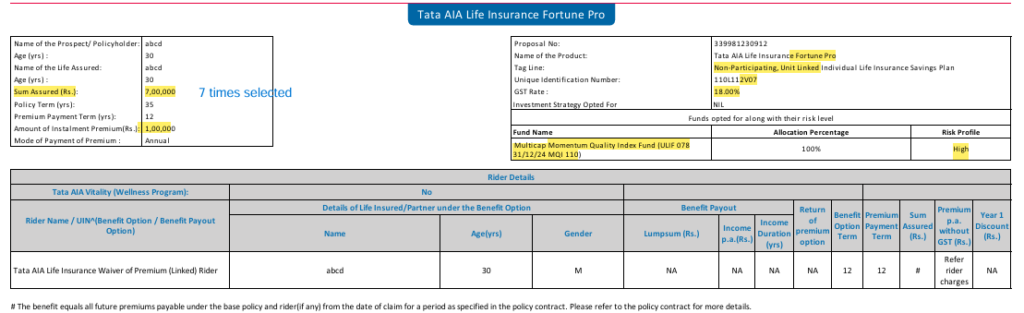

Non-Participating, Unit Linked, Individual Life Insurance Savings Plan

1. What is this policy about?

- It’s an insurance plan that also helps grow your money by investing in different funds.

- It offers both life cover (insurance) and investment options.

- If something happens to you, your family gets life cover (insurance payout).

- At the same time, your money is invested in funds that can grow over time.

- You can choose how much to invest and how long you want to keep the policy.

2. How does it work?

- You pay a premium (either once, regularly, or for a limited period).

- A part of this amount goes into life insurance. The remaining amount is invested in funds of your choice (like stock market funds, bonds, or mixed funds).

- You can choose from 24 different investment options based on your risk preference.

- If you survive the policy term, you get the maturity benefit (your total investment value).

- Over time, your money grows depending on how well the funds perform.

3. Key Features

- Flexible Payments: You can pay once or in installments (monthly, yearly, etc.).

- Investment Options: You can choose from 24 different funds based on your risk preference.

- Loyalty Additions: The company rewards long-term investors by adding extra units to their funds.

- Fund Boosters: If you buy online, you get additional benefits at maturity.

- Life Cover: If the policyholder passes away, their nominee gets a payout.

4. What happens at maturity?

- If you complete the policy term, you get back the Total Fund Value, which is the total worth of your investments.

- You can take it as a lump sum or in installments for up to 5 years (Settlement Option).

5. What happens if you pass away?

- If you pass away during the policy term, your family (nominee) will receive the higher of:

- Sum Assured (Life Cover) (after deducting any withdrawals)

- Fund Value (total worth of your investment)

- 105% of the total premiums paid.

Example:

- You have a life cover of ₹10 lakhs, and your fund value is ₹8 lakhs at the time of death.

- Your nominee will get ₹10 lakhs because it is the highest of the three amounts.

6. Can you take out money before maturity?

- Yes, but only after 5 years.

- Minimum withdrawal: ₹5,000

- Maximum: 4 times per year

- The money will be taken first from your extra investments (top-up funds), then from the main investment.

- You cannot withdraw if it makes your fund value too low.

7. What happens if you stop paying?

- If you stop within the first 5 years, your money is moved to a discontinued fund with a lower interest rate and you can withdraw it after 5 years.

- If you stop after 5 years, your policy the policy continues with a lower life cover, or you can withdraw the money and close the policy (surrender it).

8. Extra Benefits in the Plan

- Loyalty Additions – Extra units are added to your investment after the 6th year (single premium) or 11th year (regular premium).

- Fund Booster – If you buy online, extra money is added at the end of the policy.

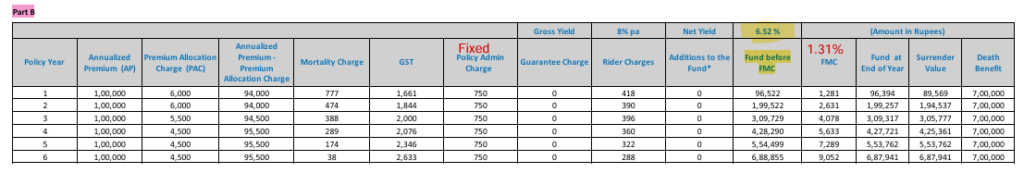

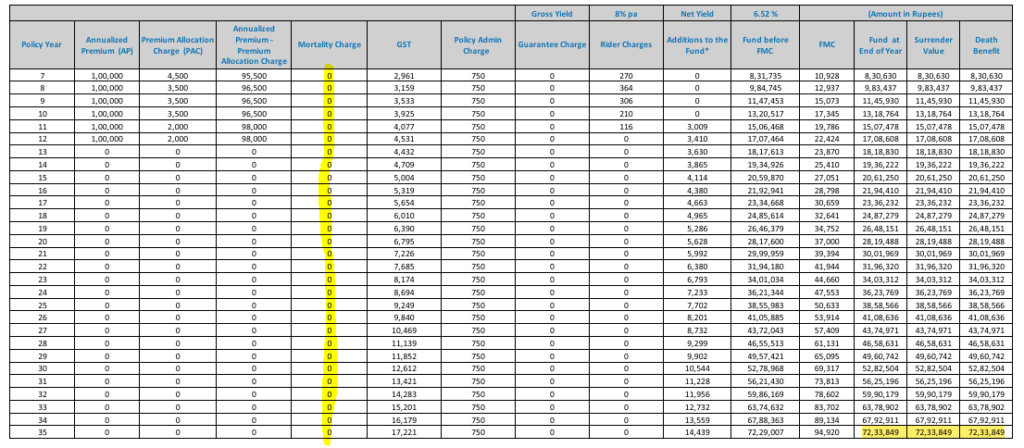

9. Charges to be aware of

- Premium Allocation Charge (one-time per premium): A fee deducted from your payments.

- Fund Management Charge (daily deduction from your investment): A small percentage is taken for managing your investments.

- Mortality Charge (monthly cost of life insurance): The cost of life cover.

- Switching Charges: You can change funds for free up to 12 times a year, after which there’s a fee.

- Policy Admin Charge (monthly deduction)

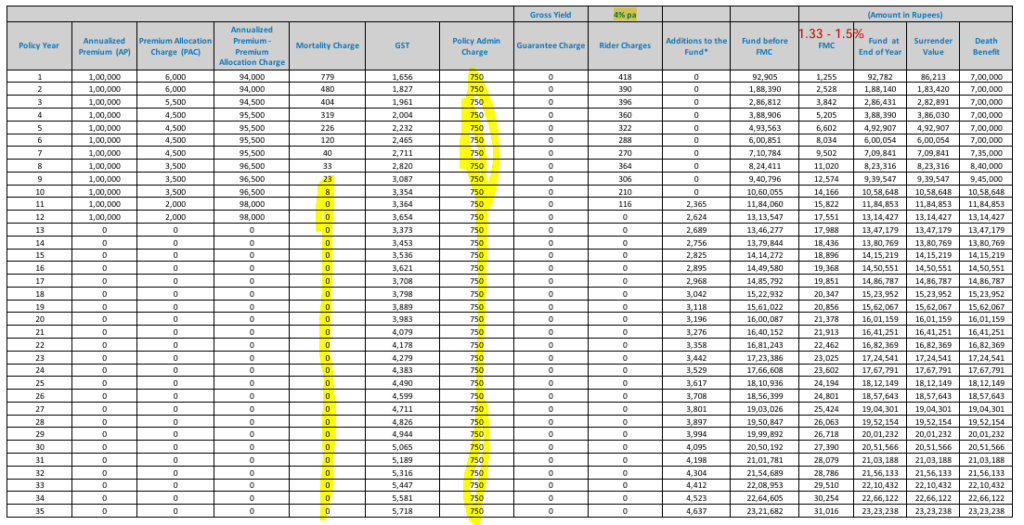

A . Premium Allocation Charge

What is it?

A part of your premium is deducted before investing your money in funds. This is called the Premium Allocation Charge.

Rates:

- Single Pay (one-time payment) – 3% of the premium is deducted.

- Regular/Limited Pay (paying yearly/monthly) – Charged based on the year:

| Policy Year | % of Annual Premium Deducted (reduces over time.) |

|---|---|

| 1 | 6% |

| 2 | 6% |

| 3 | 5.5% |

| 4 to 7 | 4.5% |

| 8 to 10 | 3.5% |

| 11 & onwards | 2% |

Example:

If you pay ₹1,00,000 as an annual premium in the 1st year, ₹6,000 (6%) will be deducted, and ₹94,000 will be invested.

B. Fund Management Charge (FMC)

What is it?

A fee charged daily to manage your investments. It is a percentage of your fund value.

Rates:

| Fund Type | Fixed Annual FMC (%) |

|---|---|

| Equity Funds (high-risk) | 1.20% – 1.35% |

| Balanced Funds | 1.00% – 1.20% |

| Debt Funds (low-risk) | 0.65% – 0.80% |

| Discontinued Fund | 0.50% |

Example:

If your fund value is ₹10,00,000 and the FMC is 1.20%, then ₹12,000 per year (or about ₹33 per day) will be deducted.

C. Mortality Charge (Cost of Life Cover -varies by age)

What is it?

This is the cost of life insurance provided in the policy. It depends on:

- Your age

- The sum assured (insurance amount)

- Your health status

Example: Mortality Charges per ₹1,000 Sum at Risk

| Age (Years) | Mortality Charge (₹ per ₹1,000 Sum Assured) |

|---|---|

| 25 | 1.187 |

| 35 | 1.122 |

| 45 | 2.428 |

| 55 | 5.751 |

Example:

If a 35-year-old has a sum at risk of ₹10,00,000, the charge will be ₹1,122 per year (1.122 × 10,00,000/1,000).

D. Policy Administration Charge

What is it?

A small monthly charge deducted for policy maintenance.

Rates:

- Single Pay: 0.90% per year of Single Premium

- Regular Pay: 0.75% per year of Annual Premium

- Deducted monthly from your fund.

Example:

If your Annual Premium is ₹1,00,000, the yearly charge is ₹750 (0.75%), and ₹62.50 per month is deducted from your fund.

E. Discontinuance Charge (If You Stop Paying Premiums)

What is it?

If you stop paying within the first 5 years, a charge is deducted when your money is moved to the Discontinued Policy Fund.

For Regular Pay:

| Year Policy is Stopped | Charge (Lower of % of Annual Premium or Fixed ₹) |

|---|---|

| 1st Year | 20% or ₹3,000 |

| 2nd Year | 15% or ₹2,000 |

| 3rd Year | 10% or ₹1,500 |

| 4th Year | 5% or ₹1,000 |

| 5th Year onwards | Nil (No Charge) |

For Single Pay:

| Year Policy is Stopped | Charge (Lower of % of Single Premium or Fixed ₹) |

|---|---|

| 1st Year | 2% or ₹3,000 |

| 2nd Year | 1.5% or ₹2,000 |

| 3rd Year | 1% or ₹1,500 |

| 4th Year | 0.5% or ₹1,000 |

| 5th Year onwards | Nil (No Charge) |

F. Fund Switching Charge

What is it?

If you want to switch your money from one fund to another.

- 12 free switches per year.

- After that, ₹100 per switch.

- Maximum charge allowed in future: ₹250 per switch.

Example:

If you switch funds 15 times in a year:

- First 12 switches: Free.

- 3 extra switches: ₹100 × 3 = ₹300 charge.

G. Partial Withdrawal Charge

- No charge for withdrawing money after 5 years.

- Minimum withdrawal: ₹5,000.

- Maximum withdrawals: 4 times per year.

H. Premium Redirection Charge

- No charge for changing how your future premiums are allocated to different funds.

Summary of Charges

| Charge Type | Applicable Rate |

|---|---|

| Premium Allocation | 3% (Single Pay), 6% (1st Year Regular Pay) |

| Fund Management | 0.65% – 1.35% per year |

| Mortality (Life Cover) | Depends on age & sum assured |

| Policy Admin | 0.75% (Regular Pay), 0.90% (Single Pay) |

| Discontinuance (If Stopped Early) | Up to ₹3,000 (Regular Pay), ₹3,000 (Single Pay) |

| Switching Funds | 12 Free, ₹100 per extra switch |

| Partial Withdrawals | Free after 5 years |

| Premium Redirection | Free |

10.When is the policy terminated?

The policy ends in the following cases:

- If you fully withdraw your money after 5 years.

- If you pass away, and the death benefit is paid.

- If the fund value drops below the minimum required amount.

- When the policy reaches maturity, and the fund value is paid out.

11. Exclusions

What are exclusions?

Exclusions are conditions under which the insurance company will not pay the benefits. If the insured person dies due to an excluded reason, the policy will not provide the full insurance amount. Instead, only the fund value (investment portion) is given back.

A. Suicide Exclusion

What happens if the insured dies due to suicide?

- If death occurs within 12 months from the policy start date or policy revival date, the nominee will only get the fund value.

- The sum assured (life cover) will not be paid.

- Any charges (except fund management charges) deducted after the date of death will be added back to the fund value.

Example:

- Suppose a person buys the policy on January 1, 2025 and unfortunately dies by suicide on December 1, 2025.

- The nominee will only get the fund value on that date, not the full life cover.

Why is this rule there?

To prevent fraud cases where someone buys a policy for a large sum assured and commits suicide soon after to financially benefit their family.

B. Rider-Specific Exclusions

If you opt for additional riders (extra benefits), each rider has its own set of exclusions.

(a) Accidental Death and Dismemberment (ADDL) Rider Exclusions

This rider provides extra money if the insured dies in an accident or loses a body part (dismemberment) due to an accident. However, it does not cover death or injury due to:

- Suicide or self-inflicted injury (intentional harm).

- Participation in hazardous sports (bungee jumping, skydiving, paragliding, racing, etc.).

- Drug or alcohol abuse (death while intoxicated).

- Criminal activities (dying while committing a crime).

- War, terrorism, or riots (if the insured dies due to war, protests, or terror attacks).

- Participation in armed forces (if death occurs while on military duty).

- Aviation accidents (except as a passenger in a commercial airline).

- Fraud or false information – If you hide health issues, your claim may be denied.

- Pre-existing conditions (injuries or disabilities that existed before the rider was taken).

Example:

- If a person with this rider dies in a car accident, their nominee will get the extra payout.

- But if they were drunk driving when the accident happened, the rider won’t pay out.

(b) Waiver of Premium Rider Exclusions

This rider waives off future premiums if the insured person becomes disabled or dies. But it will not apply in cases like:

- Suicide or self-inflicted injury.

- Drug or alcohol abuse.

- Participation in criminal activities.

- Disabilities due to risky hobbies (like extreme sports).

- War-related injuries.

Example:

If a person gets disabled due to a car accident, their future premiums will be waived off.

But if the disability is because of drunk driving, the waiver won’t apply.

C. Taxation and Legal Exclusions

- Tax Benefits under this plan are subject to Indian tax laws. If tax laws change in the future, you might lose the tax savings.

- Claims may be denied if false information is provided at the time of buying the policy. (Example: If you hide a serious illness and later die from it, the insurer might reject the claim.)

- If the policyholder is involved in fraud or misrepresentation, the policy may be canceled.

Summary of Exclusions

| Type of Exclusion | Not Covered |

|---|---|

| Suicide Exclusion | If death happens within 12 months, only fund value is paid. No life cover. |

| Accidental Death Exclusions | Death due to suicide, hazardous activities, intoxication, crime, war, or military service is not covered. |

| Disability Waiver Exclusions | Disability due to self-harm, drugs, war, or risky activities won’t qualify for premium waiver. |

| Fraud & Misrepresentation | If false information is given while buying the policy, claims can be denied. |

| Tax Benefits | Can change based on government laws. |

| Fortune Pro | ||

| Age | 0 – 65 | Proposer and insurer concept applicable |

| Premium | 25,000 (Single)12,000 LP / RP | |

| PPT | 5 – 14 | |

| PT | PPT + 1 – 3 | |

| Premium Multiples | 5 – 10 | |

| No Riders | ||

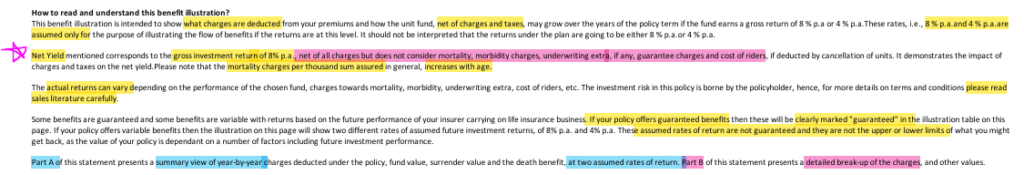

Product Disclaimers

- Tata AIA Life Insurance Fortune Pro – Non-Participating, Unit Linked, Individual Life Insurance Savings Plan (110L112V07).

- Emerging Opportunities Fund is part of a various funds which a policyholder can choose from. For further details on funds refer the sales brochure.

- Linked Insurance Products do not offer any liquidity during the first five years of the contract. The policy holder will not be able to surrender/ withdraw the monies invested in Linked Insurance Products completely or partially till the end of the fifth year.

- *Loyalty Additions will be credited only if Policy is in-force and all due premiums have been paid. For Regular Pay, additional units @ 0.20% of units in each of the funds under Regular Premium Account will be credited (post deduction of applicable charges) to the respective funds every Policy Anniversary starting from eleventh (11th) Policy Anniversary till end of Policy Term. For Single Pay, additional units @ 0.35% of units in each of the funds under the Single Premium Account will be credited (post deduction of applicable charges) to the respective funds every policy anniversary starting from sixth (6th) Policy Anniversary till end of Policy Term. Loyalty Additions are not payable on Top-up Premium Account.

- ©Riders are not mandatory and are available for a nominal extra cost. For more details on benefits, premium charges and exclusions under the Rider(s), please contact Tata AIA Life’s Insurance Advisor/ Intermediary/ Branch.

- ^^^Income Tax benefits would be available as per the prevailing income tax laws, subject to fulfillment of conditions stipulated therein. Income Tax laws are subject to change from time to time. Tata AIA Life Insurance Company Ltd. does not assume responsibility on tax implication mentioned anywhere on this site. Please consult your own tax consultant to know the tax benefits available to you.

- Insurance cover is available under this product. This product is underwritten by Tata AIA Life Insurance Company Limited. The plan is not a guaranteed issuance plan and it will be subject to Company¿s underwriting and acceptance. This product will be offered to Standard lives only.

- Tata AIA Life Insurance Company Limited is only the name of the Insurance Company & Tata AIA Life Insurance Fortune Pro is only the name of the Unit Linked Life Insurance contract and does not in any way indicate the quality of the contract, its future prospects or returns.

- The fund is managed by Tata AIA Life Insurance Company Ltd.

- For more details on risk factors, terms and conditions please read Sales Brochure carefully before concluding a sale. The precise terms and condition of this plan are specified in the Policy Contract.

- Past performance is not indicative of future performance. Returns are calculated on an absolute basis for a period of less than (or equal to) a year, with reinvestment of dividends (if any).

- Investments are subject to market risks. The Company does not guarantee any assured returns. The investment income and price may go down as well as up depending on several factors influencing the market.

- Please make your own independent decision after consulting your financial or other professional advisor.

- Unit Linked Life Insurance products are different from the traditional insurance products and are subject to the risk factors. Please know the associated risks and the applicable charges, from your Insurance Agent or Intermediary or Policy Document issued by the Insurance Company.

- Various funds offered under this contract are the names of the funds and do not in any way indicate the quality of these plans, their future prospects and returns. The underlying Fund’s NAV will be affected by interest rates and the performance of the underlying stocks.

- The performance of the managed portfolios and funds is not guaranteed and the value may increase or decrease in accordance with the future experience of the managed portfolios and funds.

- Premium paid in the Unit Linked Life Insurance Policies are subject to investment risks associated with capital markets and the NAVs of the units may go up or down based on the performance of fund and factors influencing the capital market and the Insured is responsible for his/her decisions.

- Please know the associated risks and the applicable charges, from your Insurance agent or the Intermediary or policy document issued by the Insurance Company.

- Past performance is not indicative of future performance.

- All Premiums are subject to applicable taxes, cesses & levies which will be entirely borne/ paid by the Policyholder, in addition to the payment of such Premium. Tata AIA Life shall have the right to claim, deduct, adjust, recover the amount of any applicable tax or imposition, levied by any statutory or administrative body, from the benefits payable under the Policy. Kindly refer the sales illustration for the exact premium.

- %The premium paid in Unit Linked Life Insurance policies are subject to investment risks associated with capital markets and the NAVs of the units may go up or down based on the performance of fund and factors influencing the capital market and the insured is responsible for his/her decisions. The various funds offered under this contract are the names of the funds and do not in any way indicate the quality of these plans, their future prospects and returns.

- **Individual Death Claim Settlement Ratio is 99.13% for FY 2023-24 as per the latest annual audited figures.

- ”’Claim process:

- Applicable for online channel cases & for claim intimations received within 24 hours from the time of claim intimation

- Death benefit upto 1Cr for Non-Accidental cause of death & upto 2Cr for Accidental cause of death. (Applicable as per reinsurance limits)

- Non-Early Claims => 3 years from the date of issuance or reinstatement to the date of death (Whichever is later)

- Cut-off time 3.00 PM for ULIP cases and 5PM for Traditional Cases; non-working days/ hours excluded

- Applicable for all products (excluding unclaimed, Premium Reversal, APL/RPL Reversal, Maturity Reversal, Auto Surrender Reversal cases)

- Timelines to be considered once all the necessary mandatory documents are received from the claimant.

- The risk factors of the bonuses projected under the product are not guaranteed.

- Past performance doesn’t construe any indication of future bonuses.

- These products are subject to the overall performance of the insurer in terms of investments, management of expenses, mortality and lapses.

- L&C/Advt/2025/Feb/0522

- The recommendation of ‘Most preferred package’ quotes have been shown basis customer preferences and products availability. You may opt for coverage suitable to your needs.