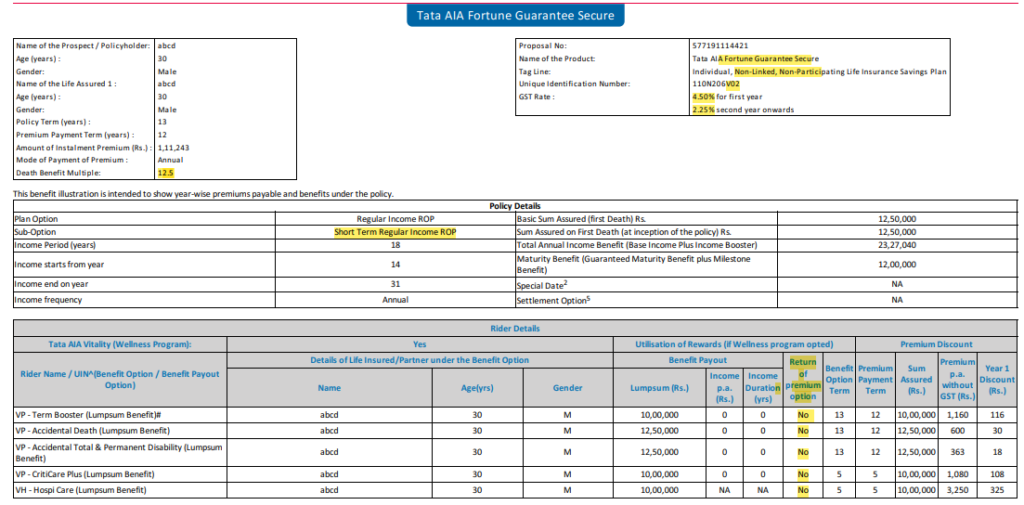

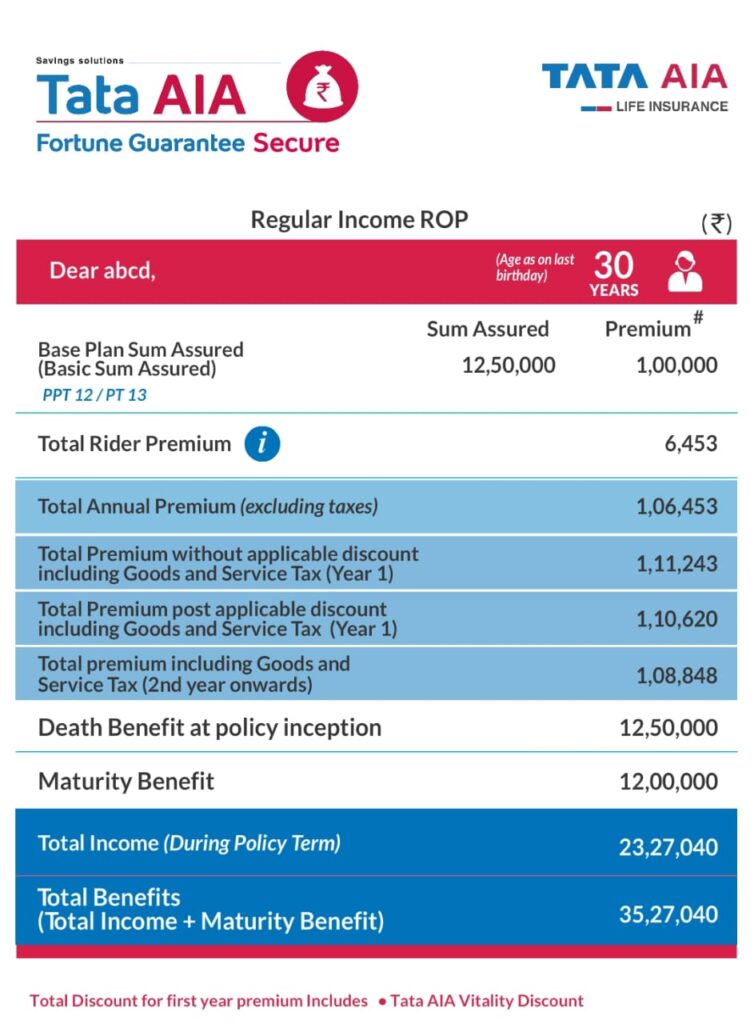

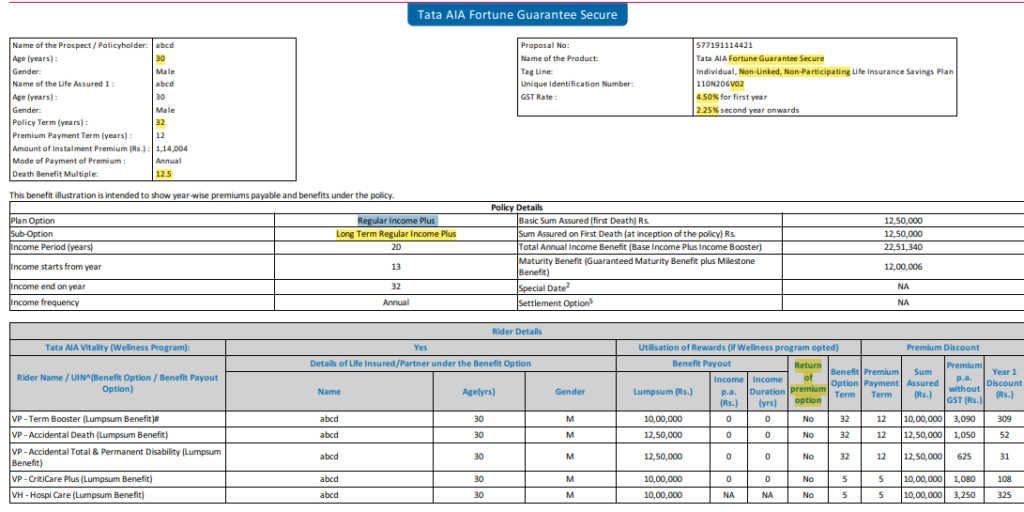

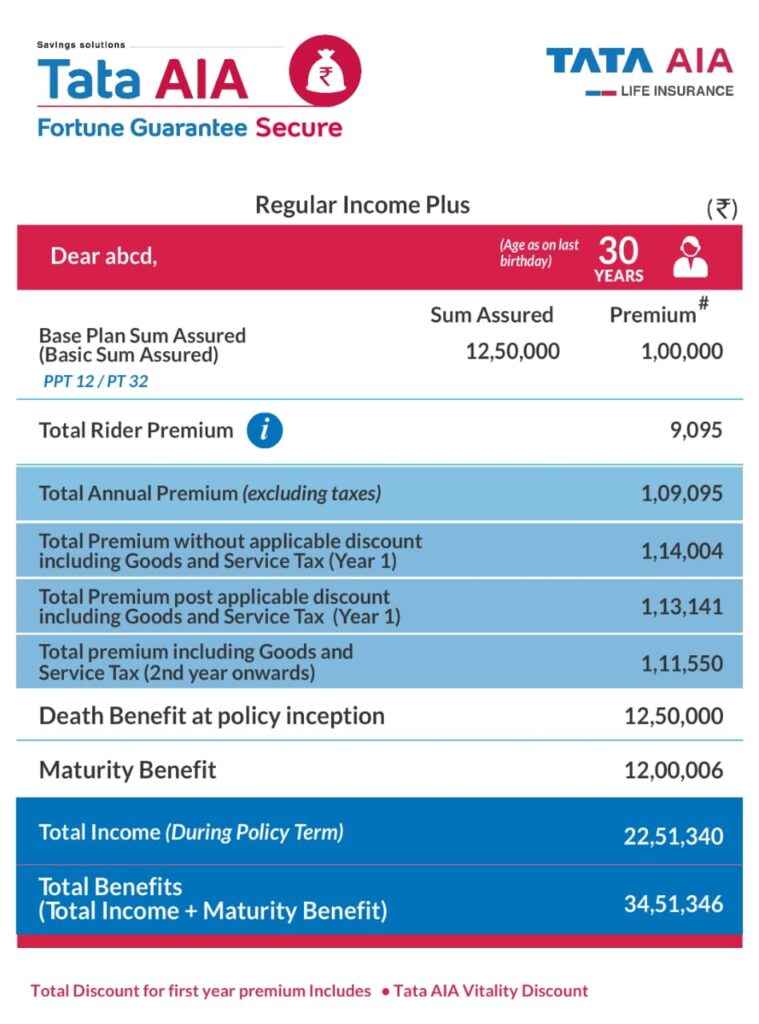

Individual, Non-Linked, Non-participating, Life Insurance Savings Plan

1. What is Fortune Guarantee Secure?

- It’s a life insurance savings plan that ensures a steady income while also providing life coverage.

- The goal is to help with future financial needs like a second income, education costs, or retirement savings.

Note:

- Once you select a plan option, you cannot change it later.

- You must pay all premiums on time to receive the full benefits.

2. How Does It Work?

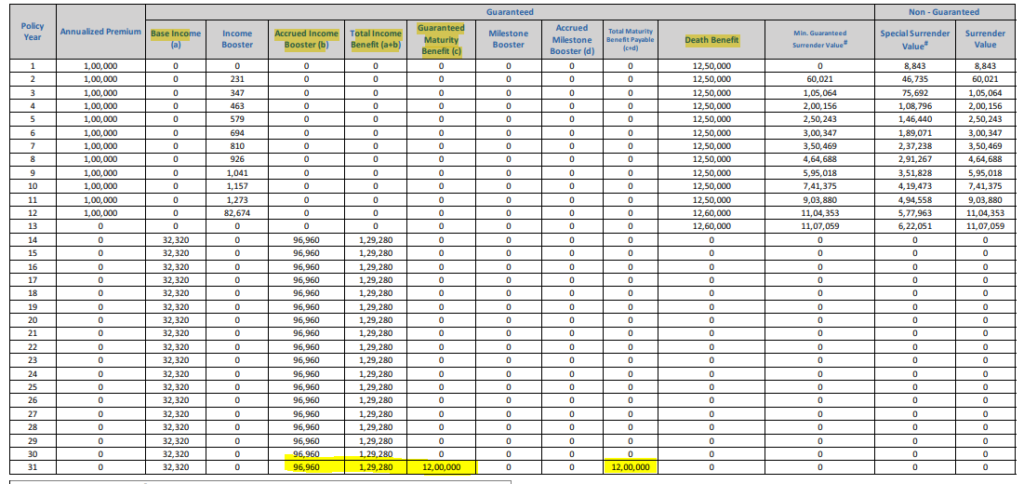

- You pay premiums for a specific number of years.

- After a set period, you start receiving regular payouts (income).

- If something happens to you (the policyholder), your family will receive financial benefits.

Note:

- If you miss a premium, you get a grace period of 15 days (monthly mode) or 30 days (other modes).

- If you die within 12 months due to suicide, only 80% of premiums paid will be returned.

3. Main Features:

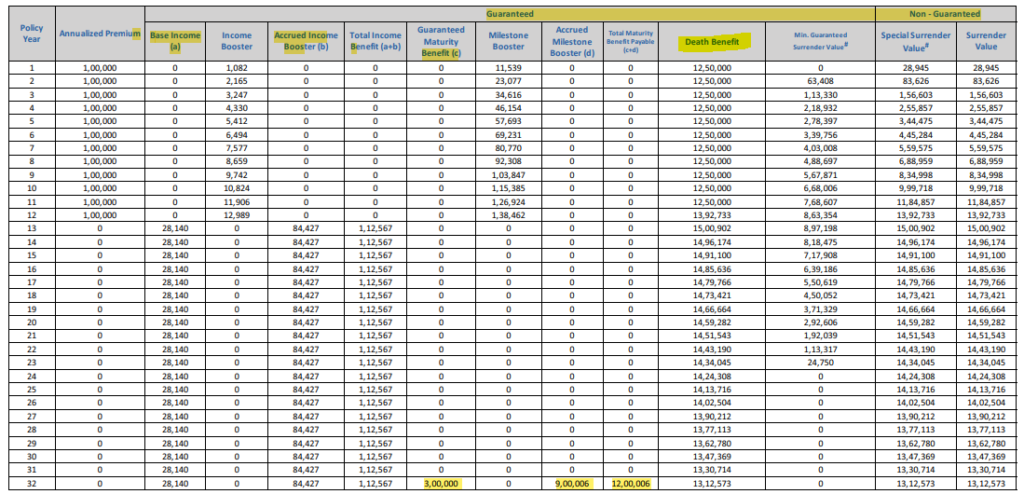

- Guaranteed Income: You get a fixed income for a set period.

- Flexible Options: Choose when to start receiving money (immediately or later).

- Tax Benefits: Get tax savings on premiums and payouts (as per Indian tax laws).

- Life Coverage: If you pass away, your nominee (family) gets financial support.

- Discount for Women: Women get a 2% discount on the first year’s premium.

4. Plan Options:

A. Regular Income

- Get steady income for a selected period (5-45 years).

Note: If you stop paying premiums early, the policy becomes “Reduced Paid-Up,” meaning lower benefits.

B. Regular Income with Return of Premium (ROP)

- Get steady income plus a refund of all premiums at the end.

Note: You must complete the full policy term to get the premium refund.

C. Regular Income Plus

- Get steady income plus an extra lump sum at the end.

Note: Lump sum is paid only if all premiums are paid.

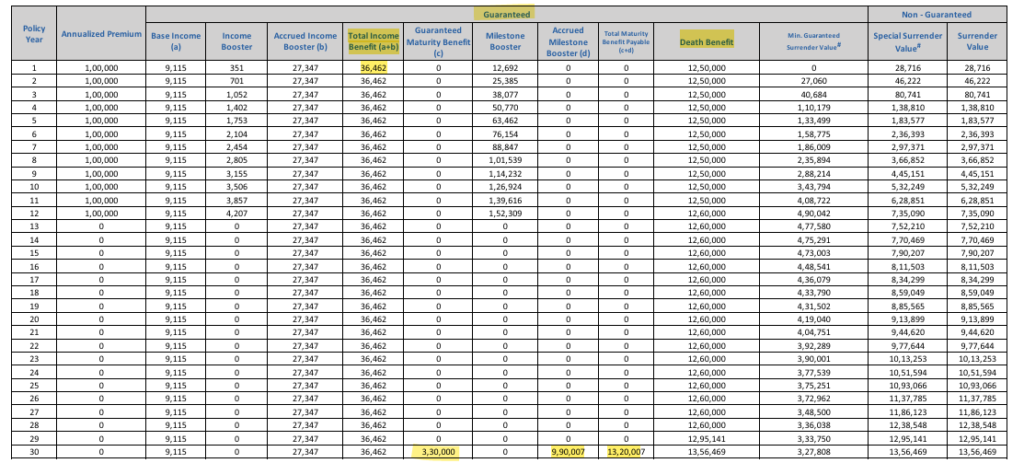

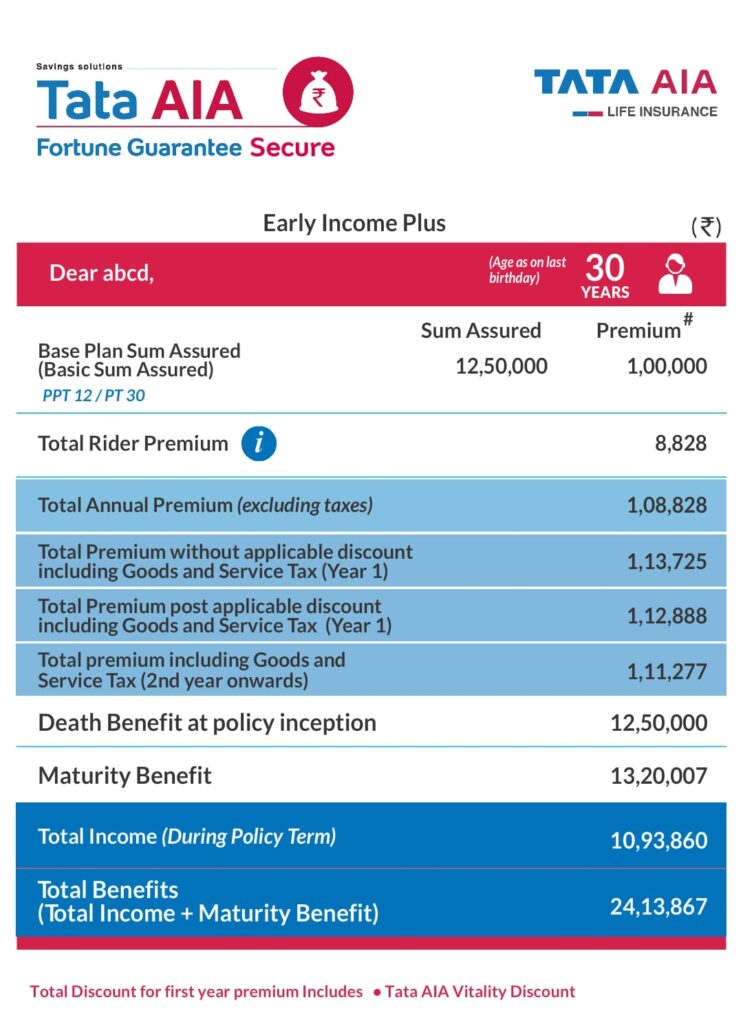

D. Early Income Plus

- Start getting income just 3 days after policy starts.

- Also get a lump sum at the end.

Note: If you choose monthly payouts, they will be slightly lower than annual payouts.

5. What Happens If You Pass Away?

- The highest of the following will be paid to your nominee:

- A multiple of your annual premium (7x if under 50 years, 5x if over 50 years).

- 105% of total premiums paid.

- The assured sum (minimum guaranteed amount).

- Your nominee can choose to receive the amount as a lump sum or continue getting regular payments.

Note: If you die within 90 days, only the total premiums paid will be refunded.

6. Other Important Points:

A. Sub-Wallet Feature

- Instead of taking money immediately, you can store it and withdraw later.

- Earns interest at a rate linked to SBI savings rate.

Note: If the policy ends, any remaining money in the Sub-Wallet is paid to you.

B. Premium Offset Feature

- You can use your income payouts to pay future premiums.

Note: If income is less than the premium, you must pay the remaining amount.

C. Policy Loan

- You can take a loan up to 80% of the surrender value against the policy if needed.

- Interest is SBI deposit rate + 2%, reviewed every 6 months.

- If the loan is more than the surrender value, the policy ends.

What If You Stop Paying?

A. Grace Period

- If you miss a payment, you get a few extra days to pay before the policy lapses.

- 15 days for monthly premiums.

- 30 days for other modes.

Note: If you die during the grace period, benefits are paid after deducting unpaid premiums.

B. Surrender (Quitting the Policy)

- You can exit after 1 year, but you get a lower amount (surrender value).

Note:

- The payout is whichever is higher: Guaranteed Surrender Value (GSV) or Special Surrender Value (SSV).

- If you quit before 1 year, you get nothing.

C. Revival

- If your policy lapses, you have 5 years to revive it.

- You must pay all missed premiums + interest.

Note: Interest is SBI deposit rate + 2%.

Exclusions

1. Suicide Clause

What Happens If the Policyholder Dies by Suicide?

- If the policyholder dies by suicide within 12 months from the policy start date or revival date (if the policy was restarted after lapsing), the nominee will not receive the full death benefit.

- Instead, the nominee will only get 80% of the total premiums paid or the surrender value, whichever is higher.

- This rule applies to both active and revived policies.

Why is this rule there?

- This prevents misuse where someone might take a high life cover knowing they intend to take extreme action shortly after.

2. Waiting Period for Death Benefits

What is the Waiting Period?

- If the policyholder dies within 90 days from the policy start date, the nominee only gets a refund of premiums paid.

- No death benefit will be paid unless the death is due to an accident.

Why is this rule there?

- It prevents fraudulent claims where someone with a known terminal illness takes the policy only to claim benefits immediately.

3. Exclusions in Riders (If Any Additional Benefits Were Chosen)

This plan does not include riders by default, but if you add riders like Accidental Death Benefit Rider, Critical Illness Rider, or Disability Rider, they have additional exclusions:

A. Accidental Death Rider Exclusions

If you have a rider that provides extra payout in case of accidental death, the payout will NOT be given if death occurs due to:

❌ Suicide or self-inflicted injuries, even if unintentional.

❌ Drug or alcohol overdose (death due to being under the influence).

❌ Participation in hazardous activities like skydiving, racing, or adventure sports.

❌ Criminal activities (if the insured was committing a crime when they died).

❌ War, terrorism, or riots (if death happens during a war or riot, benefits may not be paid).

B. Critical Illness Rider Exclusions

If you add a Critical Illness Rider, it may not pay benefits if:

❌ The illness was pre-existing (already diagnosed before the policy started).

❌ The illness is caused by self-harm, alcohol, or drug use.

❌ The illness is related to HIV/AIDS.

❌ Any congenital or birth-related diseases.

❌ If the illness occurs within 90 days of taking the policy (waiting period).

C. Permanent Disability Rider Exclusions

If you take a rider that pays in case of permanent disability, it will not pay if:

❌ Disability is due to self-inflicted injury or suicide attempt.

❌ The person was drunk or intoxicated.

❌ Disability happens due to war, riots, or nuclear exposure.

❌ Any pre-existing condition that led to disability.

4. Loan Exclusions

If you take a policy loan, here are some important points:

- If the loan amount + interest exceeds the surrender value, the policy will automatically terminate, and no further benefits will be paid.

- If the policyholder dies while the loan is active, the outstanding loan amount will be deducted from the payout before giving the money to the nominee.

Why is this rule there?

- This prevents misuse where someone takes a high loan and leaves the insurer with a financial loss.

5. Fraud, Misrepresentation & Non-Disclosure

If the policyholder lies or hides critical facts while buying the policy (e.g., medical history, smoking habits, or existing illnesses), the insurer has the right to:

❌ Cancel the policy.

❌ Deny the claim.

❌ Return only the premiums paid (without any bonuses or benefits).

Why is this rule there?

- Insurance companies rely on honest disclosure to assess risks correctly. If someone hides a serious illness and later claims benefits, it is considered fraud.

6. Tax & Legal Exclusions

- Tax benefits are not guaranteed – they depend on current tax laws, which may change.

- The insurer can deny claims or cancel policies if laws are violated (e.g., policyholder involved in criminal activities).

- If the policyholder assigns the policy to a lender, the lender has the first right to the claim amount before the nominee.

Final Summary of Exclusions

| Type of Exclusion | What is Excluded? |

|---|---|

| Suicide Clause | If death occurs within 12 months, only 80% of premiums paid are returned. |

| Waiting Period | If death occurs within 90 days (except accidental death), only premiums paid are refunded. |

| Rider Exclusions | No payout if death/disability is due to suicide, intoxication, illegal acts, adventure sports, war, or riots. |

| Loan Exclusions | Policy terminates if loan + interest exceeds surrender value. |

| Fraud/Non-Disclosure | Policy can be canceled if the insured hides medical history or misrepresents facts. |

| Tax & Legal Exclusions | Tax benefits depend on government laws, and policies may be voided if used for illegal purposes. |

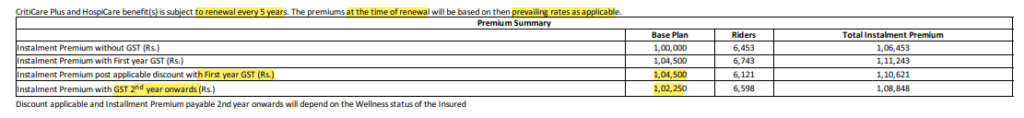

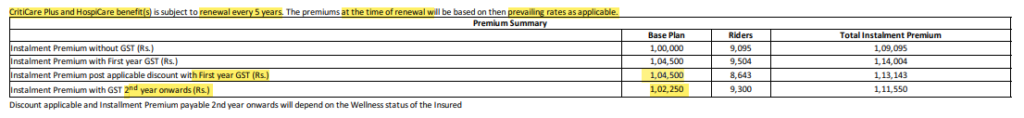

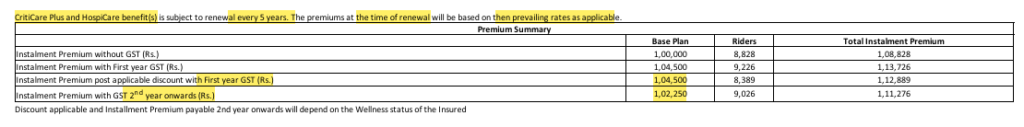

Taxes & Charges

- GST is charged on premiums.

- If you return the policy within 30 days (free-look period), you get a refund minus medical & stamp duty costs.

- Tax laws may change in the future, affecting benefits.

Nomination & Assignment

- You can nominate someone to receive the benefits.

- You can assign the policy to a lender as collateral.

- Assignment cannot be reversed once done.

How to Claim?

For Death Claim:

- Submit claim form + death certificate.

- If death was unnatural, police & medical reports are required.

- Claim must be filed within 90 days, but delays are accepted if reasonable.

For Maturity Claim:

- Provide bank details before the maturity date.

- If you change your bank, update details early to avoid delays.

| Fortune-Guarantee-Secure-Non-Linked, Non-participating, | ||

| Age | 0 – 65 | Proposer Insurer Concept Available |

| Gender | M / F / T | |

| Plan Options | 1.Regular Income ROP 2. Regular Income Plus 3. Early Income Plus | |

| Regular Income ROP | ||

| PPO | RP, LP | |

| Annualized Premium | Min 24,000 | |

| PPT | 5 – 12 | |

| PT | Ppt + 1 -5 | |

| Income Period | 15 – 33 | |

| Income Payment | Arrears / Advance | |

| Income Mode | Annual/ Half Yearly / Qtrly / Monthly | |

| Spl Date | Under this you have the option to receive your guaranteed income in one of the following ways: Annually, Monthly, quarterly or half-yearly in Arrears & Advance. Annually on a “special date” such as your birthdate, anniversary, etc. | |

| 2. Regular Income Plus | ||

| PPO | LP | |

| Annualized Premium | Min 24,000 | |

| PPT | 5 – 12 | |

| PT | 25 – 55 | |

| Income Period | Ppt + 1 –PT | |

| Income Payment | Arrears / Advance | |

| Income Mode | Annual/ Half Yearly / Qtrly / Monthly | |

| Riders (Optional) | TB: Terminal Illness AD ATPD Hospicare Criticare Plus BPR | Hospi Care: Pay fixed amount of Hospitalization, ICU benefits and also Recuperation Benefit in case of Hospitalization for 7 or More Days. Criticare Plus: 40 critical illness including Cancer and cardiac Conditions |

| 3. Early Income Plus | ||

| PPO | LP | |

| Annualized Premium | Min 24,000 | |

| PPT | 5 – 12 | |

| PT | 15 – 50 | |

| Income Period | 1 –PT | |

| Income Payment | Arrears / Advance | |

| Income Mode | Annual/ Half Yearly / Qtrly / Monthly | |

| Riders (Optional) | TB: Terminal Illness AD ATPD Hospicare Criticare Plus BPR | Hospi Care: Pay fixed amount of Hospitalization, ICU benefits and also Recuperation Benefit in case of Hospitalization for 7 or More Days. Criticare Plus: 40 critical illness including Cancer and cardiac Conditions |

Option 1: Regular Income ROP

Option 2: Regular Income Plus

Option 3: Early Income Plus

Disclaimer

- Tata AIA Fortune Guarantee Secure – Individual, Non-Linked, Non-participating, Life Insurance Savings Plan (UIN: 110N206V02)

- *Guaranteed returns in this plan depends on Age at Entry of life assured, Premium payment term, policy term, premium amount and plan option chosen. Guaranteed income shall be a % of Annualized Premium (before discount). Such Income shall be payable every year during Income Period as per the guaranteed chosen option.

- 1The current loyalty addition rate on the Sub-wallet will be 4.05% compounding annually. This rate will be reviewed every six months (on 1st April & 1st October every year).At inception or any time during the policy term, as applicable, the policyholder can choose to receive full or part of his benefits into his ‘Sub-Wallet’. The Sub-wallet will earn a loyalty addition that will accrue daily. This loyalty addition will be at the rate as outlined below:

- Lower of (State Bank of India savings bank interest rate + 1.50% p.a. AND State Bank of India savings bank interest rate X 1.5 times)

- This rate will be reviewed every six months (on 1st April & 1st October every year). The current loyalty interest rate on the Sub-wallet based on the above is 4.05% compounding annually for the period from 1st October 2024 to 31st March 2025. The Company may in future change the reference rate from State Bank of India savings bank interest rate to some other index, subject to prior approval of IRDAI. The policyholder can withdraw the balance from the Sub-wallet, in part or in full, anytime during the policy term, as applicable. The balance in the Sub-wallet, if any, will be paid to the policyholder at the time of termination or foreclosure of the policy.

- The policyholder can dynamically set/amend the proportion of the benefit receivable into his Sub-wallet any time during the policy term by prior intimation to the Company.

- 2Income Tax benefits would be available as per the prevailing income tax laws, subject to fulfillment of conditions stipulated therein. Income Tax laws are subject to change from time to time. Tata AIA Life Insurance Company Ltd. does not assume responsibility on tax implications mentioned anywhere on this site. Please consult your own tax consultant to know the tax benefits available to you.

- No Medical examination shall be required under POS variant of the product.

- This product is underwritten by Tata AIA Life Insurance Company Ltd.

- Insurance cover is available under this product.

- This plan is not a guaranteed issuance plan, and it will be subject to Company’s underwriting and acceptance.

- This plan is also available for sale through online mode.

- This product brochure should be read along with Benefit Illustration.

- Risk cover commences along with policy commencement for all lives, including minor lives. The policy shall vest in the life of the minor insured once he/she attains majority i.e. 18 years.

- Buying a Life Insurance Policy is a long-term commitment. An early termination of the Policy usually involves high costs, and the Surrender Value payable may be less than the all the Premiums Paid.

- In case of non-standard lives and on submission of non-standard age proof, extra premiums will be charged as per our underwriting guidelines.

- All Premiums and interest payable under the policy are exclusive of applicable taxes, duties, surcharge, cesses or levies which will be entirely borne/ paid by the Policyholder, in addition to the payment of such Premium or interest. Tata AIA Life shall have the right to claim, deduct, adjust and recover the amount of any applicable tax or imposition, levied by any statutory or administrative body, from the benefits payable under the Policy.

- L&C/Advt/2024/Dec/3793