~~At the time of purchase, if the policyholder chooses to opt for a Return of Balance Premium option with Tata AIA Vitality Protect and Tata AIA Vitality Health, an amount equal to the Total Premiums Paid towards the respective benefit option (excluding loading for modal premiums), less any claim amount already paid out under the respective benefit option and any premium discounts availed under the Wellness Program as premium discounts or premium cashback, shall be payable at the end of the benefit option term, provided the benefit option is not terminated.

- The risk factors of the bonuses projected under the product are not guaranteed.

- Past performance doesn’t construe any indication of future bonuses.

- These products are subject to the overall performance of the insurer in terms of investments, management of expenses, mortality and lapses.

- L&C/Advt/2024/Oct/3215

Key Benefits

- Flexibility to choose between two plan options – Regular Income or Endowment

- Under Regular Income Option:

- Receive Guaranteed income along with Maturity Benefit

- Option to choose income start year and number of years you want to receive income for

- Under Endowment option:

- Receive two guaranteed payouts – in the year preceding maturity and on maturity

- Preferential benefit for female lives

- Life cover throughout policy term

- Enhance your protection with optional Riders

- Receive tax benefits u/s 80C and 10(10D), as per the applicable Income Tax laws

In depth About the Product (no need to see)

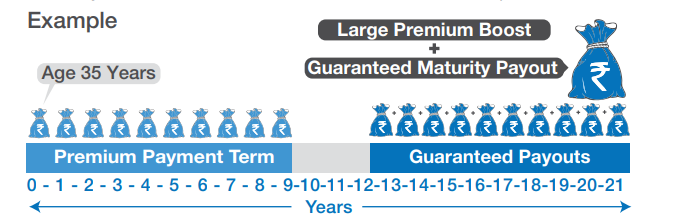

How Does the Plan Work?

Aditya, aged 35 years is a software engineer who has recently joined an MNC. He is planning to buy a limited pay guaranteed insurance plan; besides this, he also wants guaranteed income every year with tax benefits. To fulfill these needs,

he opts for Option 1 – Regular Income option under Tata AIA Life Insurance Smart Income Plus for a Policy Term of 21 years and Premium Payment Term of 10 years. He makes the following selections:

- Chooses to start receiving income from 12th year onwards.

- Pays an Annualised Premium of R 1,00,000* p.a.

- He receives Guaranteed Annual Payouts which includes Guaranteed payout and Income booster for 10 years commencing from the end of 12th Policy year

- Gets Guaranteed Maturity Benefit which include Guaranteed Maturity Payout and Milestone Benefit along with last Guaranteed Payout and Income Booster

Scenario 1: Aditya gets guaranteed benefits commencing from the end of 12th Policy year as mentioned below:

| End of Policy Year | Guaranteed Payouts | Income Booster | Milestone Benefit | Guaranteed Maturity Payout |

| 12 | 71,500 | 71,500 | – | – |

| 13 | 71,500 | 71,500 | – | – |

| 14 | 71,500 | 71,500 | – | – |

| 15 | 71,500 | 71,500 | – | – |

| 16 | 71,500 | 71,500 | – | – |

| 17 | 71,500 | 71,500 | – | – |

| 18 | 71,500 | 71,500 | – | – |

| 19 | 71,500 | 71,500 | – | – |

| 20 | 71,500 | 71,500 | – | – |

| 21 | 71,500 | 71,500 | 1,72,200 | 1,72,200 |

| Total Benefit | 7,15,000 | 7,15,000 | 1,72,200 | 1,72,200 |

| Total Guaranteed Benefit (Guaranteed Payouts + Income Booster + Milestone Benefit + Guaranteed Maturity Payout) | 17,74,400 | |||

| Total Premium Paid | 10,00,000 | |||

**Premiums are excluding applicable taxes, cesses and levies

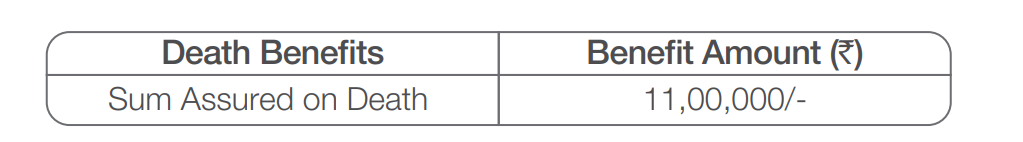

Scenario 2: In case of unfortunate demise of Aditya in the 3rd Policy year, a lump sum Death Benefit is paid:

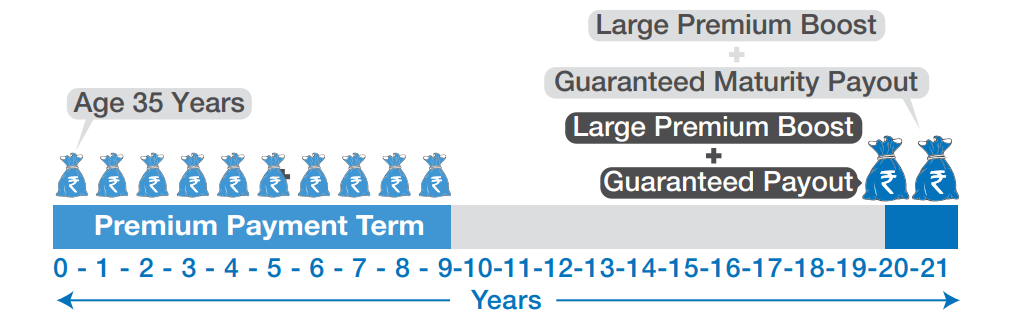

Opts for Option II – Endowment

- Pays an Annualised Premium of Rs. 1,00,000* p.a.

Scenario 1: Aditya gets guaranteed benefits in the last two Policy years as mentioned below

- Receives Guaranteed Payout (Milestone Benefit) at the end of 20th Policy year

- Gets Guaranteed Maturity Payout at the end of 21st Policy year

| End of Policy Year | Benefits | Benefit Amount (R) |

| 20 | Guaranteed Payout (Milestone benefit) | 11,46,480 |

| 21 | Guaranteed Maturity Payout | 11,46,480 |

| Total Benefit | 22,92,960 | |

| Total Premium Paid | 10,00,000 | |

Scenario 2: In case of unfortunate demise of Aditya in the 3rd Policy year, a lump sum Death Benefit is paid:

| Death Benefits | Benefits Amount (R) |

| Sum Assured on Death | 11,00,000 |

*Premiums are excluding applicable taxes, cesses and levies.

Premium will vary depending upon the option chosen.

Eligibility Criteria at a Glance

| Plan Options | Option I: Regular Income Option II: Endowment The options are to be chosen at the inception of the Policy | |

| Plan Parameters | Minimum | Maximum |

| Age at Entry (years)** | 0 (30 days) | 65 |

| Age at Maturity (years)** | 18 | 85 |

| Policy Term (PT) (years) | Option I: PPT + 6 Option II: Limited/ Regular Pay – 10 | Option I: 51 Option II: Regular Pay – 30 Limited Pay: PPT<10 – 30 PPT>=10 – 35 |

| Premium Payment Term (PPT) (years) | Option I: 5 Option II: Regular Pay – 10 Limited pay – 5 | Option I: 15 Option II: Regular Pay – 30 Limited Pay – 30 |

| Income Start Year (applicable for Option I only) | PPT + 2 | PPT + 6 |

| Income Period (years) | 5 | Subject to policy term and income start year chosen |

| Basic Sum Assured | 11 times Annualised Premium | |

| Premium (R) (Premium in multiples of 1000) | For Option I: 18,000 For Option II: 36,000 | No Limit subject to Board approved underwriting policy |

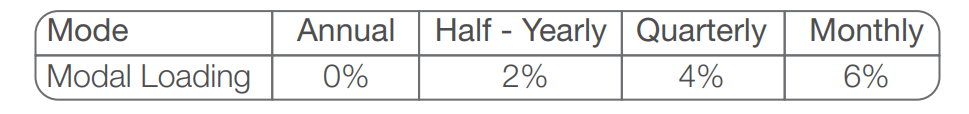

| Premium Payment Mode | Annual/ Half-yearly / Quarterly/ Monthly | |

**All reference to age is as on last birthday.

Key benefits in details

1. Survival Benefits:

Option I: Regular Income

Guaranteed Payouts (GP)

Provided the Policy is in-force and all due premiums have been paid, Guaranteed Payouts (GP) along with Income Booster, determined as a percentage of the Annualised Premium (AP) shall be payable annually. This Income shall be payable during the income period which shall commence from the end of Policy year as per the chosen income start year and shall be payable till Maturity.

The GP factors and the Income Booster shall vary by the chosen premium paying term, income start year and policy term and are independent of age and gender. In addition, the Income Booster shall also vary by Number of premiums paid (in complete year). The GP factors and the Income Boosters are provided in the Policy Bond.

Option II: Endowment

Provided the Policy is in-force and all due premiums have been paid, a Milestone Benefit determined as a multiple of the Annualised Premium will be paid at the end of Policy year preceding the year of Maturity.

The Milestone Benefit factors vary by the chosen premium payment term, policy term, age, number of Premiums Paid (in completed years) and gender and a table of all GP factors is provided in the policy bond.

2. Maturity Benefit:

Option I: Regular Income

Provided the Policy is in-force and all due premiums have been paid, an amount equal to the Guaranteed Maturity Payout (GMP) plus Milestone Benefit will be paid as a lump sum at Maturity. The last instalment of GP and Income Booster will be paid along with the above mentioned GMP. The GMP will be equal to GMP factor multiplied by Annualised Premium. The GMP factors will vary as per the age at entry, gender, income start year, policy term and premium payment term selected.

The Milestone Benefit factors vary by the chosen premium paying term, policy term, age, number of Premiums Paid (in completed years) and gender are provided in the policy bond.

Option II: Endowment

Provided the Policy is in-force and all due premiums have been paid, the Minimum Guaranteed Sum Assured on Maturity which is equal to the Guaranteed Maturity Payout (GMP) will be paid at Maturity.

The GMP factors vary by the chosen premium paying term, policy term, age and gender are provided in policy document.

3. Large Premium Boost:

An additional benefit will be payable on payment of higher premium. The Large Premium Boost will be applicable as mentioned in the table below and payable along with GMP or GP.

#The Large Premium Boost is applicable to GMP only under Option I, and applicable to GMP & GP both under Option II.

4. Death Benefit:

For Option I & Option II:

On death of the Life Assured during the policy term, provided the policy is in-force as on the date of death; Sum Assured on Death shall be payable irrespective of the Survival Benefits already paid.

“Sum Assured on death” shall be the highest of the following:

- 11 times Annualised Premium

- 105% of the Total Premiums Paid up to the date of death

- Minimum Guaranteed Sum Assured on Maturity plus applicable final Income Booster and applicable Milestone Benefit payable at the end of Policy Term

- Absolute amount assured to be paid on death

Where,

“Minimum Guaranteed Sum Assured on Maturity” refers to the absolute amount of benefit which is guaranteed to become payable on maturity of the policy. Minimum Guaranteed Sum Assured on Maturity is equal to ‘Guaranteed Maturity Payout (GMP)’ for Option II and ‘Guaranteed Maturity Payout (GMP)’ plus final Guaranteed Payout (GP) in case of Option I.

“Annualised premium” shall be the premium amount payable in a year, excluding taxes, rider premiums, underwriting extra premiums and loadings for modal premiums.

“Total Premiums paid” means total of all the premiums paid under the base product, excluding any extra premium and taxes, if collected explicitly.

“Income Booster” refers to an additional Income Benefit payout to reward persisting policyholders over and above Guaranteed Payout payable during the income period. The Income Booster shall be defined as a % of Annualized Premium (excluding discount) and will be based upon the number of premiums paid (in completed years).

“Milestone Benefit” is an additional Lumpsum benefit payout to reward persisting policyholders over and above the Guaranteed Maturity Payout payable at the end of the Policy Term for Regular Income Option. For Endowment option this benefit shall be payable at the end of policy year preceding to Maturity. The Milestone benefit shall be defined as a % of Annualized Premiums (excluding discounts and excluding loading for modal premiums) and will be dependent upon the number of premiums paid (in completed years).

Applicable taxes, cesses and levies shall be collected separately over and above the Policy premiums.

Absolute amount assured to be paid on death is the Basic Sum Assured.

The Policy will terminate upon the death of the Insured and no other benefit under the Policy shall be payable.

Note: If a claim is payable under this Policy, any amount of unpaid due premium/s will be deducted from the amount of death benefit payable to the Nominee/Legal heir.

Additional Benefits and Features

1. Flexible premium payment modes:

You have an option to pay the premiums either Annually, Half-yearly, Quarterly and Monthly modes.

Loading on premiums will be applicable as mentioned in the table below:

2. Flexibility of Additional Coverage:

You have further flexibility to enhance your cover product by adding the following optional riders by paying additional rider premium over and above your base policy premium.

- Tata AIA Life Insurance Non-Linked Comprehensive Protection Rider (UIN:110B033V02 or any other later version)

- Tata AIA Life Insurance Non-Linked Comprehensive Health Rider (UIN: 110B031V02 or any other later version)

- Tata AIA Vitality Protect (UIN: 110B046V01 or any other later version)

- Tata AIA Vitality Health (UIN: 110B045V01 or any other later version)

- TATA AIA Benefit Protection Rider (UIN: 110B049V02 or any other later version)

These riders can be attached effective policy inception or any policy anniversary of the base plan subject to the rider premium payment term and the policy term shall not be more than the outstanding premium payment term and outstanding policy term for the base plan.

If there is overlap in benefit offered under different riders with the base product, then that benefit under the rider will not be offered.

- Riders are not mandatory and are available for a nominal extra cost.

- For more details on the benefits, premiums and exclusions under the riders please refer to the Rider Brochure or contact our Insurance Advisor / Intermediary or visit our nearest branch office.

3. Grace Period:

If you are unable to pay your Premium on time, starting from the premium pay-to-date, a Grace Period of 15 days for monthly mode and 30 days for all other modes will be offered. During this period your Policy is considered to be in-force with the risk cover as per the terms & conditions of the Policy. If any premium remains unpaid at the end of its Grace Period, the Policy shall lapse and have no further value except as may be provided under the Non-Forfeiture Provisions. If any claim occurs during the Grace Period, any due premiums (without interest) of the Policy, which are not paid as on date of death, will be deducted from the death claim payout.

4. Non forfeiture provisions:

A. Lapse

On discontinuance of payment of premium during the first policy year, the policy will lapse and no further benefits shall be paid. The policy can be revived within the period of 5 years from the due date of first unpaid premium by payment of all due premiums together with interest as detailed below in revival section. Upon revival of the policy, all benefits shall be restored and be applicable with effect from the date of revival. The policy will be terminated at the end of revival period if not revived.

B. Surrender Benefit (For both Option I & Option II):

The Policy can be surrendered any time during the term of the Policy on completion of one policy year, provided at least one full year’s Premium has been paid

The Surrender Value payable is higher of Guaranteed Surrender Value or Special Surrender Value.

1. Guaranteed Surrender Value (GSV)

Guaranteed Surrender Value = [All the Premiums Paid (excluding the underwriting extra premiums and modal loading) x GSV factor)] – Survival Benefit paid, if any

2. Special Surrender Value (SSV)

Special Surrender Value (SSV) is determined by the company from time-to-time basis changing economic scenario. The Company may revise SSV based on then prevailing market conditions. Any change in the methodology/formula for calculating SSV shall be subject to IRDAI approval.

The company has the right to review the basis for calculating these factors from time to time based on the experience and will be subject to prior approval of IRDA of India.

For Guaranteed Surrender Value Factors and Special Surrender Value Factors, please refer to the policy contract.

C. Reduced Paid-Up

The Policy will be converted into a Reduced Paid-Up Policy by default on discontinuance of payment of premium after the first policy year, provided one full premium is paid and subsequent premiums remain unpaid.

In case of Reduced Paid-up policies, the beneFIt shall be payable as under:

- RPU Death Benefit for both Option I & Option II:

On death of the life assured during the policy term,

Sum Assured on death x (Number of premiums paisd)/(Number of premiums payable, during the entire policy term)

This total amount will be a minimum of 105% of the Total Premiums paid up to the date of death.

2. RPU Survival Benefit :

The reduced Survival Benenfits shall continue to be payable as mentioned below:

Option I:

Guaranteed Payouts x (Number of Premiums Paid/ Number of Premiums Payable during the entire Policy term).

The reduced Guaranteed Payouts shall commence from the end of the income start year chosen at inception and shall be payable till Maturity as per the applicable Guaranteed Payout factors

In addition, applicable Income Booster shall be payable during the Income Period.

Option II:

Guaranteed Payout x (Number of Premiums Paid/ Number of Premiums Payable during the entire Policy term).

The reduced Guaranteed Payout will be paid at the end of Policy year proceeding the year of Maturity, as per the applicable Guaranteed Payout factors

In addition, applicable Milestone Benefit shall be payable at penultimate year to the policy term.

3. Maturity Benefit:

Option I:

Guaranteed Maturity Payout x (Number of Premiums Paid/ Number of Premiums Payable during the entire Policy term)

The reduced Guaranteed Maturity Payout will be paid as a lump sum at Maturity. The last instalment of reduced Guaranteed Payout will be paid along with the above mentioned Maturity Benefit as per applicable GMP factors

In addition, applicable Milestone Benefit shall be payable at maturity.

Option II:

Guaranteed Maturity Payout x (Number of Premiums Paid/ Number of Premiums Payable during the entire policy term)

The reduced Guaranteed Maturity Payout will be paid at Maturity.

However, from the due date of First Unpaid Premium, but not later than five (5) from the due date of First Unpaid Premium; the policy can be revived by payment of full arrears of premiums together with interest.

4. Revival

If a premium is in default beyond the Grace Period and subject to the Policy not having been surrendered, it may be reinstated/revived, within five years after the due date of first unpaid premium and before the date of maturity, subject to: (i) Policyholder’s written application for reinstatement/revival; (ii) production of Insured’s current health certificate and other evidence of insurability, satisfactory to the Company; and (iii) payment of all overdue premiums with interest.

The evidences and any medical requirements called for are in line with the prevailing underwriting guidelines duly approved by the Board & the health declaration by the life insured(s).

Any reinstatement/revival shall only cover loss or insured event which occurs after the reinstatement/revival date.

Any evidence of insurability requested at the time of reinstatement/revival will be based on the prevailing underwriting guidelines duly approved by the Board. The reinstatement/revival will be based on the Board approved underwriting policy.

The applicable interest rate for revival is determined using the SBI domestic term deposit rate for ‘1 year to less than 2 years’, plus 2%. The rate of interest on revival with effect from 1st April 2024 is 8.98% simple p.a. (i.e. SBI interest rate of 6.98% + 2%) plus applicable taxes. The interest rate applicable is reviewed every 6 months and gets updated as per the given formula. Any alteration in the formula will be subject to prior approval of IRDA of India.

Terms and Conditions

1. Free Look Period

If you are not satisfied with the terms & conditions/features of the Policy, you have the right to return the Policy for cancellation by providing a written notice to the Company stating objections/reasons and receive the refund of all premiums paid without interest after deducting (a) proportionate risk premium for the period on cover and (b) stamp duty and medical examination cost (including applicable taxes, cesses and levies) which have been incurred for issuing the Policy. Such notice must be signed by you and received directly by the Company within 30 days from the date of receipt of the Policy document, whether the policy is sourced electronically or otherwise.

2. Change in Basic Sum Assured

Any change in the Basic Sum Assured is not allowed post inception of the policy.

3. Policy Loan

Policy Loan is available in Tata AIA Life Insurance Smart Income Plus provided that the Policy acquires Surrender Value, you may apply for a Policy Loan for such an amount within the extent of 65% of Surrender Value.

The interest rate on loans are verified & updated on our company’s systems every six months (on 1st April & 1st Oct every year) as per the given formula. The current rate of interest for Loan from 1st April 2024 is 8.98% (i.e. SBI interest rate of 6.98%+ 2%) compounding annually.

4. Auto Vesting

Where the policy is issued on the life of a minor, the policy shall automatically vest in the life insured on his/her attaining age of majority. On vesting, the Company shall recognize the life insured to be the holder of the policy.

5. Exclusion

In case of death due to suicide by the Life Assured, whether sane or insane, within 12 months from the date of commencement of risk under the policy or from the date of revival of the policy, as applicable, the nominee or beneficiary of the Policyholder shall be entitled to at least 80% of the total premiums paid till the date of death or the surrender value available as on the date of death whichever is higher, provided the policy is in force. The policy shall terminate and no further benefits shall be payable.

6. Tax Benefits

Premiums paid under this plan are eligible for tax benefits under Section 80C of the Income Tax Act, 1961 and are subject to modifications made thereto from time to time. Moreover, life insurance proceeds enjoy tax benefits as per Section 10(10D) of the said Act.

Income Tax benefits would be available as per the prevailing income tax laws, subject to fulfillment of conditions stipulated therein. Tata AIA Life Insurance Company Ltd. does not assume responsibility on tax implication mentioned anywhere in this document. Please consult your own tax consultant to know the tax benefits available to you

7. Assignment

Assignment allowed as per Section 38 of the Insurance Act 1938 as amended from time to time.

8. Nomination

Nomination allowed as per provisions of Section 39 of the Insurance Act 1938 as amended from time to time.

9. Advance Premium

Collection of advance premium shall be allowed, only if the premium is collected within the same Financial Year. However, where the premium due in one financial year is being collected in advance in earlier financial year, the Company may collect the same for a maximum period of three months in advance of the due date of the premium. The premium so collected in advance shall only be adjusted on the due date of the premium.

Prohibition of Rebates – Section 41 – of the Insurance Act, 1938, as amended from time to time

No person shall allow or offer to allow, either directly or indirectly, as an inducement to any person to take out or renew or continue an insurance in respect of any kind of risk relating to lives or property in India, any rebate of the whole or part of the commission payable or any rebate of the premium shown on the Policy, nor shall any person taking out or renewing or continuing a Policy accept any rebate, except such rebate as may be allowed in accordance with the published prospectuses or tables of the Insurer.

Disclaimer:

- The brochure is not a Contract of Insurance. The precise terms and conditions of this plan are specified in the Policy contract available on Tata AIA Life website.

- Buying a Life Insurance Policy is a long-term commitment. An early termination of the Policy usually involves high costs and the Surrender Value payable may be less than the all the Premiums Paid.

- This plan is also available for sale through online mode.

- This product brochure should be read along with Benefit Illustration.

- This product is underwritten by Tata AIA Life Insurance Company Ltd. This plan is not a guaranteed issuance plan and it will be subject to Company’s underwriting and acceptance.

- Insurance cover is available under this product.

- In case of non-standard lives and on submission of non-standard age proof, extra premiums will be charged as per our underwriting guidelines.