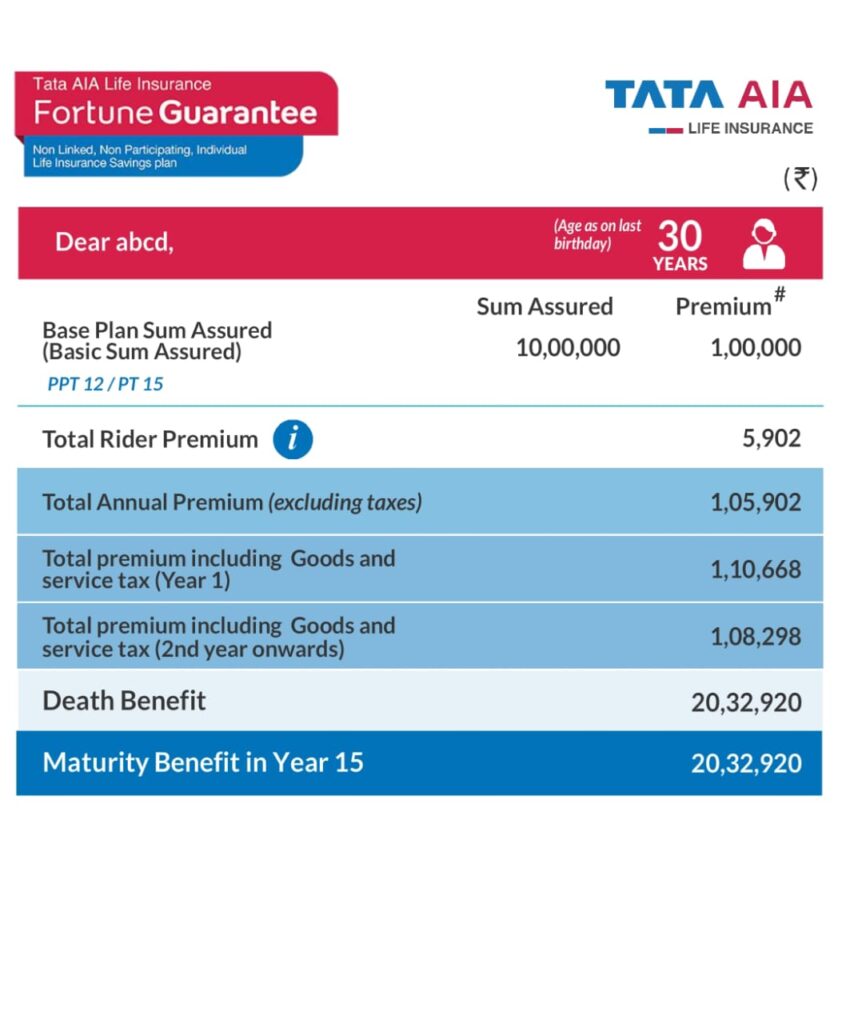

Non-Linked, Non-Participating, Individual Life Insurance Savings Plan

What is this insurance plan about?

It’s a life insurance plan that helps you secure your family’s financial future. If something happens to you, your family gets a lump sum amount. If you complete the policy term, you get a guaranteed payout at maturity.

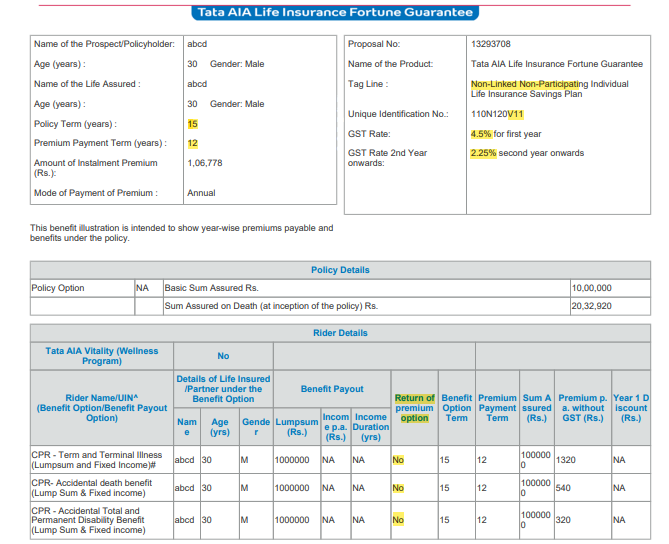

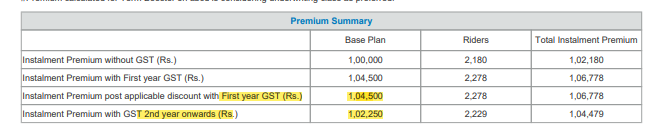

| Premium | Min 100,000 |

| Riders | No BPR 1.AD 2.ATPD 3.TB 4.Hospicare 5.Crititcare plus |

| PPT | 5 -12 |

| PT | Linked with PPT (Max 15 Years) |

Eligibility and Plan Parameters

- Minimum Age: 18 years less policy term or 0 years (30 days), whichever is higher.

- Maximum Issue Age: 65 to 80 years, Varies by payment term, e.g., Single Pay (50-70 years), Limited/Regular Pay (up to 65-80 years).

- Premium Payment Terms: Single Pay, Limited Pay (5-20 years), Regular Pay (10-20 years).

- Policy Term: 10 to 40 years (varies based on payment type).

- Premium Payment Mode: Single, Annual, Semi-Annual, Quarterly, or Monthly.

- Basic Sum Assured: Varies by policy type, e.g., 10 times Annualized Premium for Limited/Regular Pay.

Key Features:

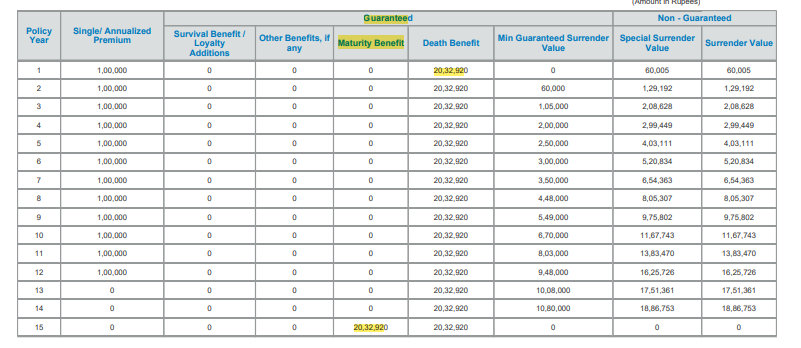

- Guaranteed Maturity Benefit – You get a fixed sum at the end of the policy term.

- Life Cover – If you pass away during the policy term, your family gets a payout.

- Flexible Payment Terms – You can pay premiums in one go (single pay) or over several years.

- Higher Benefits for Women – Women get better rates.

- Extra Coverage Available – You can add riders (extra benefits) for accidents, critical illnesses, or disability.

Payment of Premiums

- Premiums must be paid on or before the due date.

- If you pay in advance, the payment will only be adjusted on the actual due date.

How Do You Pay for This Plan?

- Single Pay – Pay once and stay covered.

- Limited Pay – Pay for a few years and get coverage for a longer period.

- Regular Pay – Pay throughout the policy term.

You can pay monthly, quarterly, semi-annually, or annually.

- Annual Pay – No extra charges.

- Half-Yearly Pay – Extra charge of 2%.

- Quarterly Pay – Extra charge of 4%.

- Monthly Pay – Extra charge of 6%.

What Do You Get (Benefits)?

- Maturity Benefit – If the insured person survives until the end of the policy term, they will receive a guaranteed lump sum (Maturity Sum Assured).

- Paid on maturity, calculated as:

- Maturity Sum Assured = Maturity Benefit Factor × Total Premiums Paid. The Maturity Benefit Factor varies based on age, gender, policy term, and premium band.

- Death Benefit – Your family gets the highest of:

- Sum Assured (10x your premium or based on age).

- 105% of total premiums paid.

- Maturity Sum Assured.

NOTE: DBM (Death Benefit Multiple) varies by age.

Special Condition for POS (Point of Sale) Plans:

- If the insured person dies within the first 90 days, only the total premiums paid will be refunded (except in case of accidental death).

Additional Benefits (Riders)

You can add these for extra protection:

1.Accidental Death & Dismemberment (ADDL) Rider

- Pays additional benefit in case of accidental death or lose limbs in an accident.

- Benefits double in certain cases.

2. Waiver of Premium Plus (WOPP) Rider

- Waives future premiums if the proposer dies or becomes permanently disabled.

3. Non-Linked Comprehensive Protection Rider

- Covers death, disability, terminal illness, and critical illness.

4. Non-Linked Comprehensive Health Rider

- Covers hospitalization, major and minor illnesses.

Free Look Period (Cancellation & Full Refund)

- If you don’t like the policy, you can cancel it within:

- 15 days (if bought in person).

- 30 days (if bought online or via phone).

- You will get a refund after deducting:

- Risk cover charges for the days the policy was active.

- Medical check-up costs (if any).

- Stamp duty & taxes.

Policy Surrender (Cancelling the Policy & Getting a Refund)

- You can cancel the policy and get a surrender value if:

- Single Pay: Can surrender anytime.

- Regular Pay/Limited Pay: Can surrender after 2 years of premium payments.

- The surrender amount will be the higher of:

- Guaranteed Surrender Value (GSV) – A percentage of premiums paid.

- Special Surrender Value (SSV) – Decided by the company based on market conditions.

- SSV varies based on market conditions and may be revised by the insurer with IRDAI approval.

Grace Period (If you miss a payment)

- 15 days for Monthly Mode, 30 days for other modes to pay before the policy lapses.

- If the insured person dies during this period, the company will deduct the unpaid premium before giving the death benefit.

Reduced Paid-Up Policy (If You Stop Paying Premiums)

- If you stop paying after 2 years, your policy won’t lapse but will become a Reduced Paid-Up policy.

- In this case:

- The death benefit will be reduced.

- The maturity benefit will also be reduced.

Policy Revival

- If a premium is not paid within the grace period, the policy lapses (becomes inactive).

- Can be revived within 5 years of first unpaid premium.

- Requires:

- Written request

- Health certificate and underwriting approval

- Payment of overdue premiums + interest (SBI Term Deposit rate + 2%).

Policy Loan

- Available once surrender value is acquired.

- Loan limit: Up to 65% of surrender value.

- Interest: SBI deposit rate + 2%, updated every six months.

- If the loan + interest exceeds the surrender value, the policy will be terminated.

Tax Benefits

- You may get income tax benefits on premiums paid and the maturity amount, but this is subject to government tax laws (which may change).

- Tata AIA is not responsible for tax implications.

Exclusions

- Suicide Clause – If the policyholder dies by suicide within 12 months of policy inception/revival, the nominee gets at least 80% of premiums paid or surrender value, whichever is higher.

- Waiting Period (for POS plans) – If death occurs within 90 days, only the premiums paid will be refunded (except for accidental deaths).

- Misstatement of Age/Gender: If the insured person’s age/gender was wrongly stated, the company will recalculate the benefits or cancel the policy.

Assignment and Nomination

- Allowed per Sections 38 & 39 of the Insurance Act, 1938.

Prohibition of Rebates (Section 41)

- Offering or accepting rebates is punishable by a fine up to ₹10 lakh.

Fraud and Misrepresentation (Section 45)

- Any fraud/misstatement can lead to policy cancellation as per IRDAI regulations.

Claim Process

To file a death claim, submit:

- Claim form.

- Death certificate.

- Medical reports (if hospitalized before death).

- ID & address proof of nominee.

- Bank details for payment.

For accidental death, additional documents are required:

- Police reports (FIR, postmortem report, etc.).

For maturity claim, submit:

- NEFT form.

- Cancelled cheque/passbook copy.

- Self-attested ID proof.

Complaints & Disputes

- If you have a complaint, you can call, email, or visit the Tata AIA Life branch.

- If not resolved within 15 days, you can escalate it to:

- Grievance Redressal Officer (GRO)

- IRDAI (Insurance Regulatory and Development Authority of India)

- Insurance Ombudsman (for unresolved claims/disputes).

Product Disclaimers

- Tata AIA Life Insurance Fortune Guarantee – Non-Linked, Non-Participating, Individual Life Insurance Savings Plan (UIN: 110N120V11).

- *Guaranteed Maturity Benefit is “Maturity Sum Assured” which is equal to maturity Benefit factor multiplied by Total Premiums Paid, where maturity Benefit factor varies as per the gender, annualized premium band, premium paying term, policy term & entry age.

- ©Rider are not mandatory and is available for a nominal extra cost. For more details on benefits, premiums and exclusions under the Rider, please contact Tata AIA Life’s Insurance Advisor/Intermediary/ branch. Tata AIA Vitality Protect (UIN:110B046V04 or any other later version) and Tata AIA Vitality Health (UIN: 110B045V03 or any other later version) are available under this plan.

- ~~At the time of purchase, if the policyholder chooses to opt for a Return of Balance Premium option with Tata AIA Vitality Protect and Tata AIA Vitality Health, an amount equal to the Total Premiums Paid towards the respective benefit option (excluding loading for modal premiums), less any claim amount already paid out under the respective benefit option and any premium discounts availed under the Wellness Program as premium discounts or premium cashback, shall be payable at the end of the benefit option term, provided the benefit option is not terminated.

- ^^^Income Tax benefits would be available as per the prevailing income tax laws, subject to fulfilment of conditions stipulated therein. Income Tax laws are subject to change from time to time. Tata AIA Life Insurance Company Ltd does not assume responsibility on tax implication mentioned anywhere in this document. Please consult your own tax consultant to know the tax benefit available to you.

- Buying a Life Insurance policy is a long-term commitment. An early termination of the policy usually involves high costs and the surrender value payable may be less than the total premium paid.

- This product is underwritten by Tata AIA Life Insurance Company Ltd. This plan is not a guaranteed issuance plan and it will be subject to Company’s underwriting and acceptance.

- Insurance cover is available under this product.

- In case of non-standard lives and on submission of non-standard age proof, extra premiums will be charged as per our underwriting guidelines.

- Risk cover commences along with policy commencement for all lives, including minor lives. For more details on risk factors, terms and conditions, please read sales brochure carefully before concluding a sale.

- **Individual Death Claim Settlement Ratio is 99.13% for FY 2023-24 as per the latest annual audited figures.

- ~Tata AIA Vitality is a Wellness Program that offers you an upfront discount at policy inception. You can also earn premium discount / cover booster (as applicable) for subsequent years on policy anniversary basis your Vitality Status (tracked on Vitality app). The TataAIA Vitality Wellness Program is available with Tata AIA Vitality Health (UIN: 110B045V03) and Tata AIA Vitality Protect (UIN: 110B046V04). Vitality is a trademark licensed to Tata AIA Life by Amplify Health Assets PTE. Limited, a joint venture between Vitality Group International, INC. and AIA Company Limited. The assessment under the wellness program shall not be considered as a medical advice or a substitute to a consultation/treatment by a professional medical practitioner.

- The risk factors of the bonuses projected under the product are not guaranteed.

- Past performance doesn’t construe any indication of future bonuses.

- These products are subject to the overall performance of the insurer in terms of investments, management of expenses, mortality and lapses.

- L&C/Advt/2024/Aug/2409