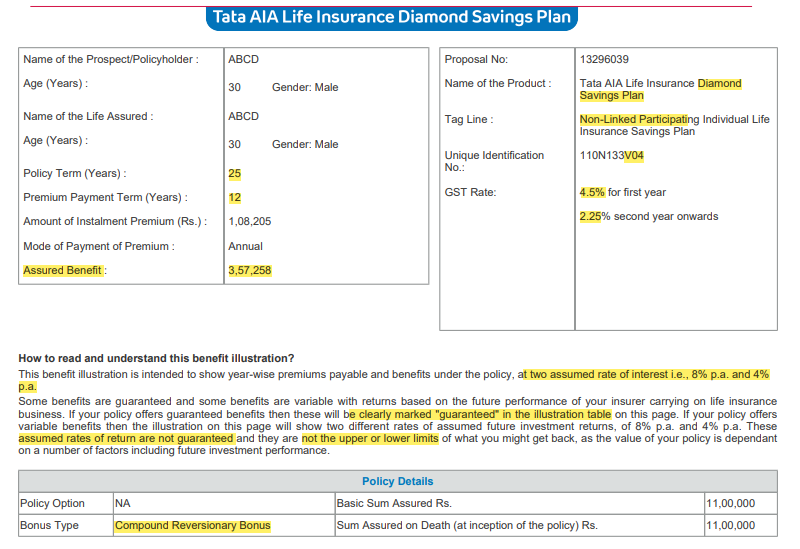

A Non-Linked, Participating Individual Life Insurance Savings Plan.

1. What is the Tata AIA Life Insurance Diamond Savings Plan?

It is a Non-Linked, Participating, Individual Life Insurance Savings Plan i.e

It’s a savings + insurance plan. This means:

- Life insurance coverage: If you pass away, your family gets a lump sum payout (death benefit).

- You pay premiums (fixed amount of money) for a few years.

- You get life insurance coverage during the policy term.

- Guaranteed regular income: After the premium payment term ends, you start receiving regular income for a set number of years.

- At maturity (end of policy term), you receive additional bonuses (if declared).

- Tax benefits on premiums and payouts.

T&C Highlight: This policy is “participating”, meaning bonuses depend on company profits and are not guaranteed (Clause 3.1.3).

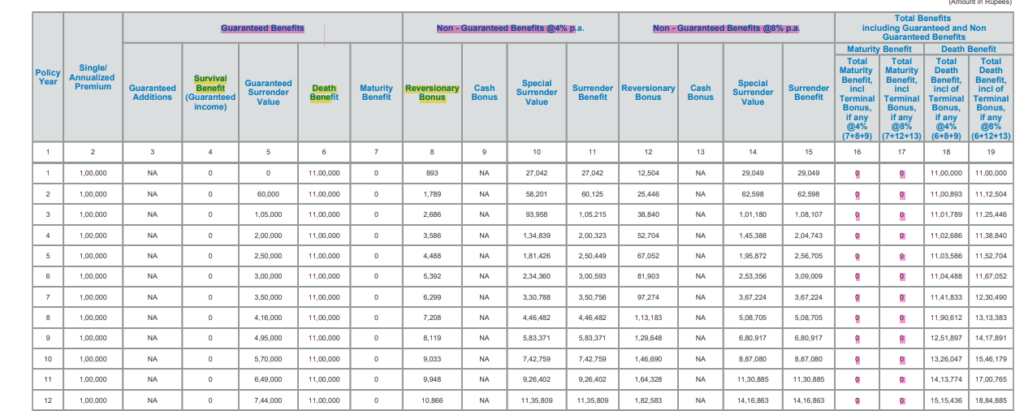

2. How does this plan work?

- You pay premiums for a few years (e.g., 5, 6, 8, or 12 years).

- After the premium payment term ends, you start receiving Guaranteed regular income for a set number of years.

- At the end of the policy term, you receive final lump sum + extra bonuses (if declared).

- If you pass away during the policy term, your family receives a lump sum payout.

T&C Highlight: The Guaranteed Income starts after the premium payment term and ends at maturity or on death (Clause 3.1.1).

3. What are the key benefits of this plan?

- Regular Income – Receive a guaranteed payout every year after premium payment ends.

- Life Insurance Cover – If something happens to you, your family gets a lump sum payout.

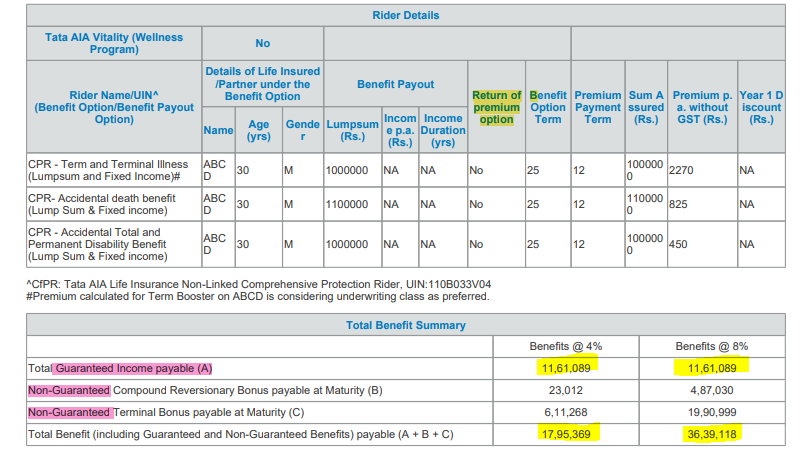

- Bonuses (Extra Earnings) – If the company makes good profits, You may get extra money as Compound Reversionary Bonus and Terminal Bonus (if declared).

- Tax Benefits – Get tax savings under Section 80C and Section 10(10D) of the Income Tax Act.

- Flexible Payment Terms – Choose how many years you want to pay (5, 6, 8, or 12 years).

4. What happens in case of death?

- During the policy term – Family gets the death benefit (sum assured + bonuses, if any).

- During the income period – Family still gets a lump sum payout.

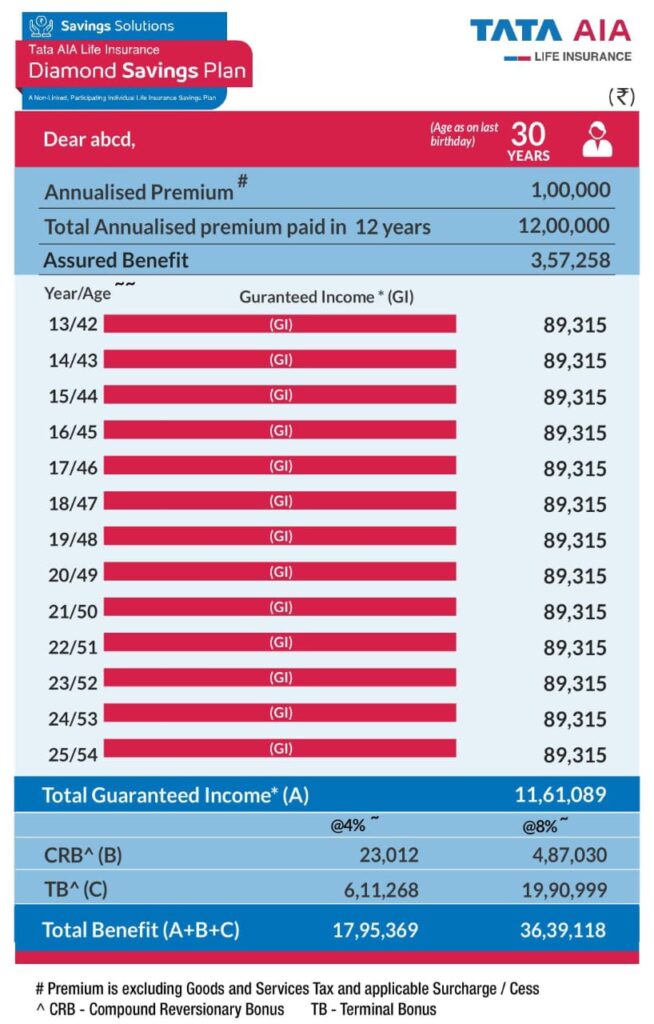

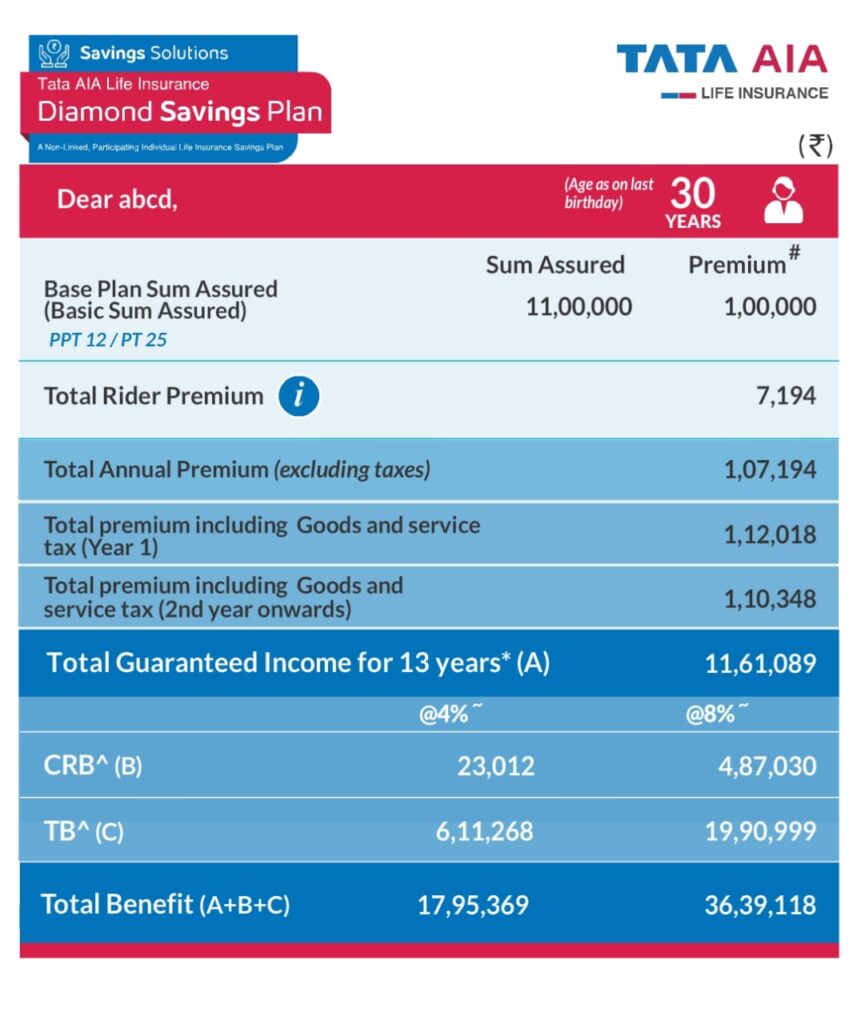

Example: Vijay (35 years old) buys this plan.He pays ₹1,00,000 per year for 12 years.After that, he gets ₹88,056 per year for 13 years.At the end of the policy term (25 years), he receives a final bonus payout (if declared).If he passes away before that, his family gets a lump sum payment.

T&C Highlight: If the policyholder dies by suicide within 12 months, only 80% of premiums paid (or surrender value) is refunded (Clause 6.3).

5. What is the maturity benefit?

If you survive till the end of the policy term, you receive:

- The last guaranteed income installment.

- Any accumulated bonuses (if declared).

6. What are the available policy terms and payment options?

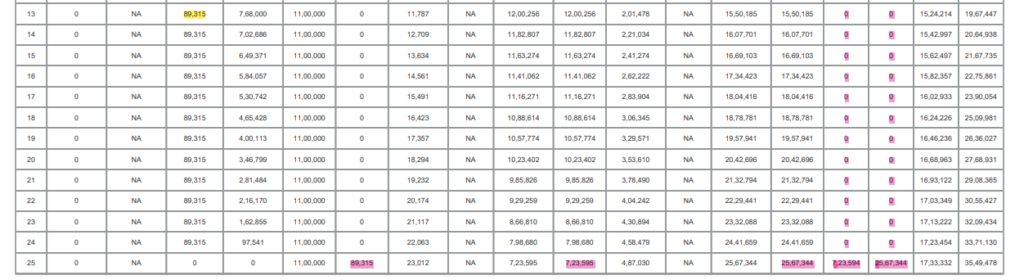

| Policy Term (Years) | Premium Payment Term (Years) | Guaranteed Income Starts After (Years) | Income Percentage |

|---|---|---|---|

| 15 | 5 | 6 | 10% |

| 20 | 5 | 6 | 7.50% |

| 15 | 6 | 7 | 15% |

| 18 | 8 | 9 | 20% |

| 25 | 12 | 13 | 25% |

Example: If you pay for 12 years, you get regular income from the 13th year to the 25th year.

T&C Highlight: If the insured passes away, future Guaranteed Income stops, and the nominee receives a lump sum payout (Clause 3.1.4).

7. Can I take a loan against this policy?

Yes, up to 80% of the surrender value. Loan interest is SBI 1-year deposit rate + 2%. if your policy has acquired a surrender value.

T&C Highlight: If loan + interest exceeds surrender value, the policy terminates (Clause 4.4).

8. What happens if I stop paying premiums?

- You get a grace period of:

- 15 days (for monthly premiums).

- 30 days (for other modes).

- If you haven’t paid at least 1 full year’s premium, the policy lapses (no benefits).

- If you paid for at least 1 year but stop paying, the policy becomes “Reduced Paid-Up” (lower benefits).

- You can revive the policy within 5 years by paying the due premiums with interest.

T&C Highlight: You can revive a lapsed policy within 5 years by paying all due premiums with interest (Clause 4.3).

9. Can I surrender the policy?

Yes, but you only get a payout if at least 1 year’s premium is paid. The payout is higher of:

- Guaranteed Surrender Value (GSV) – A fixed percentage of premiums paid.

- Special Surrender Value (SSV) – Depends on market conditions.

T&C Highlight: Bonuses are not included in surrender value unless declared (Clause 4.5.1).

10. What if I want to cancel after purchasing? (Free Look Period)

- You have a 30-day free-look period (if purchased online) or 15 days (if offline), if you are not satisfied.

- You will get a refund after deducting medical charges, stamp duty, and risk premium.

T&C Highlight: Free-look cancellation is not allowed after this period (Clause 4.1).

11. What are the tax benefits?

- Premiums paid are eligible for tax deduction under Section 80C.

- Payouts (death/maturity benefits) are tax-free under Section 10(10D).

T&C Highlight: Tax laws may change, so consult a tax expert (Clause 6.12).

12. Are there any additional riders (extra coverage options)?

Yes, you can add riders for more protection:

- Accidental Death & Dismemberment Rider – More payout if death/injury is due to an accident.

- Waiver of Premium Rider – If you become disabled, the company pays future premiums.

- Comprehensive Health Rider – Extra coverage for critical illnesses.

13. What happens if I miss a premium payment?

- You get a grace period of 15 days (monthly mode) or 30 days (other modes) to pay.

- If you don’t pay within this time, the policy may lapse or become Reduced Paid-Up.

14. What is a bonus in this plan?

A bonus is extra money you may get from the company’s profits:

- Compound Reversionary Bonus – Declared every year and accumulates (added to the policy).

- Terminal Bonus – A lump sum bonus given at maturity (if declared). only if at least 4-7 years of premiums are paid.

T&C Highlight: Bonuses are not guaranteed and depend on company performance (Clause 3.1.3).

15. What is the minimum and maximum premium?

- Minimum Premium: ₹18,000 per year.

- Maximum Premium: No limit (depends on underwriting approval).

16. What is the “Reduced Paid-Up” option?

If you stop paying after at least 1 year, your policy:

- Remains active with reduced benefits.

- You still get some reduced guaranteed income & death benefit.

17. What is the suicide clause?

If the policyholder dies by suicide within 12 months, the nominee gets:

- 80% of total premiums paid OR

- Surrender value (if higher).

18. Can I increase or decrease my policy details like sum assured later?

- No, you cannot change the sum assured after buying the policy.

- You can change the premium payment frequency (monthly, yearly, etc.).

T&C Highlight: No other policy changes are allowed (Clause 3.2.3).

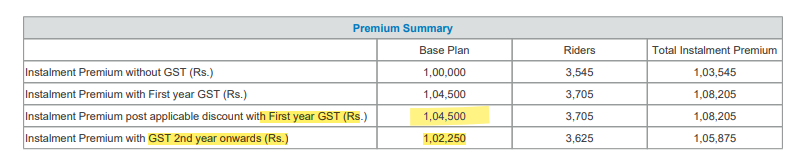

19. Are there discounts for large premium payments?

Yes, discounts are available:

- ₹50,000 – ₹99,999 premium: 2% discount.

- ₹1,00,000+ premium: 4% discount.

20. How can I pay my premiums?

You can pay annually, half-yearly, quarterly, or monthly.

- Monthly payments have a small extra charge (modal loading).

21. How do I buy this policy?

You can buy it through:

- Tata AIA Life Insurance agents.

- Insurance advisors.

- Nearest branch office.

- Company website (www.tataaia.com).

What are the claim settlement rules?

To file a death claim, the nominee must provide:

- Death certificate.

- Original policy document.

- ID & address proof.

- Bank details (cancelled cheque/passbook copy).

- Police report (if death was unnatural/accidental).

T&C Highlight: If a nominee is not assigned, the payout goes to legal heirs (Clause 6.14).

What happens if I give incorrect information?

- If you misstate your age/gender, premiums or benefits will be adjusted.

- If fraud is detected within 3 years, the policy may be canceled.

📌 T&C Highlight: Fraud or misrepresentation leads to policy cancellation as per Section 45 of the Insurance Act (Clause 6.2).

How can I file a complaint?

- Call 1-860-266-9966

- Email customercare@tataaia.com

- Visit www.tataaia.com

- Write to Tata AIA Life Grievance Redressal Office.

T&C Highlight: If unresolved, you can escalate to IRDAI or the Insurance Ombudsman (Clause 7.2.3).

Things to Remember

- If you stop paying early, your policy can lapse (meaning no benefits).

- If you want to exit early, you get a surrender value (less than what you paid).

- Bonuses are not guaranteed – they depend on company performance.

- You have a free look period (30 days) to cancel if you don’t like the policy.

- Good for: People looking for regular income + life cover.

- Not ideal for: Those needing high market-linked returns.

| Diamond Savings Plan (Non-Linked, Participating) | ||

| Age | 0 – 60 | |

| Gender | M / F | |

| Plan Options | ||

| PPT | 8,12 | |

| PT | 18,25 linked to PPT | |

| Annualized Premium | Min 18,000 | |

| Riders (Optional) | TB: Terminal Illness AD ATPD Hospicare Criticare Plus No BPR | Hospi Care: Pay fixed amount of Hospitalization, ICU benefits and also Recuperation Benefit in case of Hospitalization for 7 or More Days. Criticare Plus: 40 critical illness including Cancer and cardiac Conditions |

Disclaimer

- The complete name of Tata AIA Diamond Savings Plan is Tata AIA Life Insurance Diamond Savings Plan (UIN: 110N133V04) – A Non-Linked, Participating Individual Life Insurance Savings Plan.

- *A Guaranteed Income of Assured Benefit shall be paid annually commencing from the end of next policy year after premium payment term till maturity of the Policy or till death of the Life Insured, whichever is earlier

- ·~Compound Reversionary Bonus and Terminal Bonus will be based on Company’s performance and are not guaranteed.

- ^Income Tax benefits would be available as per the prevailing income tax laws, subject to fulfillment of conditions stipulated therein. Income Tax Laws are subject to change from time to time. Tata AIA Life Insurance Company Ltd does not assume responsibility on tax implication mentioned anywhere in this document. Please consult your own tax consultant to know the tax benefit available to you.

- #Tax benefits of up to ₹46,800 u/s 80C is calculated at highest tax slab rate of 31.20% (including cess excluding surcharge) on life insurance premium paid of ₹1,50,000 as per old tax regime. Tax benefits under the policy are subject to conditions laid under Section 80C, 80D,10(10D), 115BAC and other applicable provisions of the Income Tax Act,1961. Good and Service tax and Cess, if any will be charged extra as per prevailing rates. The Tax Free income is subject to conditions specified under section 10(10D) and other applicable provisions of the Income Tax Act,1961. Tax laws are subject to amendments made thereto from time to time. Please consult your tax advisor for details, before acting on above.

- $Riders are not mandatory and are available for a nominal extra cost. For more details on the benefits, premiums and exclusions under the riders please refer to the Rider Brochure or contact our Insurance Advisor or visit our nearest branch office.

- Tata AIA Vitality Protect – A Non-Linked, Non- Participating Individual Health rider (UIN:110B046V04 or later), Tata AIA Vitality Health – A Non-Linked, Non- Participating Individual Health rider (UIN:110B045V03 or later), Tata AIA Life Insurance Non-Linked Comprehensive Protection Rider – A Non-Linked, Non- Participating Individual Health Rider (UIN: 110B033V04 or later), Tata AIA Life Insurance Non-Linked Comprehensive Health Rider – A Non-Linked, Non- Participating Individual Health Rider (UIN: 110B031V02 or later) are available under this plan.

- 1Tata AIA Vitality – A Wellness Program that offers you an upfront discount at policy inception. You can also earn premium discount / cover booster (as applicable) for subsequent years on policy anniversary basis your Vitality Status (tracked on Vitality app)

- Vitality is a trademark licensed to Tata AIA Life by Amplify Health Assets PTE. Limited, a joint venture between Vitality Group International, INC. and AIA Company Limited. The assessment under the wellness program shall not be considered as a medical advice or a substitute to a consultation/treatment by a professional medical practitioner.

- 2On enrolling into the Wellness Program, you get an upfront discount of 5% on 1st year premium for Accidental Death, Accidental Total & Permanent Disability, Accidental Disability Care Benefits and of 10% on 1st year premium for Term Booster, CritiCare Plus, Accelerated CritiCare, Multistage CritiCare, Cancer Care, Cardiac Care, HospiCare. The rewards are offered on cumulative basis and in any year, the maximum rewards in view of both the Up-front Rewards and Annual Rewards Flex together shall be 15% for Accidental Death, Accidental Total & Permanent Disability, Accidental Disability Care and 30% for all other benefit options. Discount is driven by accumulated points which is achieved through wellness status. Please refer policy document for more details.

- The risk factors of the bonuses projected under the product are not guaranteed.

- Past performance doesn’t construe any indication of future bonuses, and

- These products are subject to the overall performance of the insurer in terms of investments, management of expenses, mortality and lapses.

- Please refer rider brochures for additional details on health and wellness benefits.

- Buying a Life Insurance Policy is a long-term commitment. An early termination of the Policy usually involves high costs and the Surrender Value payable may be less than the all the Premiums Paid.

- This product is underwritten by Tata AIA Life Insurance Company Ltd.

- This plan is not a guaranteed issuance plan and it will be subject to Company’s underwriting and acceptance.

- Insurance cover is available under this product.

- This product will be offered only to Standard lives.

- For more details on risk factors, terms and conditions, please read sales brochure carefully before concluding a sale.

- L&C/Advt/2024/Oct/2867