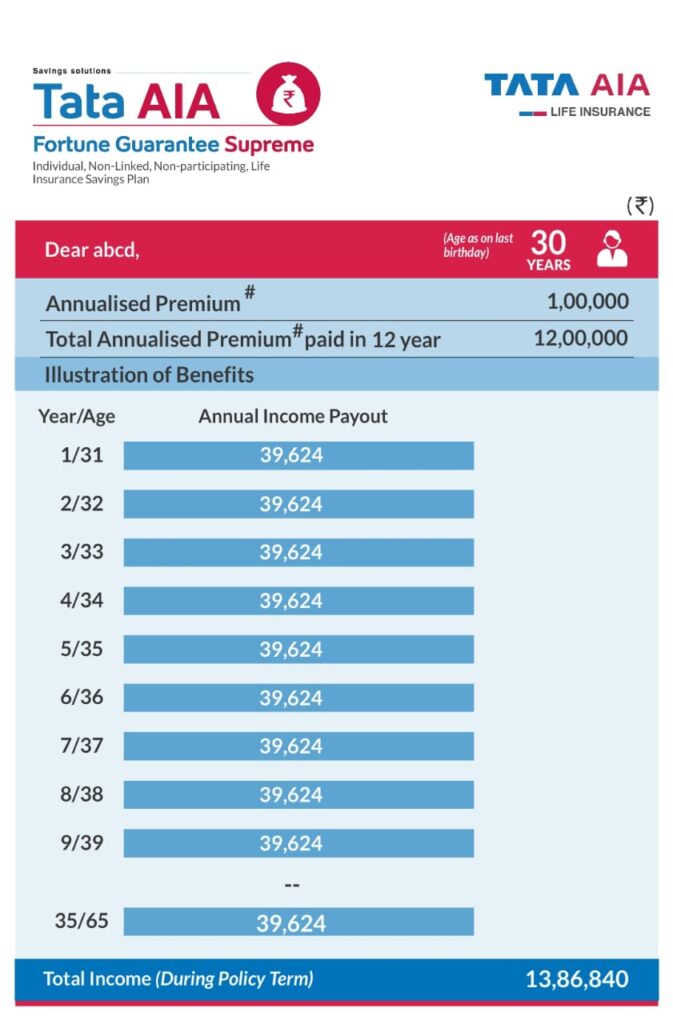

TATA AIA Fortune Guarantee Supreme is a unique plan that provides guaranteed++ income from first month onwards. You may receive this income on special occasion like your child’s birthday, your anniversary, your parent’s birthday etc.

Who Should Consider This Plan?

- Those looking for a risk-free savings plan with guaranteed returns.

- People who need regular income in the future (for retirement or children’s education).

- Individuals wanting life insurance coverage with savings benefits.

Key Features (Why Consider It?)

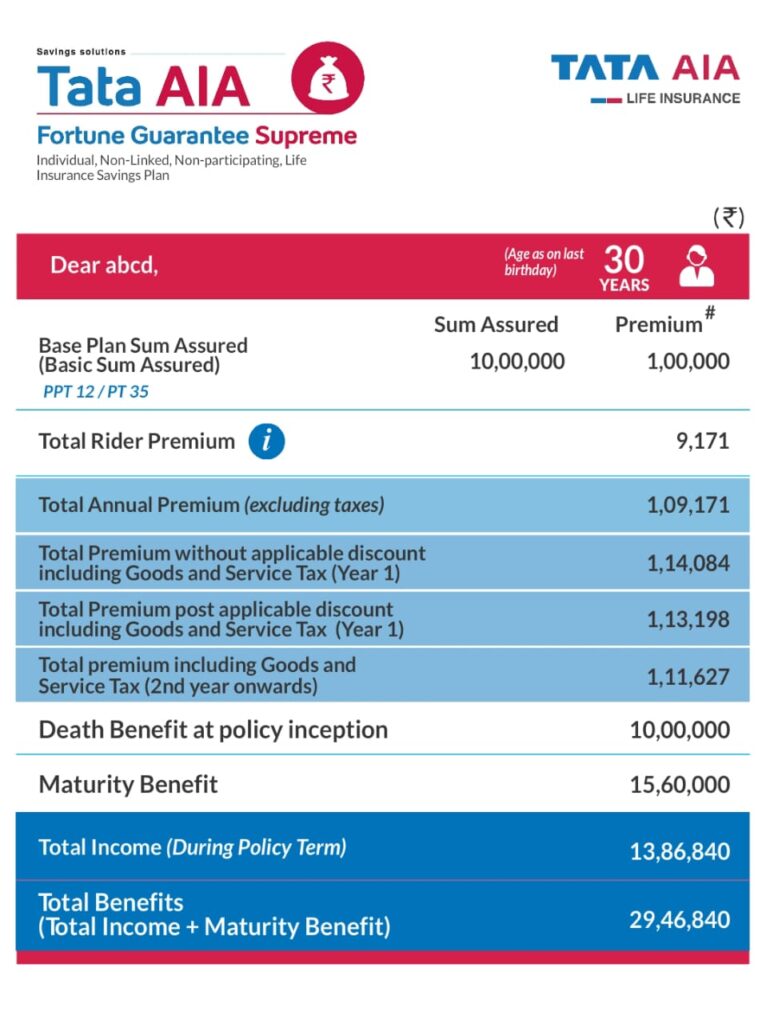

- Guaranteed Benefits: Get assured returns in either lump sum or periodic payouts.

- Flexibility: Choose how and when you receive payouts.

- Women’s Discount: Women get a 2% discount on their first-year premium.

- “Premium Offset” Feature: Use survival benefits to pay future premiums.

- Tax Benefits: Get tax savings on premiums and payouts as per tax laws

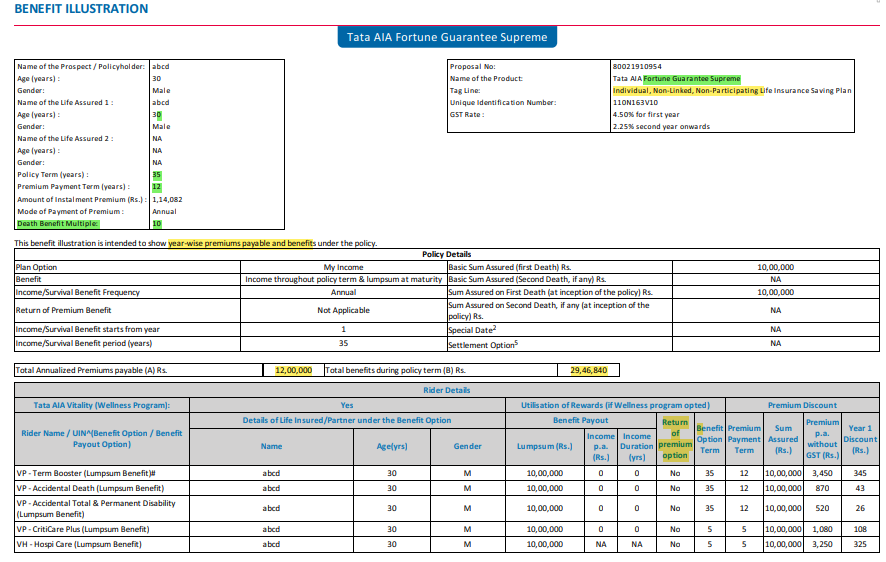

| FG Supreme | ||

| Particulars | ||

| Age | 0 – 65 | Female 2% Spl Discount on 1st years premium |

| Gender | M/F | Proposer & Insured Concepts Applicable |

| Plan Options | 1.Immediate Income 2.Deferred Income With ROP 3.Future Ready (Deferred Income) W/o ROP | |

| Option 1: Immediate Income | ||

| Premium Payment Option | Limited Pay | |

| Annualised Premium | Min 24K | |

| Premium Payment Term | 5 – 12 | |

| Policy Term | 25 -50 | It is linked with PPT |

| Income payment | Advance: within a week Arrears: year end | 1. Spl Date option Available 2. You have the option to receive your guaranteed income in one of the following ways: A. Annually in Advance B. Annually, Monthly, quarterly or half-yearly in Arrears C. Annually on a “special date” such as your birthdate, anniversary, etc. |

| Riders (Optional) | 1. TB: to cover Terminal Illness 2. AD 3. ATPD 4. Hospicare 5. Criticare 6. BPR | |

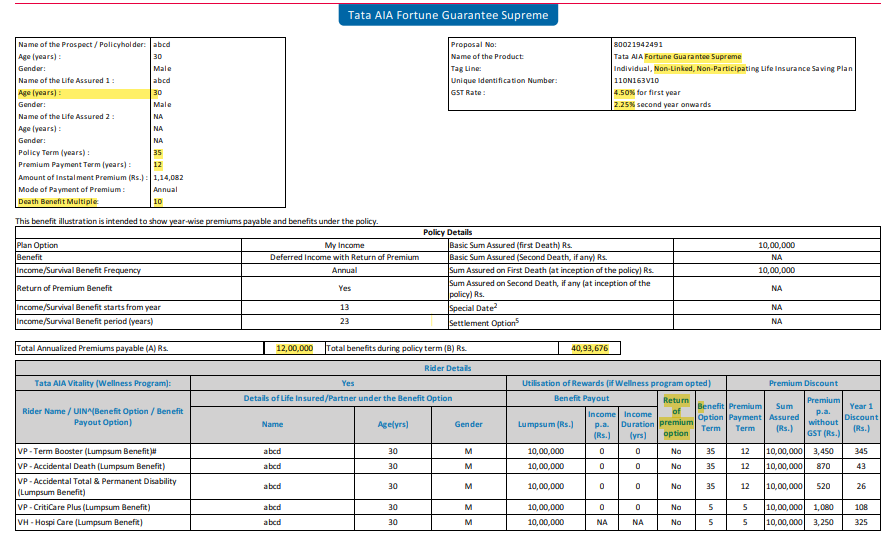

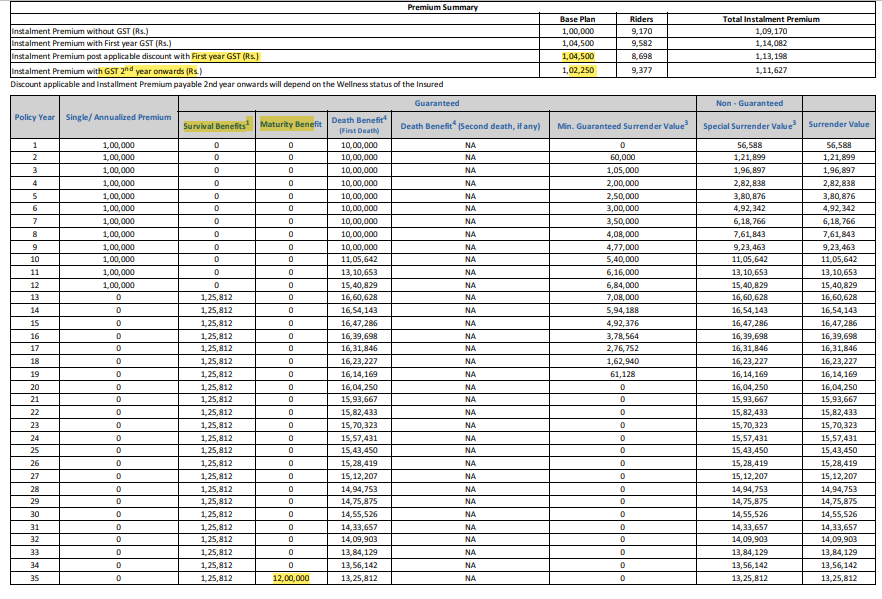

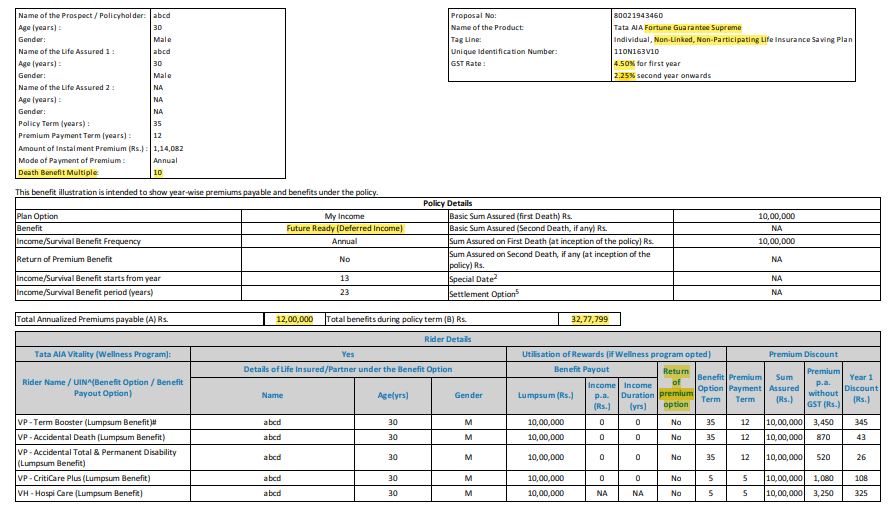

| Option 2: Deferred Income with ROP | ||

| Premium Payment Option | Only Limited Pay | |

| Annualized Premium | Min 1 lakhs | |

| Premium Payment Term | 5 –12 | |

| Policy Term | 20 -50 | |

| Income Period | It should not be less than 15 years | |

| Riders (Optional) | 1. TB: to cover Terminal Illness 2.AD 3.ATPD 4.Hospicare 5.Criticare 6.BPR | |

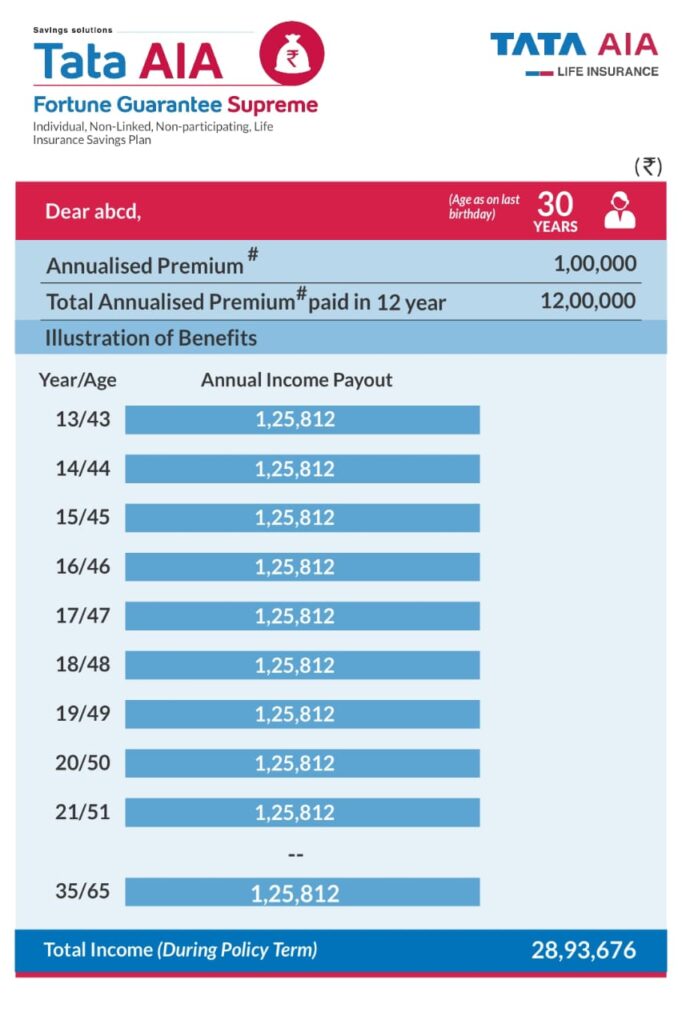

| Option 3: Future Ready (Deferred Income w/o ROP) | ||

| Premium Payment Option | Only Limited Pay | |

| Annualized Premium | Min 50,000 | |

| Premium Payment Term | 5 –12 | |

| Policy Term | 20 -50 | |

| Income Period | It should not be less than 15 years | |

| Riders (Optional) | 1.TB: to cover Terminal Illness 2.AD 3.ATPD 4.Hospicare 5.Criticare 6.BPR | |

Note: Never Surrender you will loose whole amount.

Option 1: Immediate Income:

Option 2: Deferred Income with Return of Premium

Option 3: Future Ready (Deferred Income w/o ROP)

Note:

- CritiCare Plus and HospiCare benefit(s) is subject to renewal every 5 years. The premiums at the time of renewal will be based on then prevailing rates as applicable.

- Guaranteed Income:

- You have the option to receive yourguaranteed income in one of the following ways:

- Annually in Advance

- Annually, Monthly, quarterly or half-yearly in Arrears

- Annually on a “special date” such as your birthdate, anniversary, etc…

- You have the option to receive yourguaranteed income in one of the following ways:

Additional Features

- Sub-Wallet: Save payouts in a special account and withdraw as needed while earning interest.

- Settlement Option: Convert your maturity amount into periodic installments for 3-5 years instead of taking a lump sum.

- Policy Loans: Take a loan against the policy if needed.

Exclusions

- Suicide Clause: If the policyholder dies by suicide within 12 months, only 80% of the premiums paid will be refunded.

- Waiting Period (POS Variant): If death occurs within 90 days of purchase (except for accidental death), only the total premiums paid will be refunded.

T&C:

1. Free Look Period (Trial Period)

- If you’re not happy with the policy, you can cancel it within 30 days of receiving it.

- You’ll get a refund of the premium paid, minus stamp duty, medical expenses, and any payouts already received.

2. Premium Payments & Grace Period

- You must pay your premiums on time.

- If you miss a payment, you get a grace period:

- 30 days for annual/half-yearly/quarterly payments.

- 15 days for monthly payments.

- If you don’t pay within the grace period, the policy can lapse or become a reduced-paid-up policy.

3. Policy Lapse & Revival

What Happens If You Stop Paying Premiums?

- If you miss a payment in the first year, the policy lapses, and no benefits are paid.

- If you have paid at least one full year’s premium, the policy becomes Reduced Paid-Up (RPU), meaning your benefits will reduce proportionally.

How to Revive a Lapsed Policy?

- You can revive your policy within 5 years from the first unpaid premium by:

- Paying all missed premiums + interest (currently 8.98% per year).

- Providing proof of good health (medical check-up may be needed).

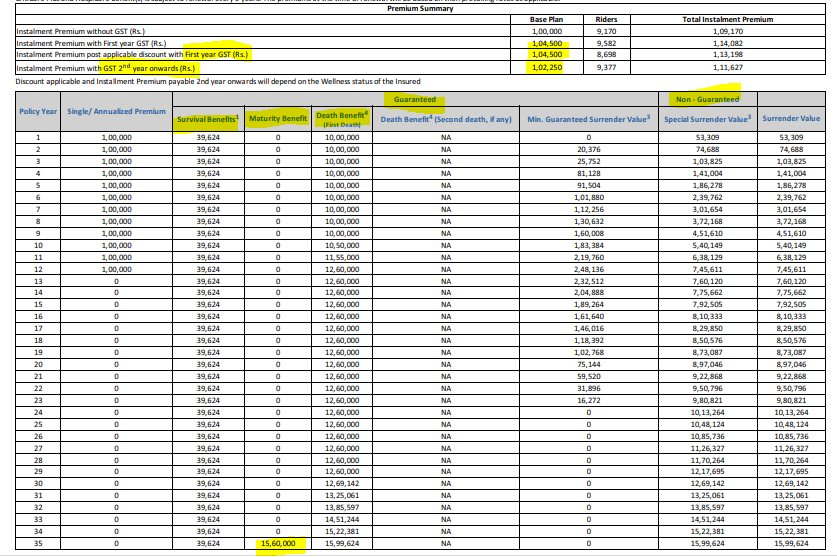

4. Surrender (Quitting the Policy Early)

- You can surrender (exit) the policy if:

- You’ve paid at least one full year’s premium (for limited/regular pay plans).

- For single pay plans, you can surrender anytime.

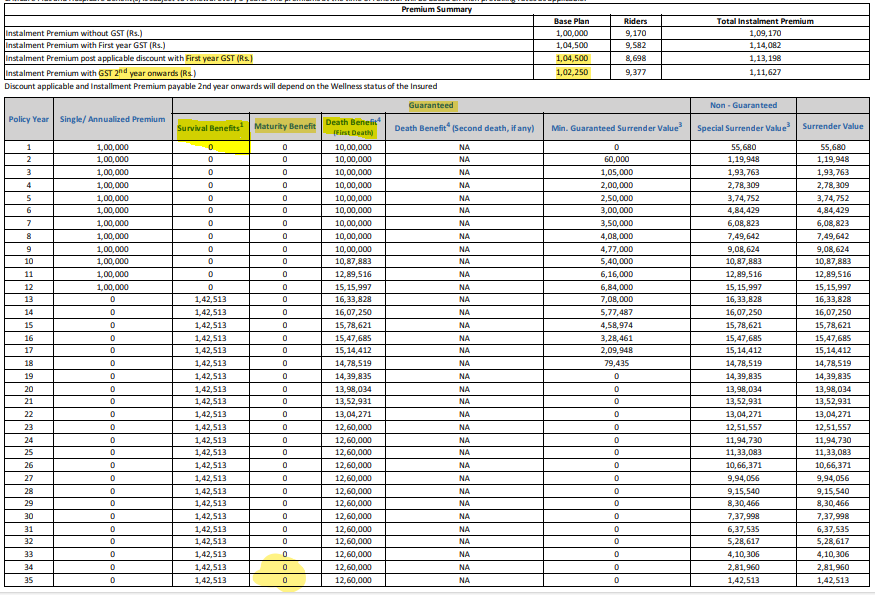

- The amount you get back is called Surrender Value, which is the higher of:

- Guaranteed Surrender Value (GSV): A percentage of the total premiums paid.

- Special Surrender Value (SSV): Decided by Tata AIA based on market conditions.

5. Death Benefit (If the Policyholder Passes Away)

- If the policyholder dies during the policy term, the nominee will receive the highest of:

- 1.25x of single premium OR 7x of annual premium (whichever applies).

- 105% of total premiums paid.

- Basic Sum Assured (the guaranteed amount).

For Joint Life Policies:

- The first person’s death does not stop the policy. The second person continues to receive benefits.

- The policy ends when the second person dies, and the final payout is made.

6. Maturity Benefit (What Happens When the Policy Ends?)

- If you survive until the end of the policy term, you will receive:

- A lump sum amount (if you chose the “My Income” plan).

- Regular income payouts (if you chose the “Immediate Income” plan).

- No maturity benefit is paid under Immediate Income if you do not opt for the Survival Benefit payouts.

7. Exclusions (What is NOT Covered?)

Suicide Clause

- If the policyholder dies by suicide within 12 months of:

- Buying the policy → The nominee will only get 80% of premiums paid or the surrender value (whichever is higher).

- Reviving the policy → The nominee will get 80% of the premiums paid up to that date.

Waiting Period (for POS variant)

- If death happens within 90 days of buying the policy (except for accidental death), only the total premiums paid will be refunded.

8. Loans Against Policy

- If your policy has Surrender Value, you can take a loan against it.

- Maximum loan amount = 80% of Surrender Value.

- Loan interest is calculated as SBI deposit rate + extra percentage, which varies:

- Female MSME owners: 7.98% per year.

- Male MSME owners: 8.48% per year.

- Others: 8.98% per year.

9. Policy Modifications (What Can Be Changed?)

✅ You can change:

- Premium Payment Mode (Yearly, Half-Yearly, Quarterly, Monthly).

- Nominee, Assignee, or Appointee.

- Income/Survival Benefit Frequency (changeable only at policy anniversary).

- DOB correction.

- Settlement Option (choosing to get maturity benefits in installments instead of a lump sum).

🚫 You CANNOT change:

- Basic Sum Assured after the policy starts.

10. Special Features & Benefits

Sub-Wallet (Earn Interest on Payouts)

- If you don’t need the payouts immediately, you can store them in a “Sub-Wallet.”

- This earns extra interest, which is currently 4.05% per year.

- You can withdraw anytime during the policy term.

Premium Offset (Using Payouts to Pay Premiums)

- If your policy gives regular payouts, you can use them to pay future premiums.

- If the payout is higher than the premium, you get the extra money.

- If the payout is lower, you need to pay the difference.

Special Date for Income Payments

- You can choose to receive payouts on a special date (e.g., your child’s birthday, spouse’s birthday).

- This amount will be adjusted with 3% extra interest for the delay.

11. Riders (Extra Coverage for Added Protection)

You can add riders for extra protection by paying an additional premium:

- Comprehensive Protection Rider (extra life cover).

- Comprehensive Health Rider (coverage for critical illnesses).

- Vitality Protect & Health Riders (health and wellness benefits).

👉 Note: Riders cannot be added for POS (Point of Sale) policies.

12. Taxes & Legal Conditions

- Taxes apply on all premiums, payouts, and loans.

- Tax benefits depend on current tax laws, so check with a tax advisor.

- Fraud & Misrepresentation: If any false information is given, the policy can be canceled as per Section 45 of the Insurance Act.

Product Disclaimers

- Tata AIA Fortune Guarantee Supreme Individual, A Non-Linked, Non-Participating Life Insurance Savings Plan (UIN 110N163V10).

- ++Guaranteed returns in this product depends on Age at Entry of life assured, Premium payment term, policy term, premium amount and plan option chosen.

- 1The current loyalty addition rate on the Sub-wallet will be 4.05% compounding annually. This rate will be reviewed every six months (on 1st April & 1st October every year).

- 2Special Date feature must be chosen at inception only. This feature is only available with Annual frequency of Income payout. The last instalment due on end of Policy Term shall be paid on the date of Maturity only, and not on Special Date. Special Surrender value may be revised depending on the prevailing market conditions.If you have selected Special Date, the Survival Benefits will be paid out on the chosen special date.

- 3A discount of 1% will be offered on the -first-year instalment due premiums for all payments paid through any permissible electronic mode debited through an auto-debit mandate. Such discount shall be capped to a maximum of r100 over the year.

- 4A discount of 2% on -first year premium will be offered to female life assureds. In case of Joint Life policies, discount of 2% on -first year will be offered when both the lives are females.

- 5The Company may offer a premium discount on the policies sourced by the company to the Existing Customers of Tata AIA Life’s Insurance Products as on the date of application. This premium discount shall be applicable on the premiums payable in the first policy year only and may range from 1.5% to 20% depending on the Policy term and Premium payment term opted.

- ^^^Tax benefits of up to ₹46,800 u/s 80C is calculated at highest tax slab rate of 31.20% (including cess excluding surcharge) on life insurance premium paid of ₹1,50,000. Tax benefits under the policy are subject to conditions laid under Section 80C, 80D,10(10D), 115BAC and other applicable provisions of the Income Tax Act,1961. Good and Service tax and Cess, if any will be charged extra as per prevailing rates. The Tax Free income is subject to conditions specified under section 10(10D) and other applicable provisions of the Income Tax Act,1961. Tax laws are subject to amendments made thereto from time to time. Please consult your tax advisor for details, before acting on above.

- *All Premiums and interest payable under the policy are exclusive of applicable taxes, duties, surcharge, cesses, or levies which will be entirely borne/ paid by the Policyholder, in addition to the payment of such Premium or interest. Tata AIA Life shall have the right to claim, deduct, adjust, and recover the amount of any applicable tax or imposition, levied by any statutory or administrative body, from the benefits payable under the Policy.

- **Individual Death Claim Settlement Ratio is 99.13% in FY 2023-24 as per the latest annual audited figures.

- ^On enrolling into the wellness Program, you get an upfront discount of 5% on first year premium for Accidental Death, Accidental Total & Permanent Disability, Accidental Disability Care Benefits and of 10% on first year premiums of the other benefit options. The rewards are offered on cumulative basis and in any year, the maximum rewards in view of both the upfront rewards and annual rewards _ex together shall be 15% for Accidental Disability Care and 30% for all other benefit options. Discount is driven by accumulated points which is achieved through wellness status. Please refer policy document for more details.

- #Tata AIA Vitality Protect (UIN:110B046V04 or any other later version) and Tata AIA Vitality Health (UIN: 110B045V03 or any other later version) are available under this plan. Rider is not mandatory and is available for a nominal extra cost. For more details on benefits, premiums, and exclusions under the Rider, please contact Tata AIA Life’s Insurance Advisor/ branch.

- Survival Benefit will be payable at the end of Survival Benefit frequency as chosen or on Special date. Please refer complete Terms and Conditions for more details on Survival Benefits.

- The Death Benefit shown above is at the end of the policy year. For single life policies and in case of Second Death for joint life policies, the death benefit is subject to a minimum of the Surrender Value on the date of death. Upon payment of Death benefit the policy terminates and no further benefits are payable the surrender values mentioned above are illustrated at the end of the policy year.

- The rider sum assured shall remain unchanged for a period as specified under ‘Guaranteed Period’ from the Date of Commencement of the benefit option. Upon the completion of ‘Guaranteed Period’, the sum assured as applicable for the benefit option may be revised or the policyholder may be given an option of top up premium to restore the benefit to original amount, subject to IRDAI’s approval. The top up premium may be payable as a single premium/ level premium during the block of next guarantee period. The requirement of paying the Top up premium in order to continue with the current level of benefit may be applicable even after expiry of limited pay premium term.

- Trade logo displayed above belongs to Tata Sons Ltd and AIA Group Ltd. and is used by Tata AIA Life Insurance Company Ltd under a license. For any information including cancellation, claims and complaints, please contact our Insurance Advisor/Intermediary or visit Tata AIA Life’s nearest branch.

- Please read Sales Brochure carefully before concluding a sale.

- Tax Laws are subject to modifications made there from time to time.

- Vitality is a trademark licensed to Tata AIA Life by Amplify Health Assets PTE. Limited, a joint venture between Vitality Group International, INC. and AIA Company Limited.

- The assessment under the wellness program shall not be considered as a medical advice or a substitute to a consultation/treatment by a professional medical practitioner.

- Insurance cover is available under this product.

- For more details on risk factors, terms and conditions please read sales brochure carefully before concluding a sale. The precise terms and condition of this plan are specified in the Policy Contract.

- The risk factors of the bonuses projected under the product are not guaranteed.

- Past performance doesn’t construe any indication of future bonuses.

- These products are subject to the overall performance of the insurer in terms of investments, management of expenses, mortality and lapses.

- L&C/Advt/2024/Dec/4031