Unit Linked, Non-Participating Individual Life Insurance Plan

| PR Series – Minimum Income – Rs.3 Lakhs– Lock in period of 5Years | ||

| Particulars | Remarks | |

| Age Eligibility | 18 – 65 | ITR / Pay slip mandatory |

| Gender | M / F / TG | |

| Plan Option | ||

| Recommended is LP, based on this premium your investment Grow. Early Investment leads to max Growth. Recommended is 30Y | 1.Life Pro +: Inbuilt With ROP of Riders A) Base SA: 1 crore (90 SSRP & 10 TB). B) AD: 90L C) ATPD: 90L TB: Terminal Illness Rider. | Min SA 50 L *** LP: PPT: 5 -55 PT: 30 – 65 RP: PPT: 30 – 50 & PT: 30 – 50. |

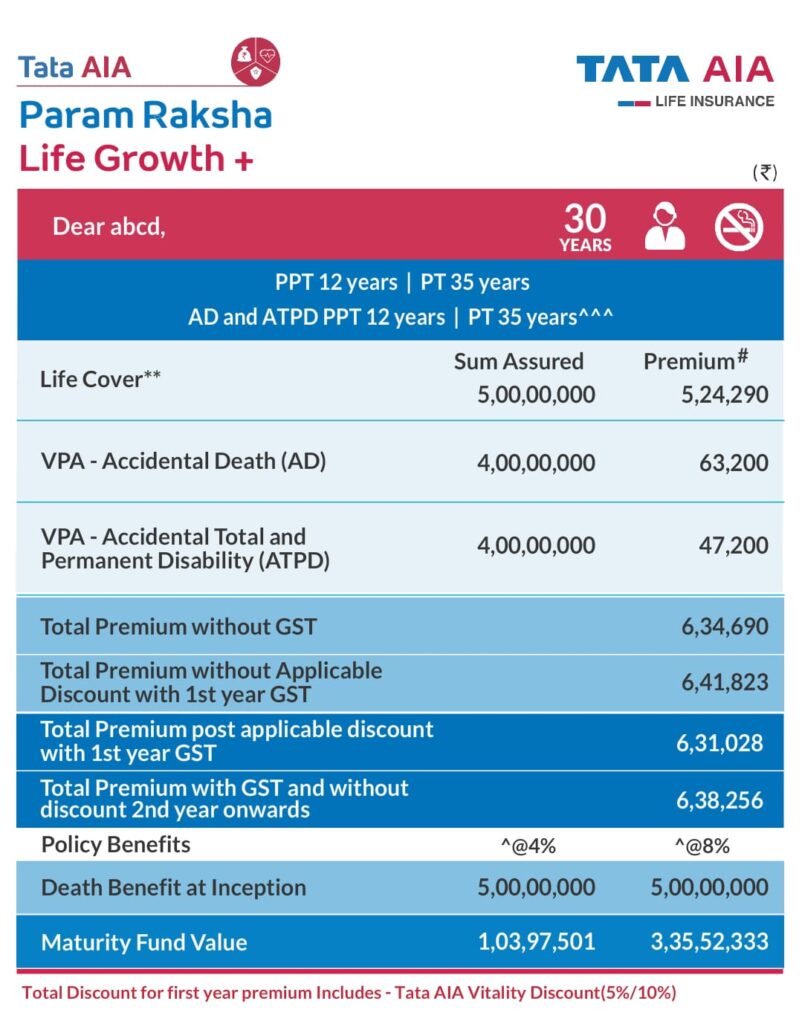

| 2. Life Growth +: Inbuilt With ROP of Riders A) Base SA: 5 crore (4 SSRP & 1 TB) B) AD: 4 Cr C) ATPD: 4Cr | Min 5 L premium, So you must increase SA. Eg: 5Cr LP: PPT: 5 -50 & PT: 30 – 65 RP: PPT: 30 – 50 & PT: 30 – 50. | |

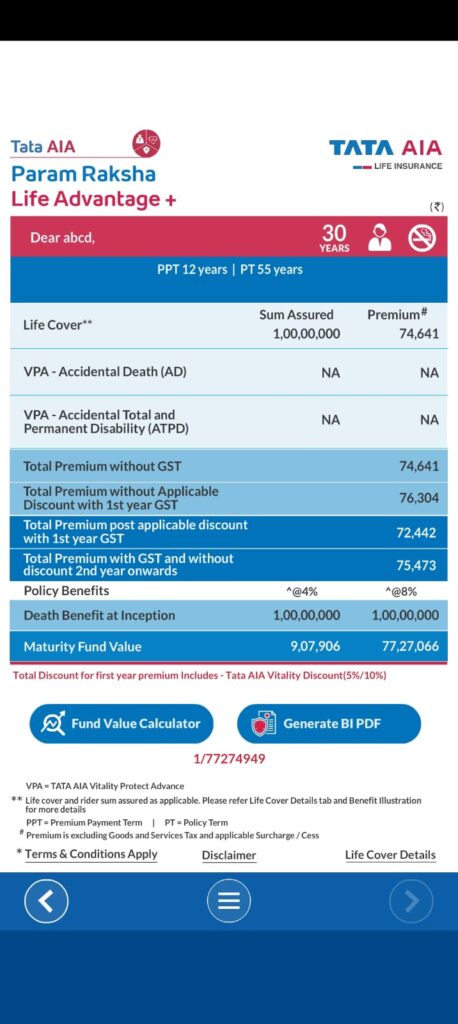

| 3. Life Advantage +: only TB With ROP of Rider **** W/O Riders Not Suggested | Min SA 1cr. **** LP PPT: 5 -50 PT: 55 – 70 RP: 50 PPT: 50 PT: 50. | |

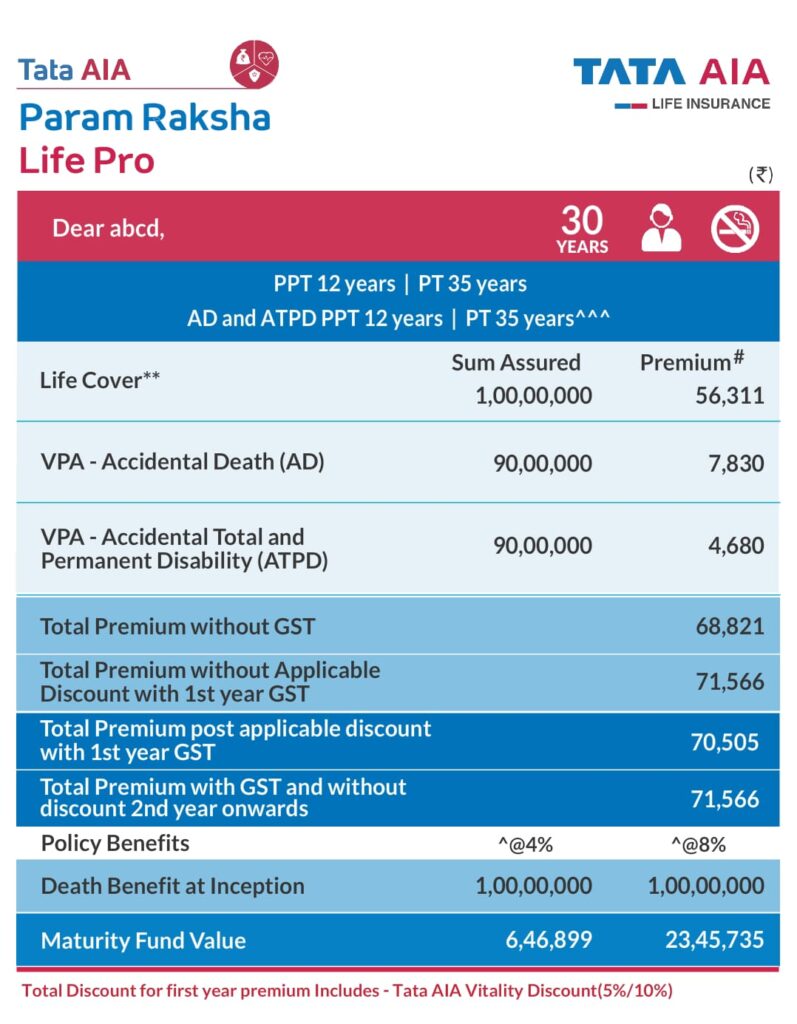

| 4. Life Pro: Inbuilt Riders Without ROP A) Base SA: 1 crore (90L SSRP & 10 TB). B) AD: 90L C) ATPD: 90L Compared to Pro + this is better as riders amount wont go to Investment. | Min SA 50 L **** LP: PPT: 5 -50 & PT: 30 – 65 RP: PPT: 30 – 50 & PT: 30 – 50. | |

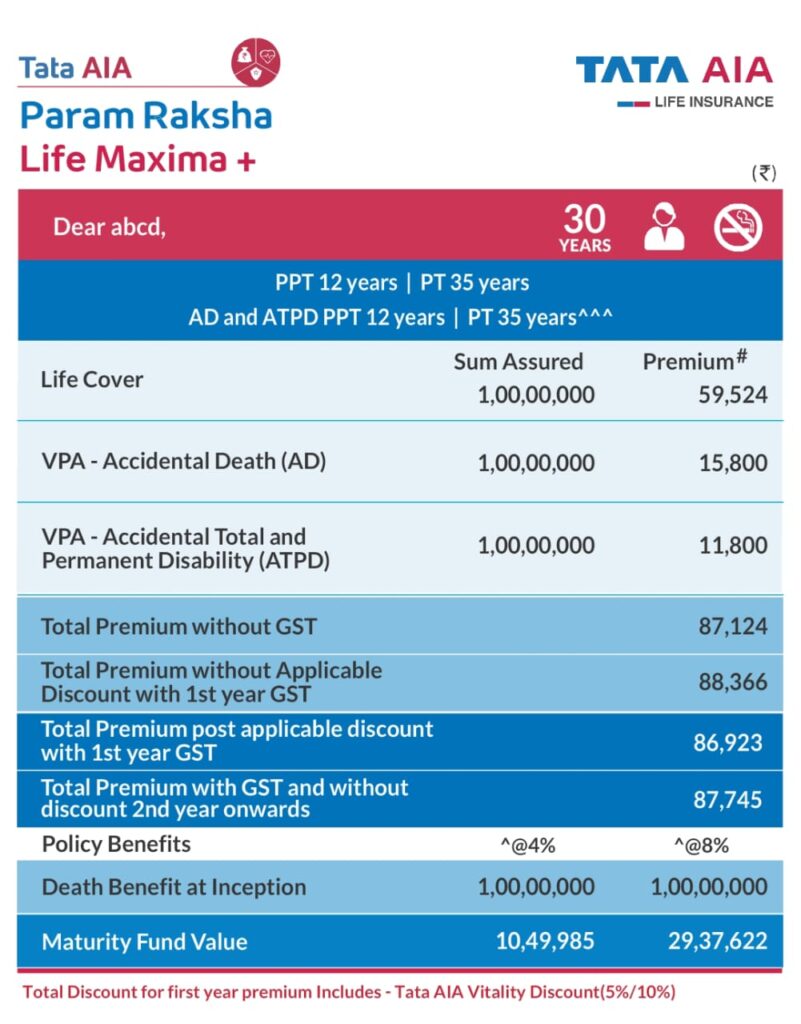

| 5. Life Maxima +: Inbuilt Riders with ROP A) Base SA: 1 crore (1 cr SSRP & no TB). B) AD: 1cr C) ATPD: 1 cr | Min SA 50 L **** LP: PPT: 5 -50 & PT: 30 – 65 RP: PPT: 30 – 50 & PT: 30 – 50. | |

| Other Options | You Can invest in 20 Funds based on your Interest from 1% to 100% in one fund. You can switch from one fund to another fund w/o exist. | |

Note: Please check net income in the BI

Note: Please check net income in the BI

Note: Please check net income in the BI

Note: Please check net income in the BI

Note: Please check net income in the BI

Author Comment: please don’t choose this plan, Instead take TERM and ULIPS separately, so that your children’s will get the SA of TERM plan and ULIPS maturity Benefit can be used for yourself.

1. Key Benefits of Tata AIA Smart Sampoorna Raksha Supreme

A. Financial Protection

- Offers high sum assured, to secure your loved ones from unforeseen events.

- Flexible premium payment term; with an option of whole life coverage.

- Customize to exactly align with future goals.

B. Wealth Creation

- Choose from a range of debt and equity oriented funds.

- Generate a second income with new partial withdrawal strategies.

C. Loyalty Addition/Fund Booster

- Refund of 2X Premium Allocation Charges

- Refund of Mortality Charges#

- Smart lady benefit for female customers*.

* Refer to Smart lady provision under benefits section.

#Applicable only under the Classic option

2. Eligiblity Criteria

Refer the Above Table

3. Sum Assured:

Refer the Above Table

4. Plan Option

Refer the Above Table

5. How does this plan work?

Secure and invest with this plan in 3 easy steps:

- Step 1: Make a choice from the two available options.

- Step 2: Decide your term of investment and pay premiums with full flexibility

- Step 3: Decide your Sum Assured amount and choose your investment strategy.

6. What are your Benefits?

Maturity Benefit

On survival to the end of the policy term, you will receive the Total Fund Value including Top-Up Premium Fund Value, valued at the applicable NAV on the date of Maturity.

Death Benefit

In case of death of the life insured during the policy term and while the policy is in force, the Nominee will get,

Highest of

- the Basic Sum Assured net of all “Deductible Partial Withdrawals”, if any, from the Premium Fund Value, or

- the Premium Fund Value of this Policy or

- 105 percent of the total Premiums paid up to the date of death net of all “Deductible Partial Withdrawals”, if any.

In addition to this:

Highest of

- the approved Top-up Sum Assured(s) or

- Top-up Premium Fund Value of this Policy

is also payable provided the policyholder has a Top-up Premium Fund Value. Deductible Partial Withdrawals is not applicable in case of Top-Up Sum Assured.

For purpose of determining the Death Benefit, the Deductible Partial Withdrawals mentioned above shall mean the Partial withdrawals made during the last two years immediately preceding the date of death of the Insured.

7. Benefit Illustration

If the Insured is alive on the day of the Maturity, Maturity Benefit shall be the Fund Value, including Top-Up Fund Value, if any.

To understand these benefits let’s have a look at the following Benefit Illustration table

For Classic:

The table below demonstrates the Total Maturity Benefit for a 35-year-old healthy, non-smoker male under Classic plan option.

- Fund Allocation: 100% in Flexi Growth Fund

| Age (Years) | Policy Term (Years) | Premium Paying Term (Years) | Annualised Premium | Total Premiums Paid | Guaranteed Benefits | Non -Guaranteed Benefits | |

| Lower Rate Illustration (4%) | Higher Rate Illustration (8%) | ||||||

| Basic Sum Assured | Total Maturity Benefit* | Total Maturity Benefit* | |||||

| 35 | 50 | 5 | 5,00,000 | 25,00,000 | 1 Cr | 37,05,511 | 4,65,52,781 |

| 35 | 50 | 10 | 4,00,000 | 40,00,000 | 1 Cr | 1,08,24,684 | 6,70,24,101 |

| 35 | 50 | 12 | 3,33,333 | 39,99,996 | 1 Cr | 1,02,00,277 | 6,30,61,333 |

| 35 | 50 | 15 | 2,85,714 | 42,85,710 | 1 Cr | 1,09,39,762 | 6,21,73,202 |

| 35 | 50 | 50 | 2,50,000 | 1,25,00,000 | 1 Cr | 2,42,82,883 | 8,66,80,470 |

Author Comment: Don’t Tempt by seeing Maturity Amount, here the PT is 50 Years, which is practically not possible

For Optima:

The table below demonstrates the Total Maturity Benefit for a 35-year-old healthy, non-smoker male under Optima plan option.

- Fund Allocation: 100% in Flexi Growth Fund

| Age (Years) | Policy Term (Years) | Premium Paying Term (Years) | Annualised Premium | Total Premiums Paid | Guaranteed Benefits | Non -Guaranteed Benefits | |

| Lower Rate Illustration (4%) | Higher Rate Illustration (8%) | ||||||

| Basic Sum Assured | Total Maturity Benefit* | Total Maturity Benefit* | |||||

| 35 | 50 | 5 | 4,00,000 | 20,00,000 | 1 Cr | 29,09,610 | 3,31,18,127 |

| 35 | 50 | 10 | 3,33,333 | 33,33,330 | 1 Cr | 59,58,190 | 5,33,75,296 |

| 35 | 50 | 12 | 2,85,714 | 34,28,568 | 1 Cr | 65,29,212 | 5,15,46,761 |

| 35 | 50 | 15 | 2,50,000 | 37,50,000 | 1 Cr | 77,97,712 | 5,19,34,469 |

| 35 | 50 | 50 | 2,22,222 | 1,11,11,100 | 1 Cr | 2,01,72,452 | 7,46,70,979 |

Premium will vary depending upon the Option chosen.

Author Comment: See both Options are not with the same parameter (Premium with 5L & 4L) as they don’t want to you to compare indirectly.

8. Loyalty Additions/Fund boosters (Must Read)

A. Refund of Mortality Charges:

Classic:

Under this plan, starting from the 11th policy year, at the end of each policy month, we add the mortality charge (excluding underwriting extra and taxes) deducted in the 120th month prior to your Fund Value in the form of addition of units. For instance, in the 121st policy month, your fund gets an addition of the mortality charges deducted (excluding underwriting extra and taxes) in the 1st policy month. All such additions shall continue till you attained age of 85 years, or till the end of policy term, whichever is earlier, provided that the policy is in force and all due premiums till date have been paid.

Optima

Not Applicable

This amount will be allocated among the funds in the same proportion as the value of total units held in each fund at the time of allocation. (Applicable to Classic Only)

B. Refund of Premium Allocation Charges

Classic

At the end of 10th, 11th 12th and 13th policy years, twice the total Premium Allocation Charges (excluding taxes) deducted 10 years prior (i.e. over the policy years 1,2, 3 and 4 respectively) shall be added to the Fund Value in the form of addition of units. Such additions shall continue till the policy is in force and all due premiums till date have been paid.

This amount will be allocated among the funds in the same proportion as the value of total units held in each fund at the time of allocation.

Optima

Not Applicable (as it is not Deducted)

Some benefits are guaranteed and some benefits are variable with returns based on the future performance of your insurer carrying on life insurance business. If your policy offers guaranteed benefits then these will be clearly marked “guaranteed’ in the illustration table on the pages 3 & 4. If your policy offer variable benefits then the illustrations on the pages 3 & 4 will show two different sections.

C. Cover Continuance Booster

Cover Continuance Boosters shall be added in the form of addition of units as below.

Cover Continuance Boosters are non-negative amounts and shall only be added if the policy is in force and all due premiums have been paid. This additional allocation will be available under both the plan options. Details of Cover Continuance Booster shall be as defined in Annexure A below.

D. Smart Lady

For Female lives, 0.50% of the Instalment Premium or 0.25% of Single Premium shall be added to the Fund Value at the time of allocation of first year’s premium or Single premium respectively.

This additional allocation will be available under both the plan options.

9. What are your investment avenues?

This product offers you the flexibility to invest in a manner that suits your investment risk profile and individual needs.

- You can choose from the 25 investment fund options OR

- Choose any one of the following PORTFOLIO STRATEGIES

- Enhanced Systematic Money Allocation & Regular Transfer (Enhanced SMART)

- Life-stage based Portfolio Strategy

Your allocable Premiums and Top- Ups (if any) are invested in one or more investment funds as per your chosen asset allocation. You have an option of choosing any or all of the 25 Funds or such funds which are available at the time of allocation

We offer 25 investment funds ranging from 100% debt to 100% equity to suit your particular needs and risk appetite – Emerging Opportunities Fund, Sustainable Equity Fund, Dynamic Advantage Fund, Multi Cap Fund, India Consumption Fund, Top 50 Fund, Top 200 Fund, Super Select Equity Fund, Large Cap Equity Fund, Whole Life Mid Cap Equity Fund, Whole Life Aggressive Growth Fund, Whole Life Stable Growth Fund, Whole Life Income Fund, Whole Life Short-term Fixed Income Fund, Flexi Growth Fund, Constant Maturity Fund, Target Maturity Fund, Small Cap Discovery Fund, Business Cycle Fund, Rising India Fund, Midcap Momentum Index, Fund Flexi Growth Fund II, Whole Life Income Fund II, The Nifty Alpha 50 Index Fund and Multicap Momentum Quality Index Fund.

If you wish to diversify your risk, you can choose to allocate your premiums in varying proportions amongst the 25 investment funds.

Our wide range of funds gives you the flexibility to redirect future premiums and change your premium allocation percentages from that point onwards. Also, you can switch monies from one investment fund to another at any time. Switches must however be within the investment funds offered under this plan.

| Investment Fund | Fund Objective | Risk Profile | Asset Allocation | Minimum | Maximum |

| Emerging Opportunities Fund (ULIF 064 12/09/22 EOF 110) | The primary investment objective of the Fund is to generate capital appreciation in the long term by investing in a portfolio of stocks that offer opportunities in the Mid Cap space and emerging leaders in the new age sectors offering significant long-term wealth creation. The fund can invest up to 30% of the portfolio in equity and equity related instruments falling outside the mid-cap range. | High | Equity | 80% | 100% |

| Debt Instruments | 0% | 10% | |||

| Money Market Instruments, Cash, Bank Deposits and Mutual Funds | 0% | 20% | |||

| Sustainable Equity Fund (ULIF 065 12/09/22 ESG 110) | To focus on investing in select companies from the investment universe, which conduct business in socially and environmentally responsible manner while maintaining governance standards. | High | Equity | 80% | 100% |

| Debt Instruments | 0% | 20% | |||

| Money Market Instruments, Cash, Bank Deposits and Mutual Funds | 0% | 20% | |||

| Multi Cap Fund (ULIF 060 15/07/14 MCF 110) | The primary investment objective of the Fund is to generate capital appreciation in the long term by investing in a diversified portfolio of Large Cap and Mid Cap companies The allocation between Large Cap and Mid Cap companies will be largely a function of the relative valuations of Large Cap companies as against Mid Cap companies. | High | Equity | 60% | 100% |

| Debt Instruments | 0% | 40% | |||

| Cash / Money Market Instruments, Bank Deposits and Mutual Funds | 0% | 40% | |||

| India Consumption Fund (ULIF 061 15/07/14 ICF 110) | The primary investment objective of the Fund is to generate capital appreciation in the long term by investing in a diversified portfolio of companies which would benefit from India’s Domestic Consumption growth story. The India Consumption Fund could provide an investment opportunity in the theme of rising consumption power in India for long term returns. | High | Equity | 60% | 100% |

| Debt Instruments | 0% | 40% | |||

| Cash / Money Market Instruments, Bank Deposits and Mutual Funds | 0% | 40% | |||

| Top 50 Fund (ULIF 026 12/01/09 ITF 110) | The Top 50 Fund will invest primarily in select stocks which are a part of Nifty 50 Index with a focus on generating long term capital appreciation. The Fund will not replicate the index but aim to attain performance better than the performance of the Index. As a defensive strategy arising out of market conditions, the scheme may also invest in debt and money market instruments. Objective: The primary investment objective of the fund is to generate long term capital appreciation by investing in select stocks. | High | Equity Instruments | 60% | 100% |

| Cash/ Money Market Instruments (including CP/CD), Bank Deposits and Mutual Funds | 0% | 40% |

| Investment Fund | Fund Objective | Risk Profile | Asset Allocation | Minimum | Maximum |

| Top 200 fund (ULIF 027 12/01/09 ITT 110) | The Top 200 Fund will invest primarily in select stocks which are a part of BSE 200 Index with a focus on generating long term capital appreciation. The Fund will not replicate the index but aim to attain performance better than the performance of the Index. As a defensive strategy arising out of market conditions, the scheme may also invest in debt and money market instruments. Objective: The primary investment objective of the fund is to generate long term capital appreciation by investing in select stocks. | High | Equity Instruments | 60% | 100% |

| Cash/ Money Market Instruments (including CP/CD), Bank Deposits and Mutual Funds | 0% | 40% | |||

| Super Select Equity Fund (ULIF 035 16/10/09 TSS 110) | The Super Select Equity Fund will invest significant amount in equity and equity linked instruments specifically excluding companies predominantly dealing in Gambling, Lotteries/Contests, Animal Produce, Liquor, Tobacco, Entertainment (Films, TV etc) Hotels, sugar, leather, Banks and Financial Institutions. The risk profile of the fund is high. The cash holding of the Fund will be kept below 40% of the Fund or according to the prevailing regulatory guidelines at each point of time. Objective: The primary investment objective of the fund is to provide income distribution over a period of medium to long term while at all times emphasizing the importance of capital appreciation | High | Equity and Equity linked Instruments | 60% | 100% |

| Debt Instruments | 0% | 40% | |||

| Cash/ Money Market Instruments (including CP/CD), Bank Deposits and Mutual Funds | 0% | 40% | |||

| Large Cap Equity Fund (ULIF 017 07/01/08 TLC 110) | The primary investment objective of the Fund is to generate long – term capital appreciation from a portfolio that is invested pre-dominantly in large cap equity and equity linked securities. | High | Equity and Equity linked Instruments | 80% | 100% |

| Cash / Money Market Instruments, Bank Deposits and Mutual Funds | 0% | 20% | |||

| Whole Life Mid Cap Equity Fund(ULIF 009 04/01/07 WLE 110) | The primary investment objective of the Fund is to generate long – term capital appreciation from a portfolio that is invested pre-dominantly in Mid Cap Equity and Mid Cap Equity linked securities. | High | Equity and Equity linked Instruments | 60% | 100% |

| Cash/Money Market Instruments, Bank Deposits and Mutual Funds | 0% | 40% | |||

| Dynamic Advantage Fund (ULIF 066 12/09/22 DAF 110) | The primary investment objective of the Fund is to maximize the returns with medium risk | Medium | Equity | 20% | 80% |

| Debt Instruments | 20% | 80% | |||

| Cash / Money Market Instruments, Bank Deposits and Mutual Funds | 0% | 20% | |||

| Whole Life Aggressive Growth Fund(ULIF 010 04/01/07 WLA 110) | The primary investment objective of the Fund is to provide higher returns in long term by investing primarily in Equities along with debt/ money market instruments. | Medium to High | Equity and Equity Linked instruments | 50% | 80% |

| Debt Instruments | 20% | 50% | |||

| Cash / Money Market Instruments, Bank Deposits and Mutual Funds | 0% | 30% | |||

| Whole Life Stable Growth Fund(ULIF 011 04/01/07 WLS 110) | The primary investment objective of the Fund is to provide stable returns by balancing the investment in Equities and debt/ money market instruments. | Low to Medium | Equity and Equity Linked instruments | 30% | 50% |

| Debt Instruments | 50% | 70% | |||

| Cash / Money Market Instruments, Bank Deposits and Mutual Funds | 0% | 20% |

| Investment Fund | Fund Objective | Risk Profile | Asset Allocation | Minimum | Maximum |

| Whole Life Income Fund (ULIF 012 04/01/07 WLI 110) | The primary investment objective of the Fund is to generate income by investing in a range of debt and money market instruments of various maturities with a view to maximizing the optimal balance between yield, safety and liquidity. | Low | Debt Instruments | 60% | 100% |

| Cash / Money Market Instruments, Bank Deposits and Mutual Funds | 0% | 40% | |||

| Whole Life Short-Term Fixed Income Fund (ULIF 013 04/01/07 WLF 110) | The primary investment objective of the Fund is to generate stable returns by investing in fixed income securities having shorter maturity periods. Under normal circumstances, the average maturity of the Fund may be in the range of 1-3 years. | Low | Debt Instruments of duration less than 3 years | 60% | 100% |

| Cash / Money Market Instruments, Bank Deposits and Mutual Funds | 0% | 40% | |||

| Flexi Growth Fund (SFIN: ULIF 068 25/04/23 FGF 110) | The primary investment objective of the Fund is to generate capital appreciation in the long term by investing in a portfolio of stocks across market capitalization. | High | Equity | 70% | 100% |

| Debt Instrument | 0% | 10% | |||

| Money Market Instrument, Cash, Bank Deposits and Mutual funds | 0% | 30% | |||

| Constant Maturity Fund (SFIN: ULIF 069 17/05/23 CMF 110) | The fund aims to provide reasonable returns over long term by investing in portfolio of Government Securities while maintaining constant average maturity of the portfolio (ex – Cash/ Money Market Instruments, Bank Deposits and Mutual Funds) in the range of 8-12 years | Medium | Debt Instruments – Government Securities such that weighted average portfolio maturity of around 10 years (in the range of 8-12 years) | 80% | 100% |

| Money Market Instrument, Cash, Bank Deposits and Mutual funds | 0% | 20% | |||

| Target Maturity Fund (SFIN: ULIF 070 17/05/23 TMF 110) | The fund aims to provide reasonable returns over long term by investing in portfolio of Government Securities. The fund shall have the maturity on 31st Dec 2053. The residual maturity of any Government Securities forming part of the portfolio shall be between the fund maturity date and date 5 years before the fund maturity date (i.e.1st Jan 2049). | Medium | Government Securities (Residual maturity of any Government Securities forming part of the portfolio shall be between the fund maturity date and date 5 years before the fund maturity date (i.e. 1st Jan 2049). | 80% | 100% |

| Money Market Instrument, Cash, Bank Deposits and Mutual funds | 0% | 20% | |||

| Small Cap Discovery Fund (SFIN: ULIF 071 22/05/23 SCF 110) | The primary investment objective of the Fund is to generate capital appreciation in the long term by investing in a portfolio of stocks in small-cap market capitalization. The fund will primarily invest in carefully selected small-cap companies that offer opportunities for long-term value creation. Minimum 65% of equity and equity related instruments of portfolio will comprise of small-cap stocks. | High | Equity | 70% | 100% |

| Debt Instrument | 0% | 10% | |||

| Money Market Instrument, Cash, Bank Deposits and Mutual funds | 0% | 30% | |||

| Business Cycle Fund (SFIN: ULIF 072 15/01/24 BCF 110) | The investment objective of the Fund is to generate capital appreciation by investing predominantly in equity and equity-related securities with a focus on investing in companies and sectors to participate in the business cycles through active portfolio allocation. | High | Equity instruments | 70% | 100% |

| Debt | 0% | 30% | |||

| Money Market Instruments, Cash, Bank Deposits and Mutual funds | 0% | 30% | |||

| Rising India Fund (SFIN: ULIF 073 17/01/24 RIF 110 | The objective of the fund is to generate capital appreciation by investing predominantly in equity and equity-related securities with a focus to invest in growth stories across the Indian corporate landscape. | High | Equity instruments | 70% | 100% |

| Debt | 0% | 30% | |||

| Money Market Instruments, Cash, Bank Deposits and Mutual funds | 0% | 30% |

| Investment Fund | Fund Objective | Risk Profile | Asset Allocation | Minimum | Maximum |

| Midcap Momentum Index Fund (SFIN: ULIF 075 09/05/24 MIF 110) | The primary investment objective of the Fund is to generate capital appreciation in the long term by investing in a portfolio of stocks indexed to the Nifty Midcap 150 Momentum 50 Index Fund, subject to regulatory limits* *Regulations may restrict us from investing in all the stocks in line with their weights in the index from time to time | High | Equity instruments | 80% | 100% |

| Debt | NA | NA | |||

| Money Market Instruments, Cash, Bank Deposits and Mutual funds | 0% | 20% | |||

| Flexi Growth Fund II (SFIN: ULIF 074 02/05/24 FG2 110) | The objective of the Fund is to generate capital appreciation in the long term by investing in a portfolio of stocks across market capitalization. The fund maintains flexibility to invest in carefully selected companies that offer opportunities across large, mid or small capitalization space. | High | Equity | 70% | 100% |

| Debt Instrument | 0% | 30% | |||

| Money Market Instrument, Cash, Bank Deposits and Mutual funds | 0% | 30% | |||

| Whole Life Income Fund II (SFIN: ULIF 076 06/06/24 WI2 110) | The primary investment objective of the Fund is to generate income through investing in a range of debt and money market instruments of various maturities with a view to maximizing the optimal balance between yield, safety and liquidity. The Fund will have no investments in equity or equity linked instruments at any point in time. | Medium | Debt Instruments | 60% | 100% |

| Money Market Instrument, Cash, Bank Deposits and Mutual funds | 0% | 40% | |||

| Nifty Alpha 50 Index Fund (SFIN: ULIF 077 30/09/24 NAF 110) | The primary investment objective of the Fund is to generate capital appreciation in the long term by investing in a portfolio of stocks indexed to the Nifty Alpha 50 Index. The fund will invest 80%-100% in Equity and Equity related instruments and 0%-20% in Cash and Money Market Securities. | High | Equity Instruments | 80% | 100% |

| Money Market Instruments, Cash, Bank Deposits and Mutual funds | 0% | 20% | |||

| Multicap Momentum Quality Index Fund (SFIN: ULIF 078 31/12/24 MQI 110) | The primary investment objective of the Fund is to generate capital appreciation in the long term by investing in a portfolio of stocks that are aligned to the Multicap Momentum Quality Index. The objective of the fund is to invest in companies with similar weights as in the index and generate returns as closely as possible, subject to tracking error. | High | Equity & Equity related instruments | 80% | 100% |

| Debt | NA | NA | |||

| Money Market Instruments, Cash, Bank Deposits and Mutual funds | 0% | 20% |

These funds have different risk profiles based on different types of investments that are offered under these funds. The returns are expected to vary according to the risk profile of the funds chosen.

Although the funds are open ended, the Company may, as per Board approved policy and subject to prior approval from IRDAI, completely close any of the funds. The Policyholder will be given at least three months’ prior written notice of our intention to close any of the Funds completely or partially except in ‘Force Majeure’, where we may give a shorter notice.

In case of complete closure of a Fund, on and from the date of such closure, we shall cease to issue and cancel units of the said Fund and cease to carry on activities in respect of the said Fund, except such acts as are required to complete the closure. In such an event if the Units are not switched to another Fund by the Policyholder, we will switch the said units to any other appropriate Fund with similar characteristics as per Board approved policy, with due weightage for the respective NAVs at the time of switching, subject to prior approval from the IRDAI. Switching of units from opted fund to default fund will be done in the manner shown below:

| Closed Fund | Default Fund |

| Whole Life Mid Cap Equity Fund, Multi Cap Fund, India Consumption Fund, Top 50 Fund, Top 200 Fund, Super Select Equity Fund, Emerging Opportunities Fund, Sustainable Equity Fund, Flexi Growth Fund, Small Cap Discovery Fund, Business Cycle Fund, Rising India Fund, Midcap Momentum Index Fund, Flexi Growth Fund II, Nifty Alfa 50 Index Fund, Multicap Momentum Quality Index Fund. | Large Cap Equity Fund |

| Whole Life Aggressive Growth Fund, Dynamic Advantage Fund, Constant Maturity Fund, Target Maturity Fund | Whole Life Stable Growth Fund |

| Whole Life Income Fund, Whole Life Income Fund II | Whole Life Short Term Fixed Income Fund |

If default Fund as mentioned in the table above is closed, then we will switch the said Units to any other appropriate Fund with similar characteristics as per Board approved policy, with due weightage for the respective NAVs at the time of switching, subject to prior approval from the IRDAI.

A. Force Majeure Provisions:

- The Company shall value the Funds (SFIN – “Segregated Fund Identification Number,”) on each day for which the financial markets are open. However, the Company may value the SFIN less frequently in extreme circumstances external to the Company i.e. in force majeure events, where the value of the assets is too uncertain. In such circumstances, the Company may defer the valuation of assets for up to 30 days until the Company is certain that the valuation of SFIN can be resumed.

- The Company shall inform IRDAI of such deferment in the valuation of assets. During the continuance of the force majeure events, all request for servicing the policy including policy related payment shall be kept in abeyance.

- The Company shall continue to invest as per the fund mandates as chosen by You. However, the Company shall reserve its right to change the exposure of all or any part of the Fund to Money Market Instruments [as defined under Schedule III – Part- I – 1(8) of IRDAI (Actuarial, Finance and Investment Functions of Insurers) Regulations, 2024] in circumstances mentioned under points (a and b) above. The exposure to of the Fund as per the fund mandates as chosen by You shall be reinstated within reasonable timelines once the force majeure situation ends.

- Few examples of circumstances as mentioned [in point 3 (a & b) above] are:

- when one or more stock exchanges which provide a basis for valuation of the assets of the fund are closed otherwise than for ordinary holidays.

- when, as a result of political, economic, monetary or any circumstances which are not in the control of the Company, the disposal of the assets of the fund would be detrimental to the interests of the continuing policyholders.

- in the event of natural calamities, strikes, war, civil unrest, riots and bandhs.

- in the event of any force majeure or disaster that affects the normal functioning of the Company.

- In such an event, an intimation of such force majeure event shall be uploaded on Our website for information.

B. Discontinued Policy Fund:

The investment objective for Discontinued Policy Fund is to provide capital protection and a minimum return as per regulatory requirement with a high level of safety and liquidity through judicious investment in high quality short-term debt. The strategy is to generate better returns with low level of risk through investment in fixed interest securities having short term maturity profile. The risk profile of the fund is very low. There is a minimum guarantee of interest @ 4% p.a. or as prescribed by IRDAI from time to time.

Asset allocation:

| Instrument | Allocation |

| Debt Instruments – G Sec (including Treasury Bills) and Corporate Debt | 60% -100% |

| Money Market Instruments, Bank Fixed Deposits, Cash and Mutual Funds | 0% – 40% |

C. Choose the following PORTFOLIO STRATEGY: (Debt to Equity)

- Enhanced Systematic Money Allocation & Regular Transfer (Enhanced SMART)

- Enhanced SMART is a systematic transfer plan available only to the policies. It allows a customer to enter the volatile equity market in a structured manner under the Regular / Limited /Single Premium Fund.

- You get to choose two funds, a debt oriented fund and an equity oriented fund. Please refer to table below for the choice of available funds:

| Debt Oriented Funds | Equity Oriented Funds |

| Whole Life Income Fund | Large Cap Equity Fund |

| Whole Life Short-Term Fixed Income Fund Constant Maturity Fund | Whole Life Mid Cap Equity Fund India Consumption Fund Multi Cap Fund Super Select Equity Fund |

| Target Maturity Fund | Top 50 Fund |

| Whole Life Income Fund II | Top 200 fund |

| Emerging Opportunities Fund | |

| Sustainable Equity Fund | |

| Flexi Growth Fund | |

| Small Cap Discovery Fund | |

| Business Cycle Fund | |

| Rising India Fund | |

| Midcap Momentum Index Fund | |

| Flexi Growth Fund II | |

| Nifty Alpha 50 Index Fund | |

| Multicap Momentum Quality Index Fund |

- Through Enhanced SMART, your entire annual allocable premium will be parked in the chosen debt oriented fund along with any existing units in that fund, if any. These combined units in the chosen debt oriented fund will be systematically transferred on a monthly basis to the chosen equity oriented fund.

- All your future allocable premiums will also follow the same pattern as long as Enhanced SMART is active on your plan. Switching to/from the Enhanced SMART funds to other available funds is not allowed.

- This strategy is applicable only till premium payment term and not with top-up premium fund.

- A portion of total units in the chosen debt oriented fund shall be switched automatically into the chosen equity oriented fund in the following way:

Monthly Enhanced SMART

Policy Month 1 1/12 of the units available at the beginning of Policy Month 1

Policy Month 2 1/11 of the units available at the beginning of Policy Month 2

……………………..

Policy Month 6 1/ 7 of the units available at the beginning of Policy Month 6

……………………..

Policy Month 11 ½ of the units available at the beginning of Policy Month 11

Policy Month 12 Balance units available at the beginning of Policy Month 12

Thus, while the stock market remains volatile and unpredictable, Enhanced SMART strategy offers a systematic way of rupee cost averaging. However, all investments through this option are still subject to investment risks, which shall continue to be borne by you.

The following are the notable features of Enhanced SMART: –

- Enhanced SMART offers flexibility, allowing you to opt for it at policy inception or on any policy anniversary.

- A written request for commencement, change, or restart must be received 30 days prior to the policy anniversary.

- The selected strategy becomes effective from the following policy anniversary and applies to future premiums for all premium payment terms.

- Commencement, change, or restart requests for the strategy are subject to the payment of all due premiums.

- The option is free of charge, and you can stop it at any time through a written request, effective from the next Enhanced SMART switching that follows company’s receipt.

- Manual fund switching is not allowed for the two funds selected for Enhanced SMART activation but is permitted for other available funds with applicable charges.

- Manual switching for top-up premiums is available at applicable charges.

- Funds not associated with Enhanced SMART remain invested in regular/Limited/Single premium funds.

- The Enhanced SMART option is unavailable during the discontinuance of premium, but it can be opted for again upon policy revival.

The Company may cease offering Enhanced SMART by giving 30 days of written notice subject to prior approval of Insurance Regulatory and Development Authority of India.

D. LIFE-STAGE BASED PORTFOLIO STRATEGY (Equity to debt)

My Choice is this.

Under the Life-stage based Portfolio Strategy, customer’s portfolio will be structured as per the age and risk profile (Conservative, Moderate or Aggressive) chosen by the customer.

Under Life-Stage based strategy, you need to choose two funds, a debt-oriented fund and an equity-oriented fund. Below table demonstrates the choice of available funds:

| Debt Oriented Funds | Equity Oriented Funds |

| Large Cap Equity Fund | |

| Whole Life Income Fund Whole Life Short-Term Fixed Income Fund Constant Maturity Fund | Whole Life Mid Cap Equity Fund India Consumption Fund Multi Cap Fund Super Select Equity Fund |

| Target Maturity Fund | Top 50 Fund |

| Whole Life Income Fund II | Top 200 fund |

| Emerging Opportunities Fund | |

| Sustainable Equity Fund | |

| Flexi Growth Fund | |

| Small Cap Discovery Fund | |

| Business Cycle Fund | |

| Rising India Fund | |

| Midcap Momentum Index Fund | |

| Flexi Growth Fund II | |

| Nifty Alpha 50 Index Fund | |

| Multicap Momentum Quality Index |

- Through this strategy, your allocable premium will be parked in the chosen equity-oriented and debt-oriented fund in a pre-determined proportion based on the selected risk profile and age. As you ages, your Fund value will be shifted automatically from chosen equity-oriented fund to chosen debt-oriented fund according to then applicable Equity-Debt proportion as per the age group. If opted for this strategy, you shall not be allowed to exercise the Premium-Redirection or Fund-Switching option. However, you have an option to opt out of this strategy anytime during the Policy Term, by notifying the company at least 30-days prior to the policy anniversary. You will be allowed to exercise free Switches or Premium Redirection options after opting out of this strategy.

The percentage allocation to equity-oriented fund according to age and risk profile is given below. The remaining percentage allocation out of 100% shall be in the debt-oriented fund.

| Age Group | Risk Profile | ||

| Aggressive | Moderate | Conservative | |

| 1-30 | 90% | 70% | 50% |

| 31-40 | 80% | 60% | 50% |

| 41-50 | 70% | 50% | 30% |

| 51-60 | 55% | 35% | 15% |

| 61-70 | 40% | 20% | 0% |

| 71 & above | 25% | 5% | 0% |

Units shall be rebalanced as necessary to achieve the above proportions of the Fund Value in the equity-oriented fund and the debt-oriented fund on the last day of each Policy quarter.

The following are the notable features of Life-Stage Based Strategy:-

- The Life-Stage Based strategy is available for you and is exercisable at policy inception or any policy anniversary, with a written request received 30 days in advance of the policy anniversary for commencement, change, or restart. The request shall take effect on the policy anniversary.

- Commencement, change, or restart requests for the strategy are subject to the payment of all due premiums.

- The Life-Stage Based Strategy comes with free of any charge.

- You can halt the Life-Stage Based Strategy at any point of time through a written request at least 30 days prior to policy anniversary, with the cessation effective from the following policy anniversary.

- Manual fund switching or Premium-Redirection is not permitted under this strategy.

- The Life-Stage Based Strategy Option is not available during the discontinuance of premium. Upon policy revival, you can opt for the Life-Stage Based Strategy again.

Tracking and Assessing Your Investments

You can monitor your investments

- On our website (www.tataaia.com);

- Through the annual statement detailing the number of units you have in each investment fund and their respective then prevailing NAV; and

- Through the published NAVs of all investment funds on our website and Life council’s website.

10. What are the other benefits in your policy?

This is a Regular / Single/ Limited payment policy with protection for a chosen policy term and it is in your best interest to stay invested for the entire term. This will enable you to pay for a short term and enjoy all the special benefits offered under this innovative product for the rest of your life. However, for contingency needs during the term of the policy, you may avail of the Partial Withdrawal option. In case if you have a surplus income, you may invest the same in your plan through top-ups.

11. Flexibility of Partial Withdrawals to create your second income

Subject to policy being in force (including when the policy is reduced paid up), Partial Withdrawal is allowed any time after five policy anniversaries from the date of issuance of the policy. Under this facility, the policyholder can also opt for Systematic Withdrawal Plan (SWP), Chosen-Rate Withdrawal Plan (CWP) and Index-Based Withdrawal Plan (IWP).

- Partial withdrawals shall be made first from the Top-Up Premium Fund which has completed the lock in period and then from Regular/ Single / Premium Fund, if Top-Up Fund is insufficient.

- For the purpose of partial withdrawals, lock in period for the Top-up premiums will be five years or any such limit prescribed by IRDAI from time to time.

- The minimum amount that can be withdrawn is Rs. 1,000/- subject to Total Fund Value (Regular + Top Up Fund) post such withdrawals not being less than an amount equivalent to two years’ Annualised Regular Premiums in case of Regular/Limited Pay or 10% of Single Premium in case of Single Pay.

- Maximum limit for partial withdrawal in a year, if any, will be as per BAUP and will be updated on the website from time to time.

- Any number of partial withdrawals can be made in a policy year and no charges shall be levied for making the partial withdrawals.

- The partial withdrawals shall not be allowed if it would result in termination of the contract.

12. Systematic Withdrawal Plan (SWP):

This partial withdrawal facility allows policyholder to withdraw from the fund at pre-determined intervals. Such withdrawals can be a pre-determined percentage of the fund value or a pre-determined absolute amount.

For example, if the policyholder chooses 6% of the fund value to be withdrawn yearly, then an amount equal to 6% of the fund value would be paid as per the specified payout frequency.

Following conditions shall apply on SWP:

- The policyholder has option to choose the percentage ranging from 1% to 15%.

- This facility can be opted at policy inception or anytime during the policy term. The policyholder may modify or opt-out of the facility by notifying the Company at least 30-days prior to the policy anniversary. Policyholder may choose to opt-in again as per the requirements on a later date.

- It is allowed only after five policy anniversaries from the date of issuance of the policy.

- The payouts can be taken monthly, quarterly, half-yearly, yearly or on specified date(s). The first payout will be made on the withdrawal start date as chosen by the policyholder.

- All conditions applicable for partial withdrawals such as minimum and maximum withdrawal amount, age, etc. will be applicable for Systematic Withdrawal Plan as well. Both SWP and partial withdrawal can be availed simultaneously provided the fund value in any given year is not less than two years’ annualized premiums for Limited/ regular pay and 10% of single premium paid for single pay.

13. Chosen-rate Withdrawal Plan (CWP):

Under this partial withdrawal facility, a payout, as per the payout frequency chosen, will be processed in case the performance of the fund(s) where policyholder has invested their premium is higher than the chosen rate of return by the policyholder.

For example, if the actual fund value on the date of withdrawal is more than the fund value basis the chosen rate of return , then the positive difference between the two fund values shall be paid out to the policyholder. If the actual fund value is less than the fund value basis the chosen rate, then no payout shall be processed.

The following conditions shall apply on CWP:

- The T&Cs applicable to SWP, shall be applicable to CWP. Both SWP and CWP cannot be opted together.

- Both CWP and partial withdrawal can be availed simultaneously provided the fund value in any given year is not less than two years’ Annualized premiums for Limited/ regular pay and 10% of single premium paid for single pay

Index based Withdrawal Plan (IWP):

This option works similar to CWP. But instead of choosing a rate of return, the policyholder can link rate of return to an external index. If the performance of the fund(s) where policy holder has invested their premium in is higher than their index-based return, then the positive difference between the two fund values shall be paid out to policy holder as per the payout frequency chosen.

The policyholder shall have an option to choose from a list of indices such as

- Compound Annual Growth Rate (CAGR) of benchmark fund as on date of withdrawal

- 10-year G-Sec rate dated 1st April of each year as published by M/s. Financial Benchmarks India Pvt Ltd (FBIL)shall be applicable during the period of twelve months, beginning 1st May of the relevant financial year.

- SBI’s Savings A/c rate basis April 1 of the relevant year shall be applicable during the period of twelve months, beginning 1st May of the relevant financial year

- SBI’s 5-year term deposit rates basis April 1 of the relevant year shall be applicable during the period of twelve months, beginning 1st May of the relevant financial year

- CPI Inflation rate as published by mospi.gov.in for March shall be applicable during the period of 12 months, beginning 1st May of the next financial year.

The following conditions shall apply on IWP:

- The list of indices shall be specified by the company from time to time. The policyholder shall have the flexibility to change the index by notifying the company at least 30 days prior to the policy anniversary.

- The T&Cs applicable to SWP, shall be applicable to IWP as well.

- Both IWP and partial withdrawal can be availed simultaneously provided the fund value in any given year is not less than two years’ annualized premiums for Limited/ Regular pay and 10% of single premium paid for single pay.

Note: Only one plan out of SWP/CWP and IWP can be chosen by the policyholder. However, partial withdrawal can be availed along with any of the above plans provided all the conditions are being met.

Author Comment: Don’t go with partial withdrawal, better go with surrender after 20 – 25 years as the Mortality Charges will be higher based on your age, these charges will be higher than your returns, so, the fund won’t grow (even it will become negative in worst case)

14. Flexibility of Top-ups

You have the flexibility to pay additional premium as ‘Top-up Premium’, provided the policy is in force

- Top-up premiums can be paid any time except during the last five years of the policy term, subject to underwriting, as long as all due premiums have been paid.

- The minimum Top-up amount is Rs 1,000/-.

- Policyholder will be provided an additional sum assured as per the table below, subject to BAUP.

| Age at Entry | Top-Up Multiple |

| Less than 50 years | 1.25 times single premium |

| 50 years and above | 1.10 times single premium |

- Top-up premiums can be allocated in any proportion between the funds offered as chosen by the policyholder.

- Every Top-up Premium will have a lock- in period of five years from the date acceptance of such Top up premiums except in case of complete withdrawal of policy.

- Top-up premiums are subject to charges as described under “What are my Policy charges?”

Increase or decrease in the Top-up Sum Assured is not allowed.

15. Flexibility of Premium Mode

You have an option to pay the premiums either as Single Pay or as Limited/Regular pay in Annually, Half-yearly, Quarterly and Monthly modes.

Loading on premiums will be applicable as mentioned in the table below:

| Mode | Modal Loading |

| If monthly paid | Annualised Premium / 12 |

| If quarterly paid | Annualised Premium / 4 |

| If semi-annually paid | Annualised Premium / 2 |

| If annually paid | Annualised Premium / 1 |

16. Settlement Option

On survival till the maturity date, you have an option to receive the Maturity Benefit either in lump sum or in the form of periodical payments over a Settlement Period of five years from the Maturity Date. The first instalment under settlement option shall be payable on the date of maturity. The frequency of periodical payment shall be chosen by you and can be yearly, half-yearly, quarterly or monthly. The value of such periodical payments will depend on the performance of the Funds selected for investment. Switches may be allowed during the settlement period. Partial withdrawals shall not be available to you during the period. At any time during the settlement period, you have the option to withdraw the Total Fund Value at that time. No additional charges will be levied on such withdrawal.

During this Settlement Period, life cover shall be maintained at 105% of the total premiums paid. In case of death, higher of Total Fund Value at the time of death or 105% of total premiums paid will be returned to the Nominee.

During this period, Fund Management Charges and Mortality Charges will be deducted as due. Switching Charges will be levied if applicable. No other charges shall be levied. All charges are shown under “What are my Policy Charges?”

During this Settlement Period, the investment risk will be borne by you. Refund of Mortality Charges and Cover Continuance Boosters do not apply during Settlement Period.

17. Optional Riders –

You have further flexibility to customize your product by adding the following non-participating premium-paying health riders

- Tata AIA Life Insurance Linked Comprehensive Protection Rider (UIN: 110A031V02 or any other later version) This rider provides coverage for various unforeseen events, such as death, disability due to accident, a wide range of critical illnesses, or terminal illness. It allows flexibility to receive benefi¬t as combination of lump sum or income for ¬fixed period, Income till survival of partner or Waiver of Premium. This rider can be opted either while taking the policy, or at the time of any policy anniversary.

- Tata AIA Life Insurance Linked Comprehensive Health Rider (UIN: 110A032V02 or any other later version) The rider covers various unforeseen events and illnesses, including disability, hospitalization, and critical illnesses such as cancer and cardiac arrests. It also provides coverage against both major illnesses, and minor injuries or illnesses, while allowing multiple claim payouts. Rider can be opted either while taking the policy, or at the time of any policy anniversary.

- Tata AIA Vitality Protect Plus (UIN: 110A048V03 or any later version) This rider provides coverage for various unforeseen events, such as death, disability due to accident, a wide range of critical illnesses, or terminal illness. It allows flexibility to receive benefi¬t as combination of lump sum or income for ¬fixed period, Income till survival of partner or Waiver of Premium. This rider also motivates to live healthy lifestyle through ‘Tata AIA Vitality’ our Wellness Program by offering rewards on achievements/ health goals.

- Tata AIA Vitality Health Plus (UIN: 110A047V03 or any later version) The rider covers various unforeseen events and illnesses, including disability, hospitalization, and critical illnesses such as cancer and cardiac arrests. It also provides coverage against both major illnesses, and minor injuries or illnesses, while allowing multiple claim payouts. This rider also motivates to live healthy lifestyle through ‘Tata AIA Vitality’ our Wellness Program by offering rewards on achievements/ health goals.

- Tata AIA Sampoorna Health (UIN: 110A167V02 or any later version) The Tata AIA Sampoorna Health provides fixed benefit payouts as chosen by you for all your health requirements regardless of hospital medical bills. The rider provides fixed benefit payout for multistage 57 critical illnesses, unlimited Day Care procedures, surgeries, and hospitalization.

The following non-participating Unit-deducting riders can be added to the base plan:

1. Tata AIA Life Insurance Waiver of Premium (Linked) Rider (UIN: 110A026V01 or any later version)

The Tata AIA Life Insurance Waiver of Premium (Linked) Rider which that insurance benefits under the plan continue to remain in place even if you are unable to pay the premiums towards the base plan owing to total and permanent disability.

2. Tata AIA Life Insurance Waiver of Premium Plus (Linked) Rider (UIN: 110A025V01 or any later version)

The Tata AIA Life Insurance Waiver of Premium Plus (Linked) Rider ensures that insurance benefits under the plan continue to remain in place, even if you are unable to pay the premiums towards the base plan owing to total and permanent disability, or death of the proposer.

3. Tata AIA Life Insurance Accidental Death and Dismemberment (Long Scale) (ADDL) Linked Rider (UIN: 110A027V01 or any later version)

Tata AIA Life Insurance Accidental Death and Dismemberment (Long Scale) (ADDL) Linked Rider provides a convenient solution that helps fill the financial gap for your family, in the event of an unfortunate death of the Life insured due to an accident.

4. Tata AIA OPD Care (UIN: 110A166V01 or any later version)

Tata AIA OPD Care provides end-to-end healthcare solutions. Under this rider, you can avail benefits like consultations with general physicians or specialists, booking physiotherapy sessions, coverage for medicines prescribed, managing your nutrition intake, and accessing emotional wellness tools like podcasts, guided meditation, and mood tracker

The unit-deducting riders can be attached either at inception or any policy anniversary subject to the following:

- The policy term of Waiver of Premium Rider and Waiver of Premium Plus Rider should not be more than the outstanding premium paying term of the base policy

- The policy term of Accidental Death and Dismemberment Rider should not be more than the outstanding policy term of the base policy.

The premium paying riders can be attached at policy inception or any policy anniversary of the base plan subject to the rider premium payment term and the policy term shall not be more than the outstanding premium payment term and outstanding policy term for the base plan.

Any minimum and maximum sum assured limits on all the above premium-paying riders will remain applicable, irrespective of the fact that lower or higher sum assured might be chosen as the base cover under this plan.

Such rider attachments will be as per the ‘Board approved underwriting policy’ (BAUP) of the Company.

The sum assured for any attaching rider(s) will not exceed the Basic Sum Assured. The cost of any attaching rider benefit / cover will be levied either through rider charge or rider premium, but not both.

18. How is the NAV calculated?

The Net Asset Value (NAV) of the segregated funds shall be computed as:

Market value of investment held by the fund + value of current assets – (value of current liabilities and provisions, if any)

—————————————————————————————————————————————-

Number of units existing on Valuation Date (before creation/redemption of units)

The Net Asset value (NAV) will be determined and published daily in various financial newspapers and will also be available on www.tataaia.com, the official website of Tata AIA Life. All you have to do is multiply the number of Units you have with the published NAV to arrive at the value of your investments.

Credit/Debit of Units

Premiums received, after deducting the Regular/ Limited /Single Premium / Top-up Premium Allocation Charge and applicable Goods and Services Tax and cess as applicable, will be used to purchase Units at the NAV according to your instruction for allocation of Premium. Units purchased by Regular/ Limited /Single Premium and Top-up Premium, net of payable premium allocation charge and applicable Goods and Service Tax and cess as applicable, will be deposited into the Regular Premium Fund Value and Top-up Premium Fund Value respectively.

Where notice is required (Partial Withdrawal, Complete withdrawal or death of the Insured), Units being debited shall be valued by reference to their NAV as specified in the section “Cut-off time for determining the appropriate valuation date”.

19. Unit Encashment Conditions

Cut-off time for determining the appropriate valuation date

The appropriate Business Day at which NAV will be used to purchase or redeem Units shall be determined in the following manner: –

- Purchase & Allocation of Units in respect of Premiums received or Fund Value(s) switched in:

- If the premiums, by way of cash or a local cheque or a demand draft payable at par or the request for switching in Fund Value(s) is/are received by us at or before 3:00 p.m. of a Business Day at the place where these are receivable, NAV of the date of receipt or the due date, whichever is later shall apply.

- If the premium/s, by way of cash or a local cheque or a demand draft payable at par or the request for switching in Fund Value(s) is/are received by us after 3:00 pm of a Business Day, at the place where these are receivable, NAV of the next Business Day following the receipt or the due date, whichever is later shall apply.

- If the premium/s is received by us by way of an outstation cheque/outstation demand draft, NAV of the date of on which these instruments are realized shall apply.

- Sale & Redemption of Units in respect of withdrawals, surrender, Fund Value(s) switched out, death claim:

- If a valid request/application is received by us at or before 3:00 pm of a Business Day, NAV of the date of receipt shall apply.

- If a valid request/application is received by us after 3:00 pm of a Business Day, NAV of the next valuation date following the receipt shall apply.

20. What are the options to manage my investments?

We offer you ample flexibility to manage your money so that you can reap maximum benefits of your investments.

A. Switching Between the Funds

The Policyholder may send the Company a written request to switch investment between available Funds. The written request must specify the Fund(s) from which Units are to be redeemed and the Fund(s) to which Units are being allocated.

The change will be effected on the applicable NAV as specified under the paragraph “Cut-off time for determining the appropriate valuation date”.

Switching may be restricted if portfolio strategy is chosen. Please refer to the portfolio strategy section for more details.

B. Premium Re-direction

Premium Re-direction facility helps you to allocate future regular premiums to a different fund or set of funds provided percentage chosen is integral for each fund and sums to 100%. There is no Premium-Redirection charge.

Premium Re-direction will not be allowed for Enhanced SMART portfolio option.

6Please contact our Insurance Advisor or visit our nearest branch office for further details

21. What if I want to discontinue paying premiums? (Must Read)

Discontinuance of Premiums

Discontinuance of Premium within Five Years from the Date of Commencement (Discontinuance of the policy during lock-in period):

For Regular/Limited Pay:

Upon expiry of the grace period, in case of discontinuance of policy due to non-payment of premium, the fund value after deducting the applicable discontinuance charges, shall be credited to the discontinued policy fund and the risk cover and rider cover, if any, shall cease.

All such discontinued policies shall be provided a revival period of three years from date of first unpaid premium. On such discontinuance, we shall communicate the status of the policy, within three months of the first unpaid premium, to the policyholder and provide the option to revive the policy within the revival period of three years.

- In case the policyholder opts to revive but does not revive the policy during the revival period, the proceeds of the discontinued policy fund shall be paid to the policyholder at the end of the revival period or lock-in period whichever is later. In respect of revival period ending after lock-in period, the policy will remain in discontinuance fund till the end of revival period. The Fund management charges of discontinued fund will be applicable during this period and no other charges will be applied.

- In case the policyholder does not exercise the option as set out above, the policy shall continue without any risk cover and rider cover, if any, and the policy fund shall remain invested in the discontinuance fund. At the end of the lock-in period, the proceeds of the discontinuance fund shall be paid to the policyholder and the policy shall terminate.

- However, the policyholder has an option to surrender the policy anytime and proceeds of the discontinued policy shall be payable at the end of lock-in period or date of surrender whichever is later.

For Single Pay:

The policyholder has an option to surrender any time during the lock-in period. Upon receipt of request for surrender, the fund value, after deducting the applicable discontinuance charges, shall be credited to the discontinued policy fund.

The policy shall continue to be invested in the discontinued policy fund and the proceeds from the discontinuance fund shall be paid at the end of lock-in period. Only fund management charge can be deducted from this fund during this period. Further, no risk cover shall be available on such policy during the discontinuance period.

“Proceeds of the discontinued policies” means the fund value as on the date the policy was discontinued, after addition of interest computed at the minimum guaranteed interest rate.

Revival of a discontinued policy during lock-in period

Upon revival, the policy shall be revived restoring the risk cover, along with the investments made in the segregated funds as chosen by the policyholder, out of the discontinued fund, less the applicable charges in accordance with the terms and conditions of the policy.

At the time of revival, we shall:

- collect all due and unpaid premiums without charging any interest or fee

- levy policy administration charge and premium allocation charge as applicable during the discontinuance period

- add back to the fund, the discontinuance charges deducted at the time of discontinuance of the policy

Segregated Discontinued Policy Fund

The discontinued policy fund shall be a segregated unit fund. Only fund management charges shall be applicable on such funds. The fund management charge on discontinued policy fund shall be declared by the IRDAI from time to time. Currently, the fund management charge shall not exceed 50 basis points per annum (0.5 %).

Minimum Guaranteed Interest Rate

The minimum guaranteed interest rate applicable to the discontinued fund shall be declared by the IRDAI from time to time. The current minimum guaranteed interest rate applicable to the discontinued fund is 4% per annum.

The excess income earned in the discontinued fund over and above the minimum guaranteed interest rate shall also be apportioned to the discontinued policy fund in arriving at the proceeds of the discontinued policies and shall not be made available to the shareholders.

Surrender Value

If the policy acquires a surrender value during the first five years, it shall become payable only after the completion of the lock-in period.

Discontinuance of Premium after Five Years from the Date of Commencement (Discontinuance of Policy after the lock-in-Period):

For Regular/Limited Pay:

Upon expiry of the grace period, in case of discontinuance of policy due to non-payment of premium after lock-in period, the policy shall be converted into a reduced paid up policy. The policy shall continue to be in reduced paid-up status without rider cover, if any. All charges as per terms and conditions of the policy may be deducted during the revival period. However, the mortality charges shall be deducted based on the reduced paid up sum assured only.

On such discontinuance, Insurer shall communicate the status of the policy, within three months of the first unpaid premium, to the policyholder and provide the following options:

- To revive the policy within the revival period of three years, or

- Complete withdrawal of the policy.

In case the policyholder opts for (1) above but does not revive the policy during the revival period, the fund value shall be paid to the policyholder at the end of the revival period.

The death benefit during the revival period for the primary life assured shall be,

Highest of,

- Reduced Paid-up Sum Assured on Death net of all “Deductible Partial Withdrawals”, if any, from the Regular/ Limited Premium Fund Value or

- the Regular/ Limited Premium Fund Value of this Policy or

- 105 percent of the total Regular/ Limited Premiums paid up to the date of death net of all “Deductible Partial Withdrawals”, if any.

In addition to this:

Highest of

- Top-Up Sum Assured(s) or

- Top-Up Premium Fund Value of this Policy or

is also payable provided the Policyholder has a Top-Up Premium Fund Value.

In case the policyholder opts (ii), i.e., to withdraw the policy completely, then the policy will be surrendered, and the fund value (including any Top-Up fund value) shall be paid.

In case the policyholder does not exercise any option as set out above, the policy shall continue to be in reduced paid up status. At the end of the revival period the proceeds of the policy fund shall be paid to the policyholder and the policy shall terminate.

However, the policyholder has an option to surrender the policy anytime and proceeds of the policy fund shall be payable.

For Single Pay:

The policyholder has an option to surrender the policy any time. Upon receipt of request for surrender, the fund value as on date of surrender shall be payable.

Revival of a discontinued policy after lock-in period

Upon revival, the policy shall be revived restoring the risk cover in accordance with the terms and conditions of the policy. The rider may also be revived at the option of the policyholders.

At the time of revival, we:

- shall collect all due and unpaid premiums under base plan without charging any interest or fee

- may levy premium allocation charge as applicable

- shall not levy any other charges.

Surrender Value

After the lock-in period, the surrender value shall be equal to the fund value as on the date of surrender.

REDUCED PAID UP

“Discontinuance of Premium after Five Years from the Date of Commencement”

Reduced paid-up Sum Assured = Basic Sum Assured * (t / n) Where,

t = Total number of Premiums paid

n=Total number of Premiums payable for the entire premium paying term

The death benefit applicable for Reduced Paid-up policy shall be,

Highest of,

- Reduced Paid-up Sum Assured net of all deductible partial withdrawals or

- Regular Premium Fund Value of the policy

- 105% of the total Regular Premiums paid up to the date of death net of all deductible partial withdrawals, if any

In addition to this:

Highest of,

- The approved Top-up Sum Assured(s) or

- Top-Up Premium Fund Value of the policy

is also payable provided the policyholder has a Top-up Premium Fund Value.

A reduced paid-up policy will continue as per policy terms and conditions and charges as mentioned under “What are the charges in your policy?” shall continue to be deducted.

Policyholder will have an option of resuming payment of premiums with full sum assured before the end of revival period .

Partial Withdrawal will be allowed during the reduced paid-up status

22. What if I want to discontinue the policy?

Surrender Benefit and Surrender Terms & Conditions

The policyholder can completely withdraw his/her policy anytime during the policy term by intimating the company.

If policyholder requests for Complete Withdrawal from the policy –

- Within the lock-in period; the surrender value i.e. the fund value less applicable discontinuance charges as on the date of discontinuance shall be credited to the ‘Discontinued Policy Fund’ as maintained by the Company. The ‘Proceeds of the Discontinued Policy’ i.e. the fund value as on the date of discontinuance plus entire income earned after deduction of the fund management charges, subject to a minimum guarantee of interest @ 4% p.a. or as prescribed by IRDAI from time to time shall be paid to the policyholder after completion of the lock-in period.

In case of death of the insured during this period the “Proceeds of the Discontinued Policy” shall be payable to the nominee immediately.

- After the Lock-in Period; the total fund value as on the date of complete withdrawal shall be paid to the policy holder.

Lock-in period means the period of 5 consecutive years from the date of commencement of the policy, during which period the proceeds of the discontinued policies cannot be paid by the insurer, except in the case of death or upon the happening of any other contingency covered under the policy.

All the benefits in this policy shall cease on the date of complete withdrawal.

23. What are my policy charges7? (Must Read)

Premium Allocation Charge

Classic

Premium Allocation Charge as below will be deducted from the Regular/ Limited /Single Premium. The net Regular/ Limited /Single Premium after deduction of charges are invested in Funds as per your choice.

Single Pay:

| Premium Allocation Charge as a % of Single Premium | |

| Policy Year | % of Single Premium |

| 1 | 3% |

For Regular/Limited Pay:

| Premium Allocation Charge as a % of Annualised Premium | |

| Policy Year | % of Annualised Premium |

| 1 | 12% |

| 2 | 6% |

| 3 | 4% |

| 4 | 2% |

| 5 years onwards | Nil |

Top-up Premium Allocation Charge = 1.5% of Top-up premium.

The premium allocation charges are guaranteed throughout the term of the policy.

The above premium allocation charges shall not exceed the maximum premium allocation charge as declared by the IRDAI which currently stands at 12.5% of Annualised Premium for any year.

Optima

Not Applicable

Policy Administration Charge

Classic

From 5th policy year onwards Policy Administration Charge of 0.41% of Annualised Premium for Regular/Limited pay and 0.075% of Single Premium shall be charged at the beginning of each policy month. The charge will increase each policy year by 5% on compounded basis only till 18th policy year (and constant thereafter) but shall be subject to a maximum of ₹ 500 per month. The maximum Policy Administration Charge shall not exceed the limits as decided by IRDAI from time to time.

Optima

Not Applicable

Fund Management Charge

A Fund Management Charge will be charged for each fund on each valuation date at 1/365 of the following annual rates and will be applied on the total values of the investment funds as given below

| Sr. No | Fund | Fund Management Charge per annum |

| 1 | Emerging Opportunities Fund (SFIN: ULIF 064 12/09/22 EOF 110) | 1.20% |

| 2 | Sustainable Equity Fund (SFIN: ULIF 065 12/09/22 ESG 110) | 1.20% |

| 3 | Dynamic Advantage Fund (SFIN: ULIF 066 12/09/22 DAF 110) | 1.20% |

| 4 | Super Select Equity Fund (SFIN: ULIF 035 16/10/09 TSS 110) | 1.20% |

| 5 | Top 50 Fund (SFIN: ULIF 026 12/01/09 ITF 110) | 1.20% |

| 6 | Top 200 fund (SFIN: ULIF 027 12/01/09 ITT 110) | 1.20% |

| 7 | Multi Cap Fund (ULIF 060 15/07/14 MCF 110) | 1.20% |

| 8 | India Consumption Fund (ULIF 061 15/07/14 ICF 110) | 1.20% |

| 9 | Large Cap Equity Fund (ULIF 017 07/01/08 TLC 110) | 1.20% |

| 10 | Whole Life Mid Cap Equity Fund (ULIF 009 04/01/07 WLE 110) | 1.20% |

| 11 | Whole Life Aggressive Growth Fund (ULIF 010 04/01/07 WLA 110) | 1.10% |

| 12 | Whole Life Stable Growth fund (ULIF 011 04/01/07 WLS 110) | 1.00% |

| 13 | Whole Life Income Fund (ULIF 012 04/01/07 WLI 110) | 0.80% |

| Sr. No | Fund | Fund Management Charge per annum |

| 14 | Whole Life Short-Term Fixed Income Fund (ULIF 013 04/01/07 WLF 110) | 0.65% |

| 15 | Flexi Growth Fund (SFIN: ULIF 068 25/04/23 FGF 110) | 1.20% |

| 16 | Constant Maturity Fund (SFIN: ULIF 069 17/05/23 CMF 110) | 0.80% |

| 17 | Target Maturity Fund (SFIN: ULIF 070 17/05/23 TMF 110) | 0.80% |

| 18 | Small Cap Discovery Fund (SFIN: ULIF 071 22/05/23 SCF 110) | 1.20% |

| 19 | Business Cycle Fund (SFIN: ULIF 072 15/01/24 BCF 110) | 1.20% |

| 20 | Rising India Fund (SFIN: ULIF 073 17/01/24 RIF 110) | 1.20% |

| 21 | Midcap Momentum Index Fund (SFIN: ULIF 075 09/05/24 MIF 110) | 1.20% |

| 22 | Whole Life Income Fund II (SFIN: ULIF 076 06/06/24 WI2 110) | 1.35% |

| 23 | Flexi Growth Fund II (SFIN: ULIF 074 02/05/24 FG2 110) | 1.35% |

| 24 | Nifty Alpha 50 Index Fund (SFIN: ULIF 077 30/09/24 NAF 110) | 1.35% |

| 25 | Multicap Momentum Quality Index Fund (SFIN: ULIF 078 31/12/24 MQI 110) | 1.35% |

A Fund Management Charge of 0.50% p.a. shall be charged on Discontinued Policy Fund. The current cap on Fund Management Charge (FMC) for Discontinued Policy Fund is 0.50% p.a. and shall be declared by the IRDAI from time to time.

Fund Management Charges are subject to revision by Company with prior approval of IRDAI but shall not exceed 1.35% per annum of the Fund value which is the maximum limit currently specified by the IRDAI and can change from time to time.

Mortality Charge8:

The Mortality Charge of the policy will be deducted by cancelling Units at the current NAV, from the Fund value of the Policy at the beginning of each Policy Month. In case of the Top-up Sum Assured, the same will be deducted from the Top-up Premium Fund Value. If the Fund Value is insufficient, then Mortality Charge will be deducted from the Top-up Premium Fund Value, if any and vice-versa.

Mortality charge = Sum at Risk (SAR) multiplied by the applicable Mortality Rate for the month, based on the attained age of the life Insured.

Sum at Risk in each month for Regular Account is the difference between:

- Maximum of (Basic Sum Assured net of all deductible partial withdrawals, if any, from the Fund Value or 1.05 times total premiums paid) and

- Fund Value at the time of deduction of Mortality Charge

Sum at Risk in each month for Top-up Account is the difference between:

- Maximum of (Top-up Sum Assured, from the relevant Top-up Premium Fund Value and

- Top-up Premium Fund Value at the time of deduction of Mortality Charge.

Sample mortality charges for healthy, male, non-smoker are provided below:

| Sample Age | Mortality Charges per 1000 Sum at Risk (per annum) |

| 25 | 0.787 |

| 35 | 1.016 |

| 45 | 2.179 |

| 55 | 6.348 |

8The Mortality Charges will be guaranteed for the policy term. For complete details on Mortality Charges visit us at www.tataaia.com

Discontinuance Charge

The Policyholder can discontinue paying premium anytime during the policy term by intimating to the company. However, when the request for discontinuance from the policy is within the lock-in period of 5 years from policy inception, total fund value, net of discontinuance charges as on the date of discontinuance shall be put in the ‘Discontinued Policy Fund’. The ‘Proceeds of the Discontinued Policy’ i.e., the fund value as on the date of discontinuance plus entire income earned after deduction of the fund management charges, subject to a minimum guarantee of interest @ 4% p.a. or as prescribed by IRDAI from time to time shall be paid to the Policyholder only after completion of the lock-in period.

The applicable discontinuance charges are as given below.

For Single Pay:

| Where the policy is discontinued during the policy year | Maximum Discontinuance Charges for the policies having Single premium up to Rs. 3,00,000/- | Maximum Discontinuance Charges for the policies having Single premium above Rs. 3,00,000/- |

| 1 | Lower of 2% of Single Premium or Single Premium Fund Value subject to a maximum of R 3000/- | Lower of 1% of Single Premium or Single Premium Fund Value subject to a maximum of R 6000/- |

| 2 | Lower of 1.5% of Single Premium or Single Premium Fund Value subject to a maximum of R 2000/- | Lower of 0.70% of Single Premium or Single Premium Fund Value subject to a maximum of R 5000/– |

| 3 | Lower of 1% of Single Premium or Single Premium Fund Value subject to a maximum of R 1500/- | Lower of 0.50% of Single Premium or Single Premium Fund Value subject to a maximum of R 4000/- |

| 4 | Lower of 0.5% of Single Premium or Single Premium Fund Value subject to a maximum of R 1000/- | Lower of 0.35% of Single Premium or Single Premium Fund Value subject maximum of R 2000/- |

| 5 | NIL | NIL |

For Limited/Regular Pay:

| Where the policy is discontinued during the policy year | Maximum Discontinuance Charges for the policies having annualized premium up to ₹ 50,000/- | Maximum Discontinuance Charges for the policies having annualized premium above ₹ 50,000/- |

| 1 | Lower of 20% of Annualised Premium or Regular Premium Fund Value subject to a maximum of ₹ 3000 | Lower of 6% of Annualised Premium or Regular Premium Fund Value subject to a maximum of ₹ 6000 |

| 2 | Lower of 15% of Annualised Premium or Regular Premium Fund Value subject to a maximum of ₹ 2000 | Lower of 4% of Annualised Premium or Regular Premium Fund Value subject to a maximum of ₹ 5000 |

| 3 | Lower of 10% of Annualised Premium or Regular Premium Fund Value subject to a maximum of ₹ 1500 | Lower of 3% of Annualised Premium or Regular Premium Fund Value subject to a maximum of ₹ 4000 |

| 4 | Lower of 5% of Annualised Premium or Regular Premium Fund Value subject to a maximum of ₹ 1000 | Lower of 2% of Annualised Premium or Regular Premium Fund Value subject maximum of ₹ 2000 |

| 5 | NIL | NIL |

There are no discontinuance charges applicable on the Top-up premium Fund Value.

The maximum discontinuance charge shall not exceed the limits as decided by the IRDAI from time to time.

Partial Withdrawal Charge

There are no partial withdrawal charges for both options under this plan.

Fund Switching Charge

There is no fund switching charge for both options. (12 time are free after that nominal charges applicable)

Miscellaneous Charge:

Nil

Premium Re-direction Charge

There is no Premium Redirection Charge.

7The Company may alter all the above charges (except Mortality Charge and Premium Allocation Charges which are guaranteed throughout the term) by giving an advance notice of at least three months to the policyholder subject to the prior approval of IRDAI and will have prospective effect.

POLICY TERMINATION

All coverage under this Policy shall automatically terminate on the occurrence of the earliest of the following:

- Date of Maturity of policy

- Date of complete withdrawal

- Date of Death of the Insured, or

- Date of end of lock-in-period/revival period, whichever is later in case of Discontinuance of Premium within 5 years, provided the policy is not revived during the revival period.

- After completion of premium paying term, the policy will terminate as and when the total fund value becomes less than or equal to 10% of Instalment Premium/ /1% of the Single Premium or the applicable monthly charges cannot be deducted due to insufficient fund balance, whichever happens first; except if any of the following conditions is true:

- Five policy years have not elapsed since the inception of the contract.

- If the policy is in-force premium paying