What is this plan about?

This is a life insurance plan that also helps you save money. You pay a fixed amount regularly, and in return, you get guaranteed benefits either as a lump sum or as regular income over time. If something happens to you (the policyholder), your family gets financial support.

Key Features:

- Three Plan Options:

- Endowment: You get a lump sum amount at the end of the policy.

- Regular Income (Not Available): You receive a guaranteed yearly income after the policy matures.

- Whole Life Income (Not Available): You (or your spouse in a joint policy) get lifelong income.

- Guaranteed Returns: You invest a fixed amount of money regularly (premium), and at the end of the policy term, you receive a guaranteed amount as a return on your investment.

- Coverage for Spouse (Not Available): You can include your spouse in the same policy.

- You Pay Premiums – Either once or over a few years. This is the amount of money you pay regularly (monthly, quarterly, yearly) to keep the policy active.

- Flexible Payment Options: Choose to pay for a few years but get benefits for a longer period.

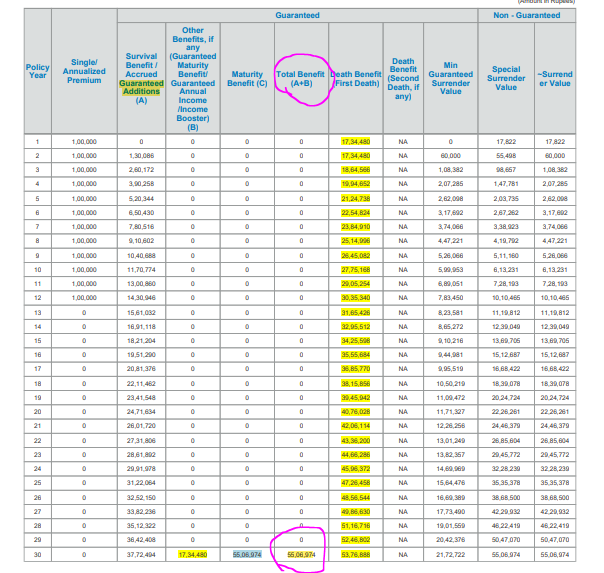

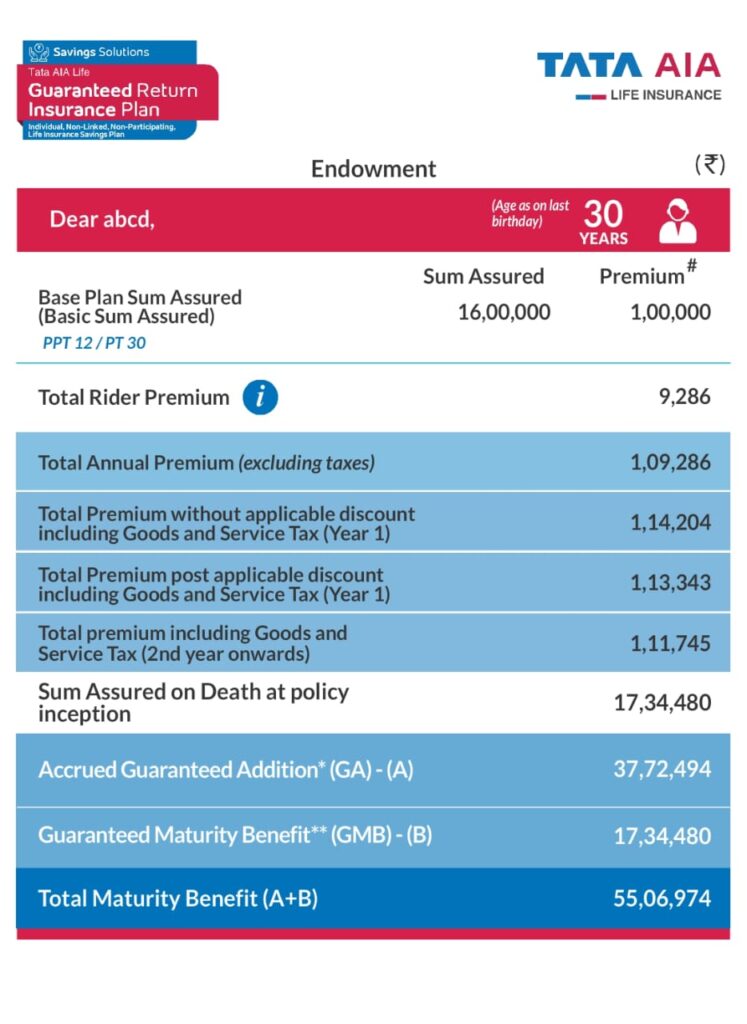

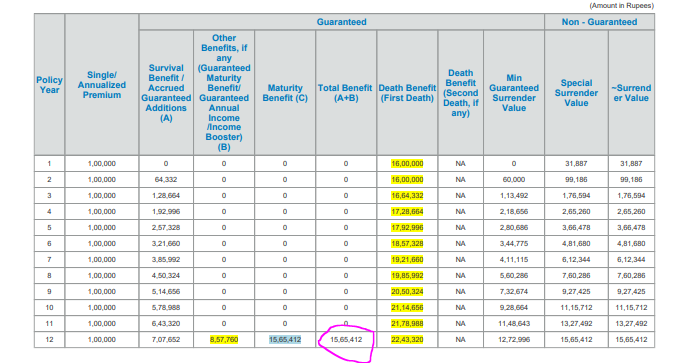

- Maturity Benefit – If you complete the policy term, you get a guaranteed payout, which includes:

- Guaranteed Maturity Benefit – A fixed amount paid at the end of the policy.

- Guaranteed Additions – Extra benefits added every year if premiums are paid on time.

- Death Benefit – If the life insured passes away before the policy ends, a lump sum amount is paid to the nominee.

- Grace Period – If you miss a premium payment, you get extra time (15-30 days) to pay before the policy lapses.

- Surrender Value – If you decide to exit the policy early, you get a certain amount back. However, surrendering early might mean getting less than what you paid.

- Loan Against Policy – Once the policy builds enough value, you can take a loan against it.

- Free Look Period – After buying the policy, you have 15-30 days to cancel and get a refund if you’re not satisfied.

- Lapsed Policy & Revival – If you stop paying premiums, the policy becomes inactive (lapsed). You can restart it by paying overdue premiums within a certain time

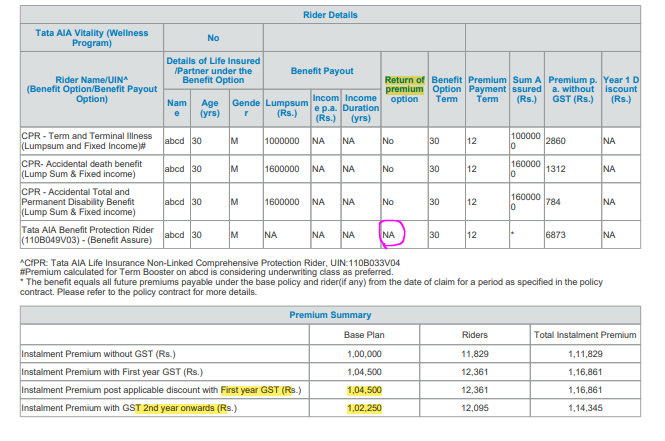

- Optional Add-ons (Riders): Extra protection for accidents, critical illnesses, or premium waivers in case of disability.

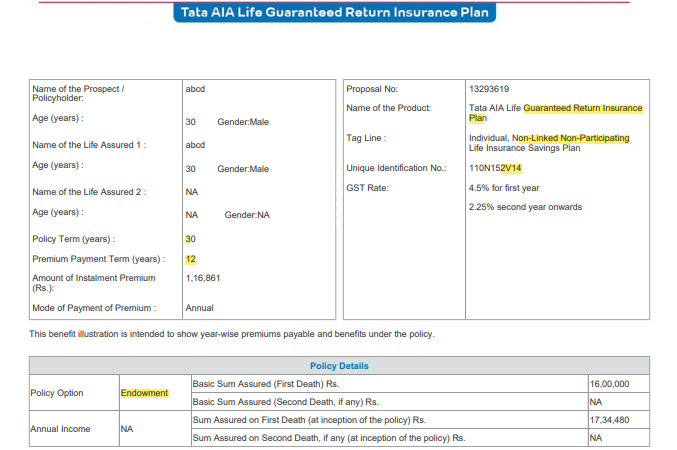

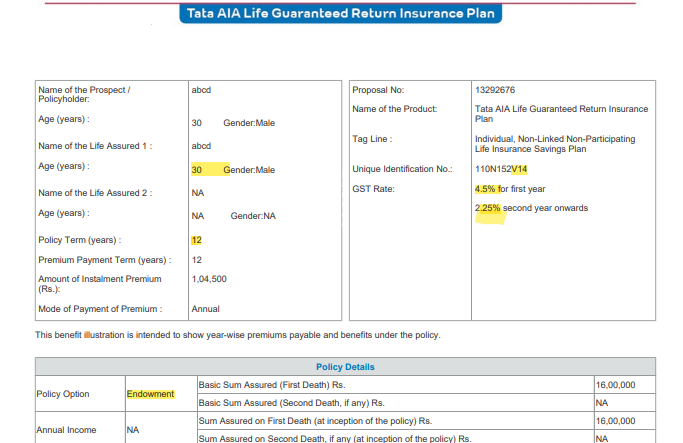

| Plan Option | Endowment | |

| Age | 0 – 65 | Proposer and Insurer option Available |

| Premium | Min 24,000 | |

| Premium Payment Option | LP only | |

| PPT | 5 – 12 | |

| PT | PPT + 5 – 8 | |

| Riders Optional | 1. TB 2. AD 3. ATPD 4. Hospicare 5. Criticare Plus 6. BPR | Hospi Care: Pay fixed amount of Hospitalization, ICU benefits and also Recuperation Benefit in case of Hospitalization for 7 or More Days. Criticare Plus: 40 critical illness including Cancer and cardiac Conditions |

Option 1: Endowment with LP

Option 2 : Endowment with RP (not available)

How it Works:

- You Choose a Plan – Pick between a lump sum payout or regular income.

- You Pay Premiums – Either once or over a few years.

- Guaranteed Benefits – After the policy term, you or your family receive the promised payouts.

- If You Pass Away – Your family gets a death benefit to secure their future.

Here is a detailed explanation of the Terms & Conditions applicable to each key concept in the Guaranteed Return Insurance Plan document:

1. Policy Benefits

- On maturity, the policy provides a Guaranteed Maturity Benefit (GMB) and Guaranteed Additions (GA) based on the plan option chosen.

- Maturity Benefit – If you survive the policy term, you get a guaranteed sum based on the chosen plan.

- If the policyholder dies during the policy term, the Sum Assured on Death plus any GA (if applicable) will be paid to the claimant.

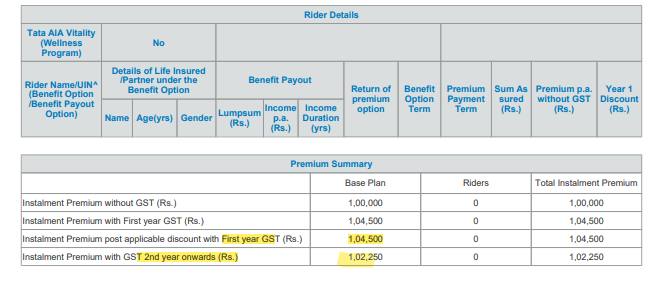

2. Premium Payment

- Premiums can be paid annually, half-yearly, quarterly, or monthly.

- If you miss a payment, There is a Grace Period of 15 days for monthly payments and 30 days for all other modes, before the policy lapses.

- If a premium is not paid within the grace period and the policy has not acquired a Surrender Value, it will lapse.

- If the policy has acquired a Surrender Value, it will become a Reduced Paid-up Policy, which reduces the benefits accordingly.

3. Surrender Value

- If you decide to exit the plan early, you may receive a portion of the amount paid.

- The policy can be surrendered at any time, but it will acquire a Surrender Value only if:

- It is a Single Premium Policy (acquires Surrender Value anytime).

- For other policies, at least two full years of premiums must be paid.

- The Guaranteed Surrender Value (GSV) and Special Surrender Value (SSV) are calculated based on pre-defined factors.

4. Death Benefit

- If the life insured dies during the policy term, the higher of:

- 1.25 times the Single Premium (for single-pay policies) or 7-11 times the annual premium (for regular-pay policies).

- 105% of total premiums paid.

- Guaranteed Maturity Benefit.

- Basic Sum Assured is paid.

- If the insured dies after the policy term, the total premiums paid are returned.

5. Policy Lapse and Revival

- If a policy lapses due to non-payment of premiums and has not acquired a surrender value, no benefits are payable.

- If a policy has acquired Surrender Value, it becomes a Reduced Paid-up Policy.

- A lapsed policy can be revived within five years by paying all due premiums along with interest.

6. Loan Against Policy

- A policyholder can take a loan of up to 80% of the Surrender Value.

- Interest on the loan is based on SBI’s term deposit rate + 2%.

- If the loan amount exceeds the Surrender Value, the policy will be terminated.

7. Free-Look Period

- The policyholder has:

- 15 days from the receipt of the policy document to review the terms and conditions.

- 30 days if the policy was bought online or through distance marketing.

- If the policyholder disagrees with any terms, they can cancel the policy and get a refund of the premium paid after deducting applicable charges.

8. Nomination & Assignment

- The policyholder can nominate a beneficiary under Section 39 of the Insurance Act.

- The policy can be assigned to another person or financial institution as per Section 38 of the Insurance Act.

9. Suicide Clause

- If the insured dies due to suicide within 12 months of policy commencement or revival, the payout will be at least 80% of the total premiums paid or the surrender value (whichever is higher).

10. Taxation

- All premiums and benefits are subject to applicable taxes, duties, and levies.

- The insurer reserves the right to deduct these taxes from the benefits payable.

Product Disclaimers

- Tata AIA Life Guaranteed Return Insurance Plan (UIN: 110N152V14) Individual, Non Linked, Non Participating, Life Insurance Savings Plan

- 1Guaranteed Addition defined as a percentage of GMB shall accrued at a simple rate for each completed policy year, throughout the Policy Term and shall be payable on Maturity or Death whichever is earlier, subject to all due premiums being paid. Buying a Life Insurance policy is a long-term commitment. An early termination of the policy usually involves high costs and the Surrender Value payable may be less than all the Premiums Paid.

- *Guaranteed Returns/Payouts depend on Plan Option, Policy Term, Premium Payment Term and Age at entry.

- ^All Premiums, Charges, and interest payable under the policy are exclusive of applicable taxes, duties, surcharge, cesses or levies which will be entirely borne/ paid by the Policyholder, in addition to the payment of such Premium, charges or interest. Tata AIA Life shall have the right to claim, deduct, adjust and recover the amount of any applicable tax or imposition, levied by any statutory or administrative body, from the benefits payable under the Policy.

- ^^^Income Tax benefits would be available as per the tax laws, subject to fulfillment of conditions stipulated therein. Income Tax laws are subject to change from time to time. Tata AIA Life Insurance Company Ltd. does not assume responsibility on tax implication mentioned anywhere on this site. Please consult your own tax consultant to know the tax benefits available to you.

- ©Riders are not mandatory and are available for a nominal extra cost. For more details on benefits, premiums and exclusions under the Rider, please contact Tata AIA Life’s Insurance Advisor/Intermediary/ branch. Tata AIA Vitality Health (UIN: 110B045V03 or any other later version), Tata AIA Vitality Protect (UIN: 110B046V04 or any other later version) are available with this plan.

- **Individual Death Claim Settlement Ratio is 99.13% for FY 2023-24 as per the latest annual audited figures.

- ~~At the time of purchase, if the policyholder chooses to opt for a Return of Balance Premium option with Tata AIA Vitality Protect and Tata AIA Vitality Health, an amount equal to the Total Premiums Paid towards the respective benefit option (excluding loading for modal premiums), less any claim amount already paid out under the respective benefit option.

- &Any premium discounts availed under the Wellness Program as premium discounts or premium cashback, shall be payable at the end of the benefit option term, provided the benefit option is not terminated.

- 3Term Benefit, Critical Illness, Accidental Death, Accidental Disability are available with Tata AIA Life Insurance Non-Linked Comprehensive Protection Rider / Tata AIA Vitality Protect. Hospitalization Benefit is available with Tata AIA Life Insurance Non Linked Comprehensive Health Rider / Tata AIA Vitality Health

- ~Tata AIA Vitality is a Wellness Program that offers you an upfront discount at policy inception. You can also earn premium discount / cover booster (as applicable) for subsequent years on policy anniversary basis your Vitality Status (tracked on TATA AIA Vitality app). The TataAIA Vitality Wellness Program is available with Tata AIA Vitality Health (UIN: 110B045V03) and Tata AIA Vitality Protect (UIN: 110B046V04). Vitality is a trademark licensed to Tata AIA Life by Amplify Health Assets PTE. Limited, a joint venture between Vitality Group International, INC. and AIA Company Limited. The assessment under the wellness program shall not be considered as a medical advice or a substitute to a consultation/treatment by a professional medical practitioner.

- $On enrolling into the wellness Program, you get an upfront discount of 5% on first year premium for Accidental Death, Accidental Total & Permanent Disability, Accidental Disability Care Benefits and of 10% on first year premiums of the other benefit options. The rewards are offered on cumulative basis and in any year, the maximum rewards in view of both the upfront rewards and annual rewards _ex together shall be 15% for Accidental Disability Care and 30% for all other benefit options. Discount is driven by accumulated points which is achieved through wellness status. Please refer policy document for more details.

- This product is underwritten by Tata AIA Life Insurance Company Ltd. This plan is not a guaranteed issuance plan and it will be subject to Company’s underwriting and acceptance.

- Insurance cover is available under this product.

- In case of non-standard lives and on submission of non-standard age proof, extra premiums will be charged as per our underwriting guidelines.

- For more details on risk factors, terms and conditions, please read the sales brochure carefully before concluding a sale

- The recommendation of ‘Most preferred package’ quotes have been shown basis customer preferences and products availability. You may opt for coverage suitable to your needs.

- For more details on risk factors, terms and conditions please read sales brochure carefully before concluding a sale. The precise terms and condition of this plan are specified in the Policy Contract.

- L&C/Advt/2024/Oct/3012