No Income Tax on Annual Income Up to ₹12.75 Lakh!

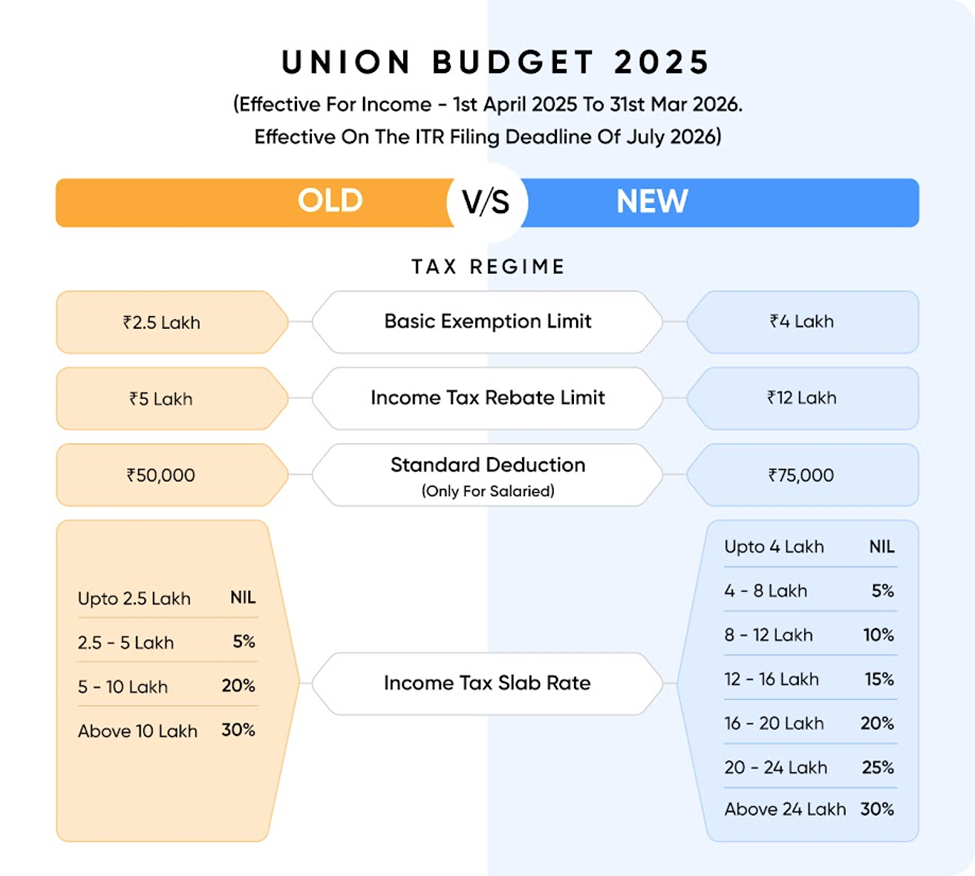

The government has raised the Section 87A rebate limit from ₹7 lakh to ₹12 lakh, providing major tax relief to the middle class. Salaried individuals can also claim a ₹75,000 standard deduction, making incomes up to ₹12.75 lakh tax-free.

The modified slab rates for new tax regime applicable for FY 2025-2026 are as follows:

| Income Tax Slabs | Tax Rates |

| Up-to ₹ 4,00,000 | NIL |

| ₹ 4,00,001 – ₹ 8,00,000 | 5% |

| ₹ 8,00,001 – ₹ 12,00,000 | 10% |

| ₹ 12,00,001 – ₹ 16,00,000 | 15% |

| ₹ 16,00,001 – ₹ 20,00,000 | 20% |

| ₹ 20,00,001 – ₹ 24,00,000 | 25% |

| Above ₹ 24,00,000 | 30% |

- The rebate allowed under section 87A has now been increased to ₹60,000 for new regime from ₹25,000. Since the rebate allowed has been increased, tax incidence for income up-to ₹12,00,000 will be zero.

- Rebate is not allowed for income taxable at special rates. For example, capital gain u/s 112A.

- Marginal relief on rebate is still applicable.

- The bill, when passed, will become the new Income Tax Act, which is applicable from 01st April

The table below shows which tax regime is more beneficial at various income levels and deduction amounts.

| Income | ₹0 | ₹1,25,000 | ₹2,50,000 | ₹5,00,000 | ₹6,50,000 | ₹7,15,000 | ₹7,75,000 | ₹7,75,001 | ₹8,75,001+ |

|---|---|---|---|---|---|---|---|---|---|

| ₹10,00,000 | NEW | NEW | NEW | BOTH | BOTH | BOTH | BOTH | BOTH | BOTH |

| ₹13,50,000 | NEW | NEW | NEW | BOTH | OLD | OLD | OLD | OLD | OLD |

| ₹17,00,000 | NEW | NEW | NEW | NEW | OLD | OLD | OLD | OLD | OLD |

| ₹20,50,000 | NEW | NEW | NEW | NEW | NEW | NEW | OLD | OLD | OLD |

| ₹24,00,000 | NEW | NEW | NEW | NEW | NEW | NEW | BOTH | OLD | OLD |

| ₹27,50,000 | NEW | NEW | NEW | NEW | NEW | NEW | BOTH | OLD | OLD |

| ₹31,00,000 | NEW | NEW | NEW | NEW | NEW | NEW | BOTH | OLD | OLD |

| ₹34,50,000 | NEW | NEW | NEW | NEW | NEW | NEW | BOTH | OLD | OLD |

| ₹35,00,000+ | NEW | NEW | NEW | NEW | NEW | NEW | BOTH | OLD | OLD |

Note: First column contains income levels and first row contains deduction amount. The above table applies only for FY 2025-2026.